Event Invites & Deeptech Market Insights - Silicon Roundabout Ventures, Community Updates Jan '24

Our new year Community & Fund update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

“Data and AI in VC" Event Recap: Key takeaways from our event discussing VC automation, tech strategies, and data-driven approaches. The full recording is also linked.

Upcoming Deeptech Fireside Chat: An invitation to meet Graphcore's CEO and learn about AI innovation (now moved to the 13th February).

Fund rundown - Portfolio snapshot, Markups, and Performance snapshot.

Portfolio Company Updates: Strong commercial progress from Greenjets, Anaphite, VyperCore, [REDACTED: ONLY FOR LPs], and Archangel Lightworks.

Final Closing: On the back of extremely strong portfolio performance and to capture the upside of the pipeline we built up, we set our target for final closing on April 15th. More info for LPs to support the work and interested parties to join will be shared separately.

A reminder of what we are about

Silicon Roundabout Ventures is a Super-Angel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 2 unicorns.

The Deeptech Lowdown (Market update)

A new year, and a lot has been happening in the market in 2023, and even more will be happening this year.

The world is going electric due to climate needs, Moore’s Law is ending when we most need it (AI is getting hungry), and Globalisation has seen better days (war, tech sovereignty pressure).

The resurgence of deeptech is not just a financial event, it’s directly linked to these trends.

Our GP talked about these trends (plus a lot more!) in an investor-only webinar in December. Francesco explored our first year of operations and unique data insights we got straight from Dealroom’s CEO ─exclusively for our record-breaking Deeptech Demo Day 2023.

If you missed the investor webinar: Francesco wrote a full article on the State of the European Deeptech Market in 2023 and what the future holds for venture and deeptech: HERE

The venture capital landscape is evolving, particularly in early-stage funding from Seed to Series A. This change is marked by a decrease in graduation rates and a shift towards more strategic, capital-efficient investments for young companies.

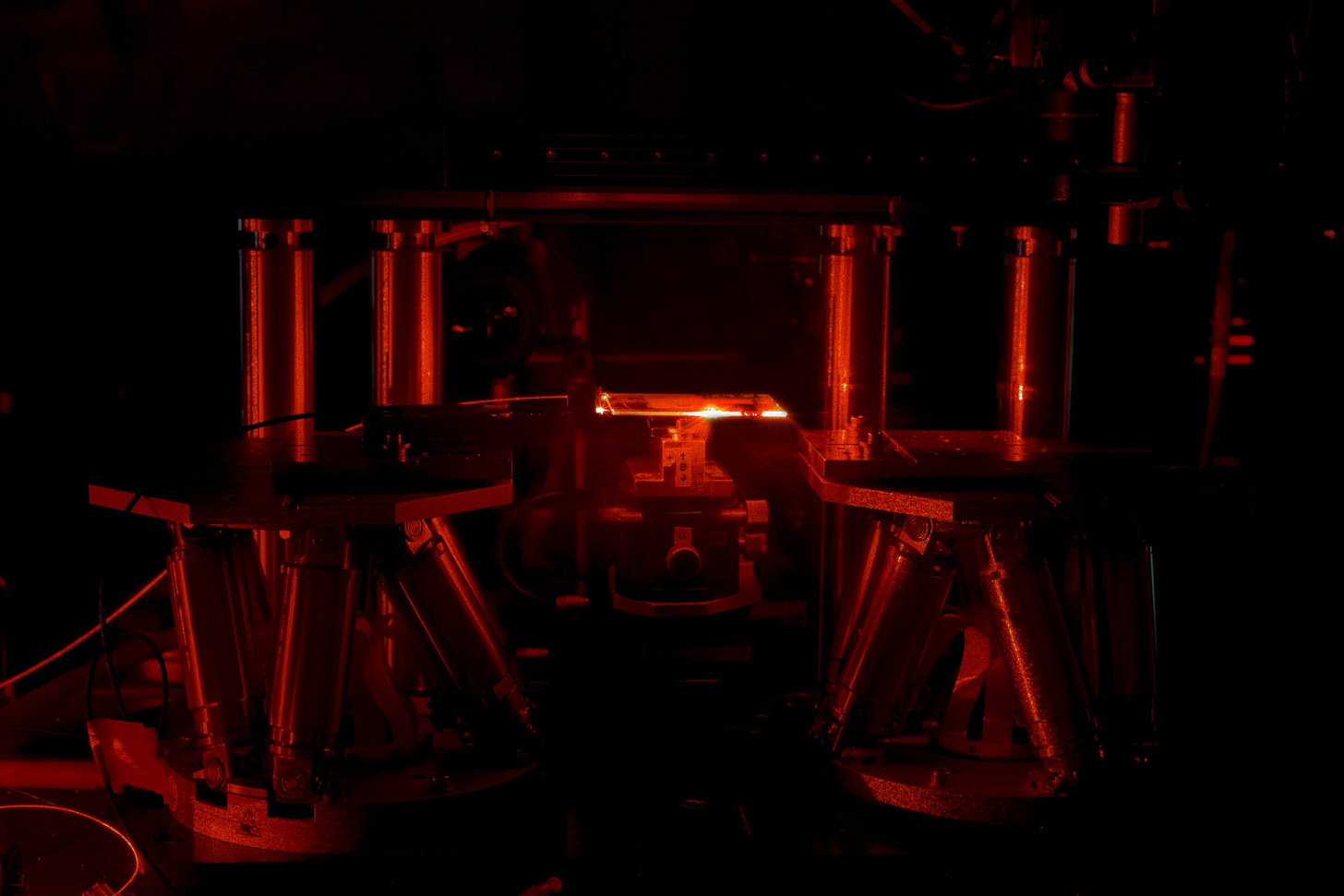

Fusion power is approaching a significant milestone, drawing increased investment and interest. As a sustainable energy source, it offers the potential for zero-carbon electricity, marking a revolutionary shift in energy production. The sector is seeing a surge in private investment, with over 40 commercial firms actively pursuing fusion power development, indicating a strong belief in its future commercial viability.

The European Space Agency (ESA) is advancing Europe's space efforts by launching a competition to create a cargo ship for the International Space Station (ISS). This initiative represents a crucial step towards Europe's space independence and offers startups a chance to contribute significantly to space exploration, aiming for a launch by 2028.

Elon Musk's Neuralink is nearing a significant breakthrough with a vision chip that could potentially cure blindness. This advancement in neurotechnology might revolutionize treatment for various vision impairments, aligning with Neuralink's broader mission to address health issues through brain-computer interfaces. The impact of this technology could be transformative for the millions affected by vision loss.

The venture capital landscape, particularly in deeptech and national security sectors, is experiencing significant changes. The current environment highlights the difficulties small funds face, especially with larger entities dominating the space. However, we are 100% committed to identifying and supporting European deep-tech leaders as they establish themselves in the global market.

📅 Upcoming Events and Community Updates

🚀 Event Highlights: "Data and AI in VC" Discussion

Broad Participation: Over 600 signups, indicating strong interest in technology's role in VC and what we are building!

Automation Debate: Mixed views on the possibility of full VC automation, with consensus leaning towards partial automation in later stages.

Tech Strategy: Discussion on whether to build in-house tech or buy; smaller funds advised to start with external solutions.

Data-Driven Approach: Emphasis on the importance of staying current with tech developments and leveraging data in decision-making.

Tool Recommendations: Suggestions included using Retool and efficient CRM systems.

Continuous Learning: Encouragement to adopt and evolve a data-driven mindset in venture capital.

A big thanks to our guests, Philipp Omenitsch - Sequel, Stephane Nasser - OpenVC, Francesco Corea - Greycroft, Danish Abdullah - hive.one, Dr. Andre Retterath - Earlybird + Data Driven VC and Mike Arpaia - Moonfire

The full recording is available here

📆👉 Upcoming Event: Deeptech Fireside Chat with Graphcore's CEO

Want to learn from & meet: 1 exited founder, 1 Unicorn CEO + 1 superstar Founder in one go?

🦄 🍷 Come have a drink at our next event in London!

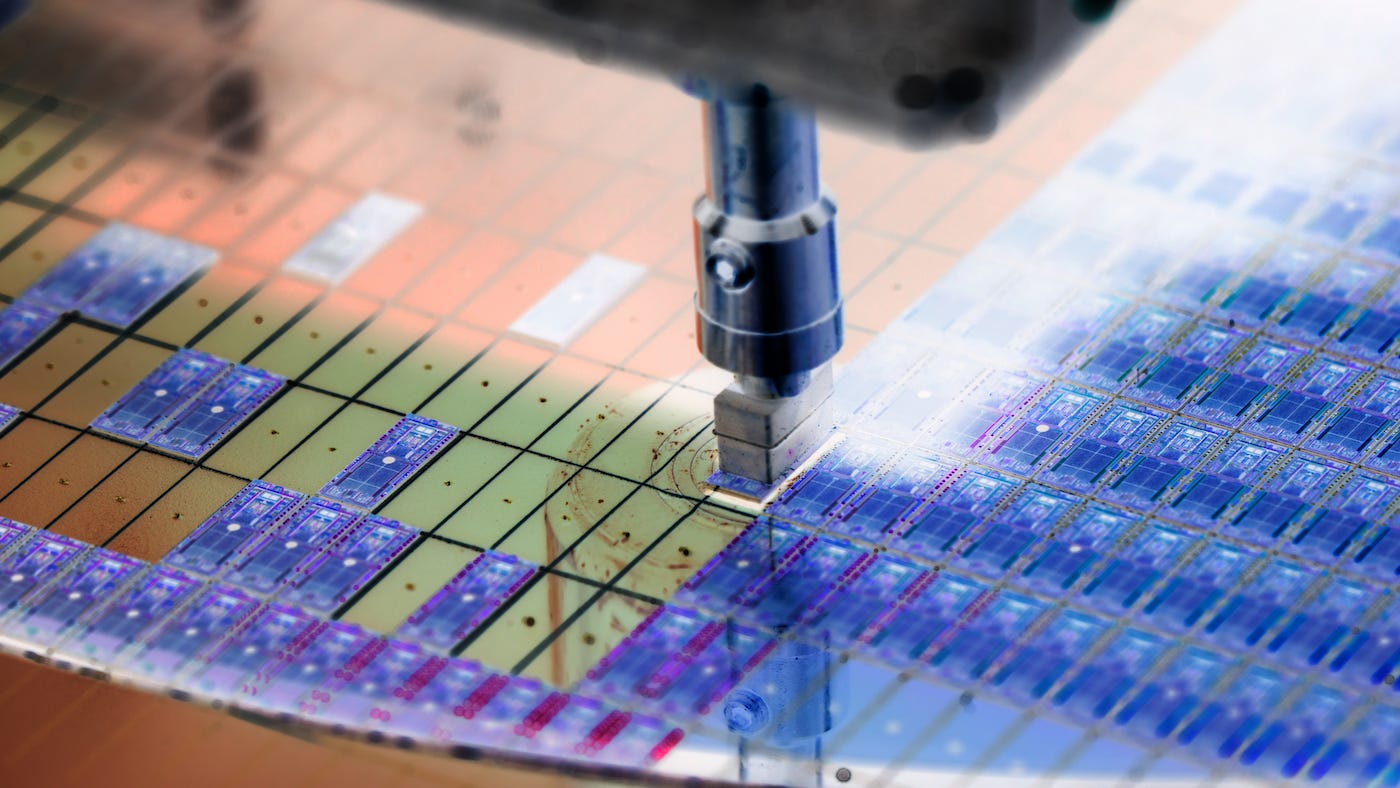

Join us on 13th February for a special fireside chat featuring Nigel Toon ─ CEO at Graphcore, building the next generation of 3D Wafer-on-Wafer Bow IPU systems are helping AI innovators worldwide to build better, more innovative AI solutions.

For more details and to register for the event, visit the event page, and use this Free Coupon for our LPs: [REDACTED: ONLY FOR LPs]

Fund rundown

New investments since last update: 0

Total Portfolio Companies: 7

Fund: 1

Vintage: 2023

Top-of-the-funnel Pipeline: 3

Key Deeptech Areas: Computing, Climate, and National Security Infrastructure

Markups

No markup since the last update, however Anaphite closed a convertible pre-A round, as well as securing grant funding. Other announced recipients of equity-free investment in our portfolio included Archangel Lightworks and [REDACTED: ONLY FOR LPs].

Anaphite and Greenjets are currently discussing terms for an upcoming priced round. Series A and Seed respectively.

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

Status: Open for new LPs (via equalisation)

Fund Min. Target Size (Soft Cap): £5M

Fund Target Hard Cap: £10M

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: n/a

DPI: n/a

Most Valuable Positions: n/a

Investments: 7

Target Pipeline Closing soon: 3

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.2X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

Portfolio

[REDACTED: ONLY FOR LPs]* is a snapshot of the current portfolio.

*Link to a private Airtable base with a list of all portfolio companies and include the company’s name, short description, why we invested, URL, and category.

➕ New Additions

No new investment since the last update.

🦄 Coinvestment Opportunities

[REDACTED: ONLY FOR LPs]

🚀 Portfolio Updates

VyperCore

RTL Simulation Success: VyperCore achieved a significant milestone with the successful simulation of its Register Transfer Level (RTL) design in a RISC-V processor.

Hardware Release on Horizon: VyperCore's Akurra, a cleansheet design, uniquely modifies the standard RISC-V architecture to enhance memory allocation, and is on track slated for release in June 2024.

Advanced Instruction Set: Akurra's RTL simulation is operational, with compiler updates supporting an extended instruction set, including innovative garbage collection functionality at the silicon layer.

Anaphite

Anaphite received notable recognition by being awarded a substantial grant from the Innovate UK Future Economy Investor Partnership fund.

The intellectual property position of Anaphite has been strengthened with the filing of two new patents and the granting of their first patent in the USA.

Anaphite has supplied samples to several major automotive OEMs in Germany and the USA, as well as to cell manufacturers in Europe and Korea. The initial test results have been very positive, and further testing and development are scheduled.

Commercial engagement has been phenomenally successful, with a growing pipeline of interested parties entering formal test agreements with Anaphite. They are set to supply additional samples to customers.

The Anaphite team has grown, with recent new hires bringing their total headcount to 27.

🌱 Greenjets

Strategic Partnerships: Progressing in European and UK defence sectors, thanks to UK DASA and an introduction by Silicon Roundabout Ventures to the UK MoD.

Multi-million Euros contracts: Currently negotiating contracts worth several million in revenue. Projected delivery start upon closing: Q3 2024.

Innovative Technology: Developed a new engine poised for production, capable of propelling drones at speeds up to 600 km/h.

High-Risk Zone Deployment: Negotiations underway for immediate deployment in high-risk areas.

Collaboration with Anduril UK: Engaged in active discussions with Anduril UK.

Pioneering Electric Propulsion: Venturing into high-speed electric propulsion, a largely unexplored market they may kickstart.

Funding Milestones: Lead investor actively engaged; aiming to close a £5M Seed Round in Q2, following terms agreement in Q1.

[REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs] has made significant progress in developing quantum technology infrastructure. They've successfully delivered a fully-packaged chip to a client and installed it in the client's lab.

A new client quote for two low-complexity chips totalling [REDACTED: ONLY FOR LPs] has been submitted. [REDACTED: ONLY FOR LPs] is expanding its team, currently hiring for key engineering roles, and has a headcount of 10.

[REDACTED: ONLY FOR LPs] The company's strategic focus includes potential Series A discussions in the US, as indicated by the CEO's increased time there in 2024.

Archangel Lightworks

Funding Success: Raised £1.7M in grants for core technology development.

Team Expansion: Grown significantly from 6 to 17 members.

Strategic Partnerships: In discussions with major satellite firms, including OneWeb.

Upcoming Demonstration: Targeting a client demonstration in May 2024.

International Recognition: Gained international interest at a conference in Orlando, Florida, for their free-space optics communication technology.

Collaboration with [REDACTED: ONLY FOR LPs]: Engaging with [REDACTED: ONLY FOR LPs] to explore the future of global telecoms using free-space optics.

Francesco’s Reads

🚀 Boost Your VC Skills with VC Lab's New LP Program

Exciting news for Limited Partners (LPs) looking to enhance their skills in emerging manager investments! Adeo Ressi and the VC Lab team are launching a specialised program designed just for LPs looking to up-skill their investment game.

🎓 Our Personal Endorsement: We, at Silicon Roundabout Ventures, are alumni of VC Lab's online VC program and their LPs can participate for free.

🔗 Exclusive Access: One exciting aspect of this program is its exclusivity. Only VC Lab alumni can make referrals. If you're interested in joining, let us know. For more details, check out the program here.

🌐 €175 Million Boost for European Deep Tech and Dual-Use Ecosystem

Big news for the European deep tech and dual-use sectors! The European Investment Fund (EIF) and European Defence Fund (EDF) have joined forces to launch an ambitious initiative: the Defence Equity Facility. This program is set to infuse a whopping €175 million in equity into venture capital and private equity funds.

📈 Impact on the Market: This funding is expected to create a ripple effect, encouraging more investments in the sector and potentially leading to groundbreaking technological developments. It's a significant step towards bolstering the European Union's strategic autonomy in critical technology areas.

🔍 Learn More: For an in-depth look at this initiative and its implications for the future of European innovation in defence and beyond, check out the full details here.

More here

🚀 Essential Content Marketing Insights for VCs

We're thrilled to share insights from Francesco Perticarari, featured in Ajdin Perco's blog on content marketing for venture capitalists. Here's a quick dive into the key lessons:

Personal Touch: VC content thrives on individual opinions and experiences. Francesco's LinkedIn presence is a testament to this, offering unfiltered views that resonate with audiences.

Clarity in Writing: Clear, succinct writing reflects clear thinking. It's not just about writing; it's about refining thoughts.

Passion and Habit: Starting with passion is great, but consistent content creation requires habit and discipline.

Long-term Investment: Like an index fund, content marketing is a long-term play with compounding benefits.

Growing Mailing Lists: Capturing emails should be a primary goal. It’s the most stable way to connect with your audience.

Social Media Savvy: Effective promotion on social platforms is key. Experiment with different content types to see what engages your audience.

Continuous Newsletter CTAs: Never miss an opportunity to include newsletter signup links.

Newsletter Growth Strategies: Think creatively about growing your subscriber base beyond traditional methods.

Structured Workflow: A clear content creation and distribution workflow helps maintain consistency and quality.

For a deeper understanding of these lessons, delve into the full article here.

Tech Updates ─by Ralph King (VP & CTO)

After announcing earlier this month the (very much!) beta release of our AI, Joi, we’re moving all of our updates and comms to Substack because of their powerful API capabilities.

We have also made a few changes on the main Silicon Roundabout website. You’ll now find our blog page links directly through to the Silicon Roundabout Community Substack (filtered, build in public content):

Our internal tools are also starting to take shape.

We’re working hard on integrating output from everything that happens on a daily basis at Silicon Roundabout Ventures directly into our system. Inbound deals we’ve seen, updates from founders, interesting articles, day to day conversation notes - the list goes on! The end goal here is to have most (if not all) of our data in one place, and an ‘oracle’ of sorts that will, and already is, help us in a myriad of ways.

Asks 🙏

Portfolio Asks

Archangel Lighworks is expanding their photonics and process engineering team in the UK, if you know anyone in the space, let us know.

Fund Asks

Final Closing: As we set our target for final closing on April 15th, we will be hosting a dinner or two with some of our LPs and a couple of portfolio founders. The goal is for you to join and invite one or two potential LPs from you network. We aim for the wk commencing Feb 26th: We’d love to have you on board!

GP Personal Updates

2023 marked a pivotal chapter in my journey, witnessing the birth of Silicon Roundabout Ventures.

It was the perfect prelude to 2024: uncovering lessons, challenges, and opportunities to set us up for our 2nd year of operations and the upcoming final closing of our Fund 1.

Here the top 3 lessons learned, but if you want to dive deeper and get a detailed analysis on our 1st year of operations and our predictions for 2024 and beyond, read our recent article:

Unicorns are Dead: The Age of Titans Begins

Brave New (Deeptech) World Picture this: I’m sitting across from a pre-seed portfolio founder, barely six months into my solo VC journey. Next to us, a senior head of procurement from a major European government. Eyes alight with the kind of interest usually reserved for industry giants.

Top lessons:

Team needs exceptional characters. Everyone in venture capital says this. But true exceptional insights and capabilities don’t come cheap ─and defining such characters is probably a never ending process.

Good co-investors matter. Especially for a small fund like ours.

Tech in VC is powerful. And we have a major opportunity to move early in the space. With Ralph on board as a Venture Partner / CTO and my background in engineering, we will slowly but surely use this engineer-driven inception at our advantage as we chart our course in 2024 and the years ahead.

So there you have it, 2023 was as much about investment as it was about learning and growing as a firm.

For our limited partners, I want to ultimately deliver on our “Silicon Roundabout Ventures promise”: to stands as a gateway to the future of technology, and play a key role in the next 20 years or more in supporting Europe’s ascent on the deeptech global scene.

As per where you can find me: I’ll be working nomadically mainly from 2 locations in London. The Intel Ignite space in Kings Cross, and the Concept Venture office in Victoria, where I’ll be VC in residence. If you want to catch up, drop me a note and we can arrange: As you know by now, we love community building at Silicon Roundabout Ventures.

Ciao!

Francesco