Fresh Co-Investments + New Fund: Silicon Roundabout Ventures, Community Updates, July 25

Our Community update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

New portfolio company – Why we backed and immediately doubled down on [REDACTED: ONLY FOR LPs], building the computing backbone for satellites.

Portfolio updates – From EU Chips Act wins to ESA contracts, quantum milestones, and hyperloop breakthroughs.

Co-Investment Opportunities: [REDACTED: ONLY FOR LPs]

Market lowdown – Grid-forming batteries replace fossil fuel inertia in UK’s first fossil-free grid stability test.

Upcoming events – Alpha Summit in London & Deeptech Demo Day 2025 finals.

Open roles – Engineering and product positions across quantum, robotics, and photonics.

GP’s personal note – Why we think AI is slowing down, and where the real breakthroughs will come from.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

💸 Co-Investment Opportunities

[REDACTED: ONLY FOR LPs]

Portfolio updates

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

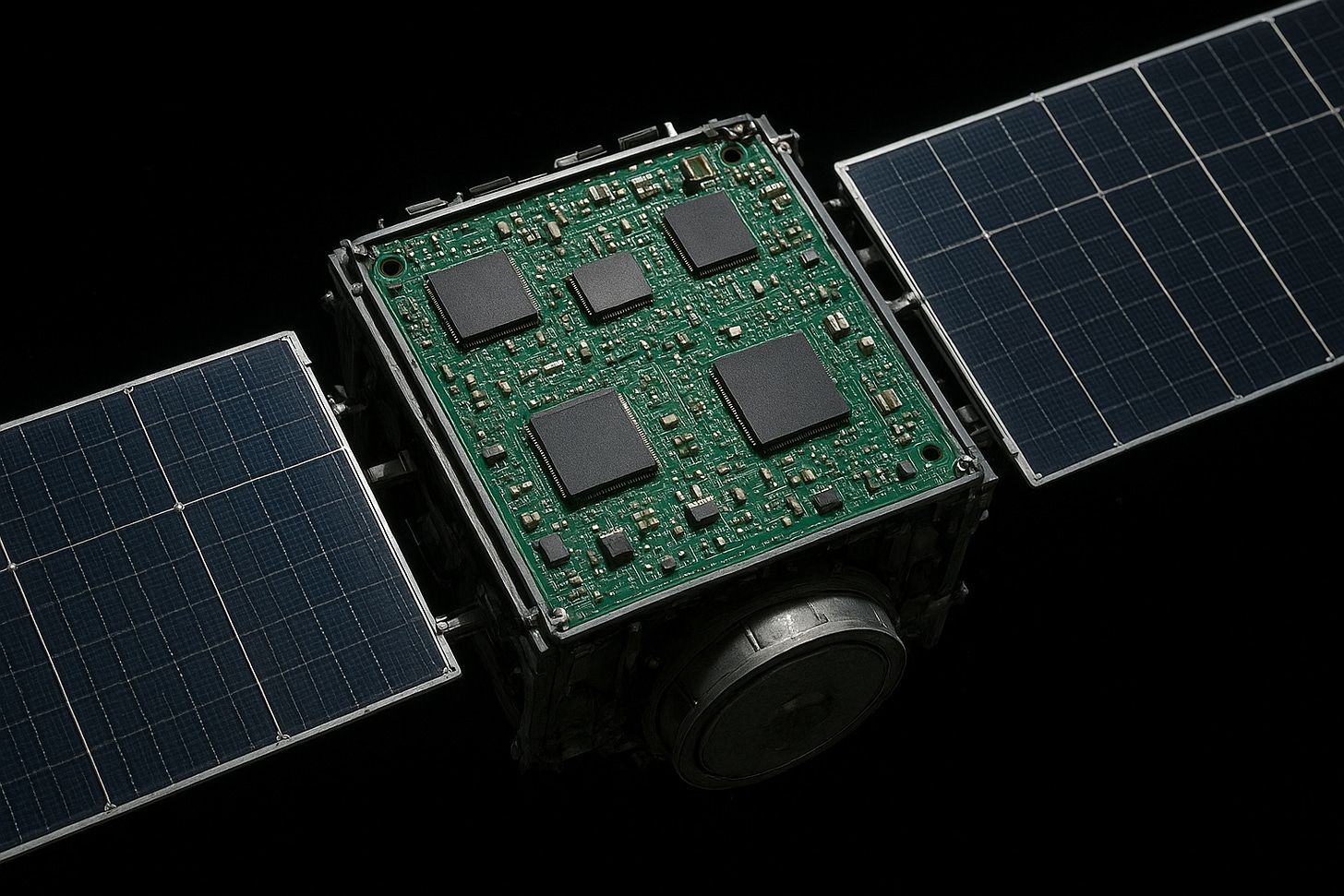

Building the computing infrastructure up in Space

Space Edge Computing | Luxembourg | Angel & Pre-Seed Rounds

Over this summer, Silicon Roundabout Ventures has invested $[REDACTED: ONLY FOR LPs] in a [REDACTED: ONLY FOR LPs]-based company building high-performance computing infrastructure for satellites, as part of their initial start-up round, then immediately doubled down for their pre-seed.

This investment targets picks and shovels long-term needs for the fast-growing in-space computing market, starting with a critical "missing middle": commercial LEO operators who need off-the-shelf cloud-class performance without scarifying reliability or paying for custom-built defence-grade clusters.

Market Opportunity

The space edge computing market sits at an inflection point where on-board computing shifts from supporting subsystem to primary payload. Our diligence reveals a clear gap: legacy vendors like [REDACTED: ONLY FOR LPs] sacrifice performance for heritage at premium pricing (~$1M per system), while emerging NVIDIA-centric players struggle with power consumption and radiation tolerance. The addressable market for commercial-grade space computing is projected to grow from $500M in 2025 to $3B by 2033, driven by increasing autonomous satellite operations and real-time data processing demands.

[REDACTED: ONLY FOR LPs]'s heterogeneous, cluster-ready architecture targets commercial constellation operators who represent the highest-volume segment currently underserved by existing solutions. They’ve started with the least fancy but most critical components: Switches, Data Processing Unit (DPU), and clusters, all reliably served by a “just works” software stack. Over time, their approach of “shipping fast”, get real customer feedback, and keep on iterating despite the hardware and flight constraints, may well prove to be a winning strategy, in an industry where Moore’s law effects lag Earth by about 7 years.

Strategic Positioning

[REDACTED: ONLY FOR LPs] operates with three competitive advantages:

Technical: Heterogeneous computing approach avoids single-vendor dependencies that plague competitors only focused on repackaging NVIDIA or similar chips.

Commercial: $[REDACTED: ONLY FOR LPs] in the pipeline, which we believe the team to be able to close very fast, proving market validation that match our 2 customer reference calls.

Strategic: Clear path from profitable subsystem sales to space-based data centre services as market evolves.

The team's acquisition-savvy background and systematic approach to building market presence positions them to become the de facto leader in space compute infrastructure.

Investment Thesis

This represents our thesis on picking category-defining infrastructure companies early. [REDACTED: ONLY FOR LPs] combines proven founder execution, validated customer demand, and positioning at a market inflection point where space computing becomes mission-critical rather than supplementary, and a critical enabler for the expansion of in-space industries.

We're backing a team that understands how to build sustainable competitive advantages through spotting the right underlying technology trends, customer relationships, a “ship fast” culture, and flight heritage, rather than speculative technology bets or attempting to rush long-term product development in what is still a nascent market.

📅 Upcoming Events and Community Updates

Alpha Summit - September 4th

Our fund has been nominated for a category award at the LP/GP AlphaSummit by AllocatorOne in London.

If you’re also attending, don’t be a stranger and drop us a note!

:)

The Deeptech Demo Day - September to November 2025

Date: Finals broadcast live on November 25th - register here: https://lu.ma/zijex7xx

Pitch all the investors that matter in one day. Our annual flagship event brings together the most promising deeptech startups with leading investors in a focused, high-impact format.

Pre-register for 2025 right now:

Startups: Apply to Pitch

Investors: Investor Signup

Markups

A recap of our markups: (latest round)

Greenjets Limited: [REDACTED: ONLY FOR LPs] (Seed)

Nu Quantum Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Anaphite Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Panakeia Technologies Limited:[REDACTED: ONLY FOR LPs](Seed+)

Notable performers preparing for a follow on round:

Origin Robotics - $[REDACTED: ONLY FOR LPs] in defence contracts closed (Latvia and Netherlands)

[REDACTED: ONLY FOR LPs] - $[REDACTED: ONLY FOR LPs] in contracts closed (US and Europe)

Astral Systems - $[REDACTED: ONLY FOR LPs] in annual revenue and word’s first breeding of tritium in a commercial reactor

Ephos - $[REDACTED: ONLY FOR LPs] in annual sales crossed in 2024; also the first startup to receive EU Chips Act funding: secured 41m+ EUR to build the world’s most advanced photonics fab for glass-based chips

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 20

Top-of-the-funnel Pipeline: 4

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

🚀 Portfolio Updates

Nu Quantum

Nu Quantum hosted Hermann Hauser (Arm co-founder) at their Cambridge HQ and strengthened partnerships with Infineon's quantum division and CERN for their White Rabbit technology integration, advancing their position in quantum networking infrastructure.

[REDACTED: ONLY FOR LPs]

New entry and already kicking asses! [REDACTED: ONLY FOR LPs] secured ESA contract for high-speed communication systems and 3-year [REDACTED: ONLY FOR LPs] Defence Ministry deal. Selected for EU Business Defence Accelerator with first Data Processing Unit qualified for February 2026 launch and August US delivery.

[REDACTED: ONLY FOR LPs]

Successfully qualified first [REDACTED: ONLY FOR LPs] drag sail module for SpaceX launch post-summer. Expanded to 18 staff including ex-SpaceX Starlink engineer joining September, focusing on large deployable space structures as critical infrastructure.

Ephos

Ephos achieved a landmark milestone by becoming the first startup to receive an EU Chips Act grant, securing €41.5M ($49M) as part of a €105M ($123M) total project investment. This positions the company alongside industry giants TSMC, Infineon, and STMicroelectronics as recipients of this prestigious funding mechanism designed to strengthen European semiconductor manufacturing capabilities.

The grant will support construction of Fab-2, Ephos's second fabrication facility dedicated to manufacturing ultra-low loss and fast-switching integrated photonic circuits on glass substrates. These chips target the rapidly expanding AI data center market, where they enable faster data transfer while significantly reducing energy consumption. The company completed this achievement less than a year after finishing construction of Fab-1, demonstrating remarkable execution velocity in the deep-tech hardware space.

Archangel Lightworks

Appointed Scott White as Chairman bringing optical communications scaling experience. CEO presented at UK Space Conference on space-ground communications while showcasing TERRA-M deployable optical ground station technology.

[REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs] named World Economic Forum Technology Pioneer 2025, joining the ranks of previous honorees including Google, PayPal, and Palantir Technologies. Achieved largest quantum CFD simulation to date (64x64 grid, 16 qubits) with Quanscient, advancing toward quantum advantage in aerospace applications.

Anaphite

Partnered with Intralink for South Korea market penetration in battery manufacturing. CEO increased thought leadership presence while scaling operations with Quality Engineer and QC Analyst hires for growing customer demand.

CEO Joe Stevenson discussed on Auto Tech News the cost-saving advantages of Anaphite's Dry Coating Precursor technology.

Swisspod Technologies

Swisspod Technologies accelerated its US operations with preparations to launch AERYS1, their first capsule deployment in America at PuebloPlex, where they built what’s already become the world's largest hyperloop infrastructure.

The Deeptech Lowdown (Market update)

Scotland's 200-MW Blackhillock battery facility has successfully demonstrated the world's first grid-scale battery commissioned for grid stabilization services. Using advanced grid-forming inverters, the facility provides synthetic inertia and short-circuit current capabilities traditionally supplied by fossil fuel generators, proving that power electronics can replace spinning machinery for grid stability. This breakthrough supports the UK's goal to demonstrate fossil-free grid operation by end of 2025…

Asks & Portfolio Roles 🙏

As always, if interested or you know a fit, please reach out!

Nu Quantum is hiring a Product Manager - Optical and Photonic Systems and a Mechanical Engineer in Cambridge

Origin Robotics has multiple engineering roles open including Control Systems, Electronics, Embedded Software, and Mechanical Design Engineers

Ephos is hiring for Photonics, Electronic, and Process Engineers

GP Personal Update

LinkedIn now thinks I’m an AI perma-bear.

Oh well, so much for it.

But for you all going deeper with these reads and not stopping at the headline, here the nuanced view:

On August 1st I sent out our first official “Letter to our Limited Partners” where I forecast a likely scalability wall to the current AI development.

Already at the Mobile World Congress in March, I pointed out that the narrative that shoveling resources and money at current AI architectures and algos won’t necessarily yield the leap forward we need for the next stage of machine intelligence.

When GPT-5 came out, its underwhelming results prompted skeptics like Gary Marcus to summarise just how bad a news this is for the current approach.

On this, I see no reason to disagree.

The more evidence builds up, the more I think we will hit more and more of a plateau and a wall on the current technology and economics cycle, before we have truly unlocked the power of a truly generalised human-like or even super-human machine intelligence.

Is this certain?

No. And I wrote here before that even probably exaggerated accounts like ai-2027.com should be taken seriously if there is even 1% chances that the opposite will materialise and we get a runaway system we can’t control.

Does this mean I’m bearish on AI?

Hell no! We backed infrastructure companies IN the field.

But I do think the industry is chasing the wrong returns in the wrong way and with too much money.

If we are correct this will only expand our opportunities to back fundamental breakthroughs.

And if we are not, it seems now that we will now have at least enough time to notice this, since clearly the pace of a mainstream AI capabilities HAS slowed down significantly with the progression from say GPT-2 to 3 and then now from GPT-4 to GPT-5

We remain attentive to where the underlying technology is going.

Time will give us more indications on where we are actually heading.

But we continue to believe, first and foremost, that a new infrastructure leap will be needed for AI to keep on advancing.

That’s where we ultimately want to be the best-in-class investors —and one of the space we work hard to support with out community.