Building Europe's Deeptech Backbone - Silicon Roundabout Ventures, Community Updates, August 25

Our Community update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

Co-Investment Opportunities: 💸

[REDACTED: ONLY FOR LPs] raising an internal round; [REDACTED: ONLY FOR LPs] stretching its Series A towards $60m (LPs can invest via SPV); [REDACTED: ONLY FOR LPs] opening Series A after [REDACTED: ONLY FOR LPs]; [REDACTED: ONLY FOR LPs] raising Series A to scale Europe’s first [REDACTED: ONLY FOR LPs] supercomputer.

Portfolio Updates: 🚀

Ephos secured EU Chips Act support; Origin Robotics closed defence contracts and was named among Europe’s DefenceTech startups to watch; Archangel Lightworks showcased its optical ground station and met the UK Space Agency CEO; Swisspod advanced its US hyperloop proving ground and presented with Etihad Rail; [REDACTED: ONLY FOR LPs] delivered record-scale simulations with IBM, GSK and Quanscient; Finchetto profiled for breakthroughs in optical switching; Anaphite expanded into South Korea through Intralink partnership.

New Investments:

➕ Final Fund I investment signed in a steelmaking company, announcement coming soon

Events you can join / meet us at:

📅 Alpha Summit in London on 4 September with the fund nominated; Silicon Roundabout Ventures FO/Exited Founder Dinner in Turin on 1 October with Riccardo Zacconi; Deeptech Demo Day on 25 November with applications open and 60+ VCs confirmed.

Market Lowdown:

🛰️ Google, TVA and Kairos to power data centres with the Hermes-2 SMR from 2030; NVIDIA Rubin GPUs and Vera CPUs now in fab with a silicon-photonics processor; Starship completed its tenth test flight with successful re-entry and splashdown.

GP Update:

Recap on the portfolio, a reflection on risk-taking, and plans for Fund II

NEWS: If you’re a Limited Partner and missed Francesco’s email to you containing our first Letter to Limited Partners, you can get a copy [REDACTED: ONLY FOR LPs]

And please do book a call to discuss the next steps after the fund completes its final investment (wrapping up as we type): via Calendly [REDACTED: ONLY FOR LPs]. (And a massive thank you for all the LPs who’ve booked since last month and already recommitted / re-upped! 🙏)

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

💸 Co-Investment Opportunities

(1 x Pre-seed / 4 x Series A)

[REDACTED: ONLY FOR LPs]

✅ Internal round to support [REDACTED: ONLY FOR LPs]+ revenue contracts over the next 12 months.

[REDACTED: ONLY FOR LPs] valuation; [REDACTED: ONLY FOR LPs] raise [REDACTED: ONLY FOR LPs].

Founding story:

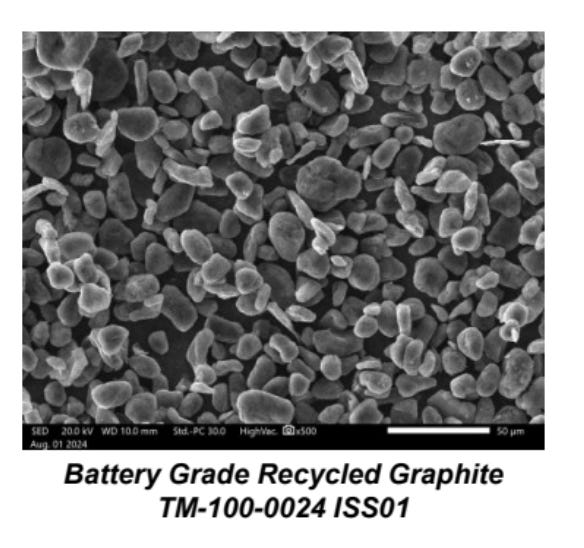

[REDACTED: ONLY FOR LPs] turned his house into a chemistry lab to build Europe’s first chemistry-agnostic, scalable battery recycling.

He’s that type of super obsessive person able to spot unusual long-term tech trends and “drive through walls” to make things happen. Now supported by operations and advisors support ensuring he nails the chemistry and GTM compliance (eg ex-Britishvolt/Johnson Matthey). Plus our full backing.

Breakthroughs:

[REDACTED: ONLY FOR LPs]

Why now:

Only European direct recycler with commercial-ready platform

Perfect storm: EV waste surge, new gigafactories, regulatory & reshoring tailwinds

2 pilots in place, contracts to follow—unlocking meaningful 2026 revenue and stronger position for Seed

Founder with unique blend of precision robotics senior position at unicorn deeptech scale-up, leaving it all to follow his obsession.

Deck: [REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs] (note: may be oversubscribed)

Given our fund doesn’t have a follow on strategy post Seed, we’ve agreed to take up our pro-rata with [REDACTED: ONLY FOR LPs].

Why I’m excited:

[REDACTED: ONLY FOR LPs]’s ground-breaking work in quantum [REDACTED: ONLY FOR LPs].

Their approach to building scalable [REDACTED: ONLY FOR LPs].

Round / SPV Update:

[REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs] is raising their Series A on the back of being the first company in the world to [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs]

Raising [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs] is leading [REDACTED: ONLY FOR LPs] as co-founder and CEO and building the only [REDACTED: ONLY FOR LPs] that hit scale tapeout in the world (and even powers one data centre).

They have sales with their first model including to the US and are launching a new version that completely obliterates competitors’ performance and [REDACTED: ONLY FOR LPs].

Yet, what we find most interesting is that if the LLM paradigm slows down, they are best positioned to empower other algorithms and architectures much better than [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs]

Key Wins:

Deployed world’s largest [REDACTED: ONLY FOR LPs]

Shipping first systems 2025, with [REDACTED: ONLY FOR LPs]

Tech: [REDACTED: ONLY FOR LPs]

Strong early traction in defense, robotics, and pharma as [REDACTED: ONLY FOR LPs] bottlenecks hit [REDACTED: ONLY FOR LPs].

If LLMs alone aren’t the way to AGI (we don’t think they are), then something like [REDACTED: ONLY FOR LPs] in the next 10-30 years may be the perfect [REDACTED: ONLY FOR LPs] to take us closer to it.

We can as usual pass our pro-rata to our LPs via SPV if anyone is interested. We can also organise a meet the founder call like we did for [REDACTED: ONLY FOR LPs], just drop us an email reply or whatsapp.

[REDACTED: ONLY FOR LPs]

While not in a rush to raise, [REDACTED: ONLY FOR LPs] is having conversations with Series A investors to lock in a round while their traction soars and [REDACTED: ONLY FOR LPs] becomes inevitable.

We’ve already introduced them to a couple of investors who were keen to have a chat with [REDACTED: ONLY FOR LPs], the founder.

Recent highlights include the massive [REDACTED: ONLY FOR LPs].

Portfolio updates

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

We’re wrapping up fund 1 with an investment in a steelmaking company.

Final reviews completed and we are writing the cheque as we type.

Stay tuned for an announcement soon.

And if you’re a science and techno-economic geek as we are, here is an interesting paper that was key to our investment thesis into the company to keep you busy reading.

📅 Upcoming Events and Community Updates

Alpha Summit - September 4th

Our fund has been nominated for a category award at the LP/GP AlphaSummit by AllocatorOne in London.

If you’re also attending, don’t be a stranger and drop us a note!

:)

The Deeptech Demo Day - September to November 2025

Date: Finals broadcast live on November 25th - register here: https://lu.ma/zijex7xx

Our annual flagship event brings together the most promising deeptech startups with leading investors in a focused, high-impact format.

We OFFICIALLY LAUNCHED the startup and VC applications, with 60+ investment firms already on board.

Please DO Re-SHARE, LIKE and COMMENT to support our LinkedIn campaign: HERE.

You can also register to watch the finals at the link above.

LP Dinner - Turin, Oct 1, 8-10pm

We're hosting an invite-only dinner with Riccardo Zacconi (King/Candy Crush) as our guest speaker for exited founders and family offices during Italian Tech Week. Discussion will focus on identifying technology opportunities outside mainstream venture trends and examining what comes after the current AI cycle.

Register here (approval required): https://luma.com/yz2oee62 (only apply if you fit the criteria)

Markups

A recap of our markups: (latest round)

Greenjets Limited: [REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs]: [REDACTED: ONLY FOR LPs] (Series A)

[REDACTED: ONLY FOR LPs] [REDACTED: ONLY FOR LPs] (Angel round)

[REDACTED: ONLY FOR LPs]: [REDACTED: ONLY FOR LPs] (Seed)

Anaphite Ltd: [REDACTED: ONLY FOR LPs](Series A)

Panakeia Technologies Limited: [REDACTED: ONLY FOR LPs]

Notable performers preparing for a follow on round:

Origin Robotics - $[REDACTED: ONLY FOR LPs]m in defence contracts closed (Latvia and Netherlands)

SpiNNcloud Systems - $[REDACTED: ONLY FOR LPs]m in contracts closed (US and Europe)

Astral Systems - $[REDACTED: ONLY FOR LPs]m in annual revenue and word’s first breeding of tritium in a commercial reactor

Ephos - $[REDACTED: ONLY FOR LPs]m in annual sales crossed in 2024; also the first startup to receive EU Chips Act funding: secured 41m EUR to build the world’s most advanced photonics fab for glass-based chips

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 20

Top-of-the-funnel Pipeline: 4

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

🚀 Portfolio Updates

Archangel Lightworks

Archangel Lightworks demonstrated significant market presence through their participation at SmallSat2025, where they presented their poster "Towards Increased Adoption of Direct to Earth Optical Communication" at board D-6. The company showcased their TERRA-M miniature Optical Ground Station, which measures just 1.1M tall and 0.7M in diameter, offering high-speed data transfer up to 10 Gbps with secure, license-free communication capabilities. The technology promises deployability advantages with software-defined interoperability across multiple standards.

The team met with UK Space Agency CEO Paul Bate at the UK Space Conference to discuss how their technology adds communications resilience to critical infrastructure, with the UK Space Agency's support being instrumental in developing their world-leading deployable laser communication systems.

Swisspod Technologies

Swisspod achieved significant market presence through their invitation by Etihad Rail to join the Global Rail Transport Infrastructure Exhibition & Conference alongside world leaders shaping high-speed travel. The company showcased progress on hyperloop technology and highlighted their work on the world's largest hyperloop infrastructure project. Their ambitious 1-mile closed-loop track construction is advancing rapidly, which will unlock endless possibilities to push hyperloop technology to new performance limits.

The company's hyperloop proving ground is taking shape in the United States, demonstrating international expansion and technological advancement. Swisspod's focus on building "a world where distance no longer limits dreams" reflects their strategic vision as they advance hyperloop technology across America, positioning themselves as leaders in next-generation transportation infrastructure.

[REDACTED: ONLY FOR LPs]

At IBM Quantum Partner Forum 2025 in London, [REDACTED: ONLY FOR LPs] presented their collaborative project with GSK and IBM Quantum researchers, executing one of the largest electronic-structure Hamiltonian-dynamics simulations to date using [REDACTED: ONLY FOR LPs] execution and middleware methods.

Origin Robotics

Origin Robotics was featured in EU-Startups' "The Frontline of Innovation: 10 European Defence Tech Startups to Watch in 2025." This recognition positions them as a leader in Europe's evolving DefenceTech landscape. The company is expanding into new European markets with their flagship product BEAK while seeing strong traction for their newest system, BLAZE - a counter-unmanned aerial system (C-UAS) interceptor.

Finchetto

Finchetto have a great interview in Blocks and Files, where Mark explains their approach to network switching beyond electrons into photons. Their technology addresses the core challenge that light cannot be stored by using "light controlling light" principles with optical destination encoding.

Anaphite

Anaphite achieved strategic international expansion through partnership with Intralink to strengthen presence in South Korea and accelerate the battery industry's shift to dry coating technology. This partnership positions the company in one of the world's most important battery manufacturing markets, leveraging Intralink's expertise in Asian market entry.

CEO Joe authored content in Auto Tech News discussing cost-saving benefits of their Dry Coating Precursor technology.

The Deeptech Lowdown (Market update)

Google, TVA, and Kairos are teaming up to power data centers with the Hermes-2 small modular reactor to supply its data centers with carbon-free power starting in 2030.

NVIDIA confirmed its Rubin GPU and Vera CPU are in fab at TSMC alongside a silicon-photonics processor designed to handle future AI data center workloads.

Starship completed its tenth test flight, with the vehicle surviving high-energy reentry and making controlled splashdowns in the Gulf of Mexico.

GP Personal Update

We’re off to the races once again.

After we shared our Letter to Limited Partners and started to book calls, we already secured £1.25m in pledged commitments and about another million that may be confirmed soon. All from existing LPs we’ve spoke with.

In parallel to that we received strong interest and even DD progression from a few selected LPs we’ve been engaging and will be working with these to co-anchor our first closing alongside you all, dear LP family.

For now we prefer to focus only on relationships we’ve already built and referrals from our existing LPs and founders, so if you do know someone who would be a good fit for our next fund drop us a line.

If we haven’t had a chat to speak yet and you won’t make it to the AlphaSummit, please feel free to grab a call slot with me via Calendly [REDACTED: ONLY FOR LPs].

The journey has taken me from washing dishes, mopping floors, waiting floating tables and even selling fruit and veg on taking bigger and bigger risks to make Silicon Roundabout Ventures happen.

I reflected on this journey of work, risk and grind on LinkedIn, and I’d love to have you all on board for Chapter 2 as the chats so far seem to indicate :)

Your deeptech chief of VC hustle, Francesco✌️