Computing, Energy and Aerospace –Silicon Roundabout Ventures Community Updates, May 25

Our LP update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

New Portfolio Markup: [REDACTED: ONLY FOR LPs] up 10% following extension of Seed round at higher valuation

Co-Investment Opportunities: Slots available in [REDACTED: ONLY FOR LPs] and 2 other portfolio Seed rounds

Upcoming Events: SuperVenture Berlin (June 2–4), Basel Investor Forum (June 17–18) — Francesco & Ralph attending (invite links below 👇)

Portfolio Highlights: Origin Robotics deploys BEAK systems in the Netherlands + unveils BLAZE interceptor; Panakeia hits 7/8 targets, ASCO-bound; Anaphite showcases in Stuttgart + fundraises for Safe Passage; Nu Quantum wins Tech Company of the Year + launches Quantum Datacenter Alliance; Finchetto featured in Future of Compute map for 98% energy savings

Market Update: “Production Capitalists” redefining deeptech capital stacks; Anthropic warns 50% of entry-level white-collar jobs at risk from AI; US DoD flags China’s deeptech fusion in space race

Hiring: Gama Space actively recruiting (including Chief Engineer role)

GP Update: The 25/7 hustle. Europe at a cross-roads. We may very well be early and right… and doubling down.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

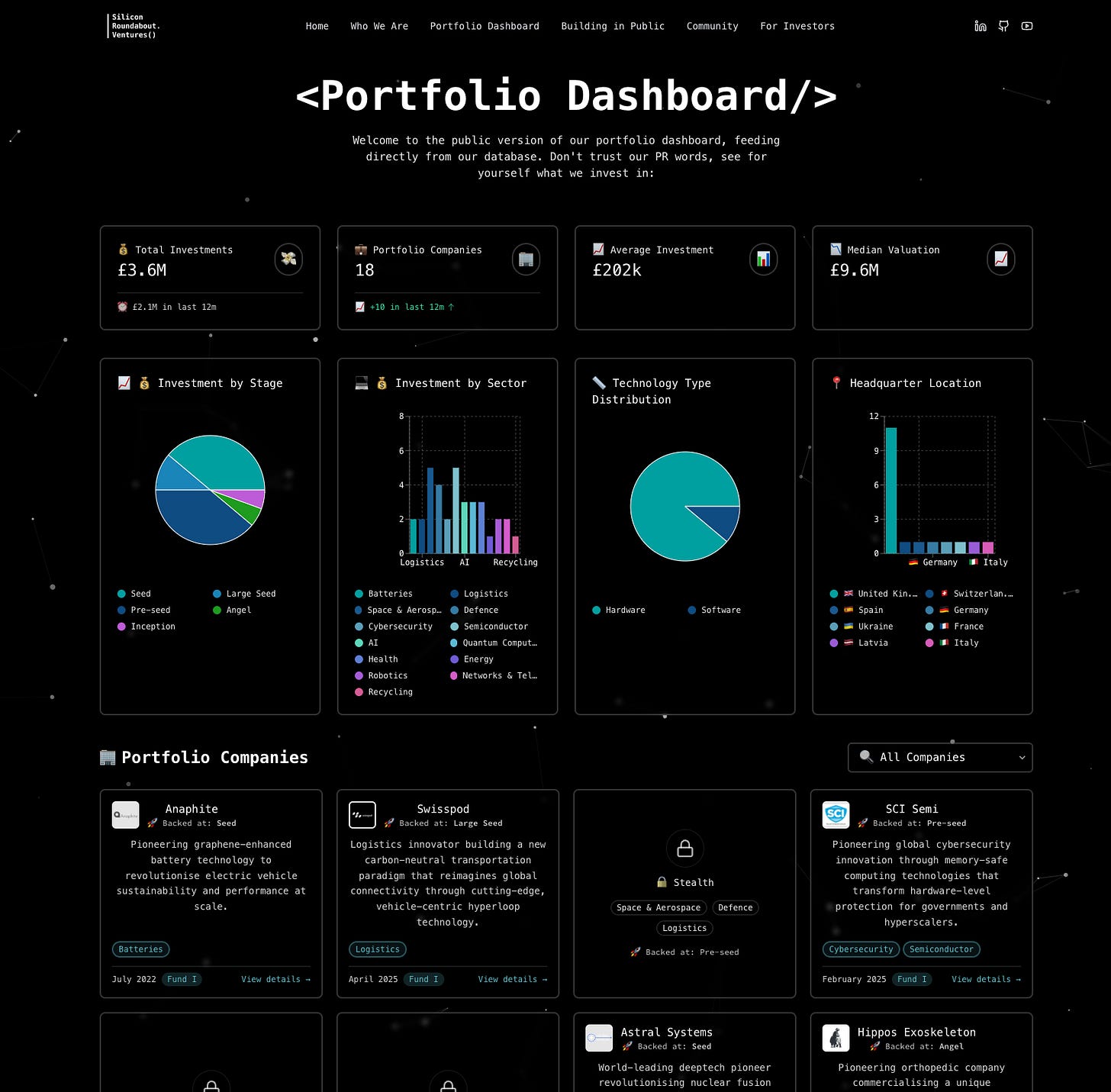

Portfolio updates (NEW: Updated Link with more live info!)

Here is the public snapshot of the current portfolio.

We overhauled our website to offer a direct and live view of our portfolio, directly from our live Airtable database. Stealth companies are anonymised, but overall stats include everyone.

Check it out!

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

No new additions in May, but we are in deep DD with 4 companies.

💸 Co-Investment Opportunities

There may be space for a couple of value-add co-investor from our LPs in [REDACTED: ONLY FOR LPs] current round (subject to CEO approval). Two other portfolio companies are preparing for their Seed round.

📅 Upcoming Events and Community Updates

June, SuperVenture Berlin

Ralph and Francesco will both be at SuperVenture Berlin from June 2nd to 4th. We’re also planning a side event and as always are co-hosting the side-event whatsapp group for LPs and GPs going. Join the group if you’re planning to go and let us know if you fancy to help organise the side event :)

Whatsapp group: https://chat.whatsapp.com/ByfH4PTKhgB3BvBhRbWGDr

We are also running an LP only lunch which we are co-hosting with Hello Tomorrow and Riceberg Ventures

Basel Investor Forum | June 17–18, 2025

Francesco will be attending the Basel Investor Forum during Art Basel week. If you're planning to be in town and would like to catch up, drop him a line — always happy to connect.

Details here: baselinvestorforum.com

Markups

[REDACTED: ONLY FOR LPs] has been marked up 10% due to the recent extension to their Seed round at a higher price.

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 18

Top-of-the-funnel Pipeline: 4

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

🚀 Portfolio Updates

Infiniti Recycling

Infiniti will be presenting at STARTUP AUTOBAHN in Stuttgart on June 5, as part of the Plug and Play / EIT Urban Mobility showcase. The event includes speakers from Mercedes-Benz, Porsche, Bosch, and Formula E, alongside 30+ startup–corporate collaborations across mobility, advanced manufacturing, and sustainable materials. Full agenda here

Origin Robotics

Origin has begun deliveries of its BEAK systems to the Netherlands, marking its first deployment with European partners. The deal was executed in collaboration with BSS Holland and signals they are able to sell to multiple NATO countries.

Separately, the company has unveiled BLAZE — a man-portable, high-explosive interceptor for counter-UAS operations. Designed to neutralise loitering munitions and hostile drones in contested environments, BLAZE adds a new layer to Origin’s autonomous defence stack.

Panakeia

Panakeia continues to make strong progress across clinical, commercial, and regulatory fronts. The team met 7 of their 8 targets this month, with one partially completed. Highlights include early traction with major distribution partners, advancing international customer negotiations, and regulatory recertifications.

🔬 Clinical & Commercial

Submitted a bid for colon cancer in the UK and entered commercial and legal negotiations in India, as well as in contract negotiation for a distribution partnership with a major pharma company.

🛡 Regulatory

Passed ISO27001 & ISO13485 audits with recommendation for recertification

Panakeia is attending the ASCO Annual Meeting 2025 in Chicago, U.S. where CEO Pahini P. will be discussing validation results from the company’s AI-driven profiling tool, PANProfiler Colorectal. The abstract is available online here

Nu Quantum

Nu Quantum has been named Technology Company of the Year by the Cambridge Independent Science & Technology Awards.

They’re also leading the launch of the Quantum Datacenter Alliance, with the inaugural forum set for June 26 at Battersea Power Station. Speakers include representatives from Google, PsiQuantum, MIT, Infineon, and more. Registration is open:

https://www.qda.global

Finchetto

Finchetto was named one of 69 UK startups to watch in AlbionVC and Beauhurst’s Future of Compute Market Map. Their all-optical, fully passive network switches are designed for AI and HPC workloads and cut power consumption by up to 98% compared to current electronic alternatives.

Following Eric Schmidt’s recent warning that AI could consume 98% of global electricity, Finchetto is positioning its tech as part of the solution: enabling data centres to scale compute without scaling energy use.

The Deeptech Lowdown (Market update)

A new essay from Venture Desktop explores how asset-heavy frontier tech companies — from battery manufacturing to aerospace — are shifting away from equity-heavy growth models. Instead, they’re blending structured debt, project finance, and securitisation to scale physical infrastructure fast. This shift is giving rise to a new breed of investor: the “Production Capitalist” — part VC, part financier — who can unlock capital efficiency and help founders master the capital stack from day one. Debt meets deeptech…

Dario Amodei, CEO of AI startup Anthropic, has issued a stark warning that artificial intelligence could eliminate up to 50% of entry-level white-collar jobs within the next five years, potentially pushing the U.S. unemployment rate to 20%. He emphasised that sectors such as technology, finance, law, and consulting are most at risk due to rapid AI advancements. Amodei criticised both the government and tech industry for downplaying these risks and urged proactive measures to address the impending employment challenges.

China is accelerating its use of frontier technologies in space, blending artificial intelligence, quantum computing, and advanced manufacturing to transform itself into a global leader in the final frontier, according to a new report from the U.S. Department of Defense. These technologies are central to Beijing’s efforts to secure strategic dominance in global space infrastructure.

Asks & Portfolio Roles 🙏

Gama Space are hiring for multiple positions

[REDACTED: ONLY FOR LPs] are hiring a Chief Engineer

GP Personal Update

We should not accept the status quo in Europe. But neither we should deny the current state of reality.

This month was a tour-de-force for me across Europe.

From organising a breakfast with UK government officials and defence stakeholders (picture above) to flying to Krakow, Poland, to build bridges with the eastern European ecosystem (thanks to the NATO Innovation Fund and Expedition Ventures for the support in making it happen), passing for a Moroccan de-tour mingling with some of the most interesting VC minds in the continent, both GPs and LPs.

In between, 12 lab visits and 5 technological deep dives, which are now informing the 4 deep DDs we are undertaking in potential investees and the investment thesis for our last 3 investments to make and future ones once we raise a new fund.

Recently one of our LPs mentioned that from the outside, it’s easier to spot the work we do in networking with fund investors than our work as investors.

In reality, I sat down to do some maths this morning, as a sanity check for both me and the transparency I want to build with you, my LP believers: By looking at just the calls/events time, we only spent 17% of this time on LP relationships. Of course adding in the deep work, this would sink much lower because most of that work is fund operations and investment.

But despite this imbalance, we’ve now started to receive interest for our next fund. Which we are not even raising yet, but at this point I believe fairly confidently will be a product we are keen to launch in the autumn to unlock the huge opportunity I see now so clearly in front of us.

An opportunity we would not be able to see, if it wasn’t for the huge family and personal sacrifices I am making to push hard for all this work visiting labs, traveling across Europe, and shutting myself in my little upstairs dungeon to square the ever morphing equation of:

fundamentalTechnologyTrends+communityInsights+exceptional(founder∗marketfit)=nextCompanyToBack

Europe is at a cross-roads. The world is at a fundamental junction.

I am not a politically correct person in voicing my views: if Europe doesn’t hurry up in creating a truly unified VC and startup market with the UK in it, driven by capitalist principles and pension LPs, rather than governments forcing an artificial fragmentation, it will lose the battle of scale. Period. I don’t like this scenario, so I’m actively working with folks like the UK All Parliamentary Group for Defence and The EU Inc to build an alternative. But I accept this is a moonshot project. And so I am currently hedging this with a strategy that now solely focuses on startups thinking (commercially) US-first. They may leverage European projects like grants and defence spending ramp ups, but their eyes are set on growth fueled by the US market (as customers and as source of growth capital). It used to be a nice to have, now it’s a hard line for me in my investment thesis. As we type, our porfolio company Ephos is shipping chips to [REDACTED: ONLY FOR LPs] in the U.S., [REDACTED: ONLY FOR LPs] relocates from Spain to L.A., and Hippos Exoskeleton signs up clinics from East to West coast.

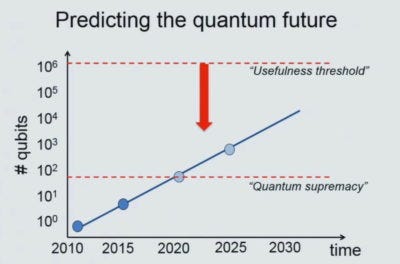

As per the world side, it’s too early to tell, but it seems that we were both early and right in defence (2 of our startups continue to win contracts in the space), early and right in photonics (NVIDIA and Huawei have now made the paradigm switch inevitable), early and right in the energy infrastructure needed to power the AI and robotics world (Anaphite is on the cusp of a major customer milestone in the battery space after successfully closing Series A, while Astral Systems sold their first fusion reactor as a neutron source), and early and (hopefully) right in quantum (quantum advantage in a practical use case is closing in with underlying trends pointing to a likely breakthrough this very decade.

We live at a time where on the scary side, our survival isn’t guaranteed. Because frankly there are 3 Arms Races going on (AI-Computing, Space-Defence, and Energy). But if we don’t accidentally wipe ourselves out, and I believe we have more chances not to do so if we thread carefully, then the above trends we enjoyed riding with our first fund and captured in various shapes with our community approach, will now unleash a host of fundamentally ground-breaking companies and a host of follow-on trends I am carefully studying. This is the excitement that knocks me out of bed in the morning and drives me to build and invest!

And I can’t wait to share it with you all, all over again :)