Grid Crisis to Gravitational Theories: Our Physics-Driven Investments against AI’s Bottlenecks - Community Updates Jan '25, Silicon Roundabout Ventures

Our Community & Fund update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

New Investment: We welcome [REDACTED: ONLY FOR LPs] to the portfolio—backing a world-class team redefining AI chip architecture.

Upcoming Invite-Only LP Dinner – Milan: Featuring Kylin Shaw, CEO of Hippos Exoskeleton, discussing his journey in deeptech and injury prevention.

The Deeptech Lowdown: AI’s energy crisis and how fully optical, passive network switches could reshape infrastructure.

Hiring & Portfolio Roles: Open positions at Archangel Lightworks, Origin Robotics, and Hippos Exoskeleton.

GP Reflections: Physics, market cycles, and our next fund—thinking through quantum computing, NISQ, and the future of deeptech.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

Invite-Only LP Dinner - Milan, 18th February 🍽️

Join us for an exclusive Silicon Roundabout Ventures dinner in Milan, featuring Kylin Shaw, Co-Founder & CEO of Hippos Exoskeleton. Kylin, a former basketball player, will share his journey in developing a first-of-its-kind AI-driven knee sleeve designed to prevent ACL and MCL injuries.

Expect great discussions on deeptech, venture, and the future of European innovation—along with a chance to unwind over dinner.

📅 [REDACTED: ONLY FOR LPs]

Markups

[REDACTED: ONLY FOR LPs]

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 15

Top-of-the-funnel Pipeline: 9

Key Deeptech Areas: Computing, Climate, and National Security Infrastructure

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: Infinity Recycling [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

Portfolio

[REDACTED: ONLY FOR LPs]* is a snapshot of the current portfolio.

*Link to a private Airtable base with a list of all portfolio companies and include the company’s name, short description, why we invested, URL, and category.

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

We welcome to the family [REDACTED: ONLY FOR LPs]!

We invested in [REDACTED: ONLY FOR LPs]’s triumvirate of technical founders as they take to market a paradigm shift in AI chips –[REDACTED: ONLY FOR LPs] (operational scaling), [REDACTED: ONLY FOR LPs] (neuromorphic architecture), and [REDACTED: ONLY FOR LPs] (chip design/verification).

Their combined expertise bridges neuroscience-inspired computing and industrial-grade hardware delivery. [REDACTED: ONLY FOR LPs]’ 13+ years in low-power circuit design ([REDACTED: ONLY FOR LPs]) provided the technical bedrock for their [REDACTED: ONLY FOR LPs]-chip production run, while his [REDACTED: ONLY FOR LPs] research roots ensured seamless IP transfer from the [REDACTED: ONLY FOR LPs] project.

[REDACTED: ONLY FOR LPs]. Their [REDACTED: ONLY FOR LPs] targets defense and robotics verticals where 50x GPU gains are transformative. Meanwhile they are already selling in the US, putting together a compelling stack not only limited to the chips and server stacks, but also the software compiling and running them.

We don’t believe NVIDIA is going anywhere as the market dominant force this decade, but as it happened before (even to them when they were the underdogs), there are limits to the state of the art, which will help a paradigm shift take place. Today dealing well with model sparsity is one of them. Symbolic AI and Graph-based models another one. Cracks will start to emerge in the opinionated matrix parallelisation in GPUs reign at the end of the 2020s, and in the meantime, [REDACTED: ONLY FOR LPs] niches will grow.

Just like gaming was the incubating market for NVIDIA, too small for the incumbents, but growing rapidly and allowing them to set the stage for AI domination in an Crypto mining and LLM-driven world, so we believe [REDACTED: ONLY FOR LPs] has a perfect technology to massively shift AI into a new wave, 6-10 years from now. Meanwhile, they have also been laser focused in finding applications where beating GPUs is already crucial for customers and where they are already generating revenue (and looking to scale fast).

We’ve been curious about brain-inspired architectures for a while but we could not find one that made us think “yes, if this takes off it will scale real BIG”. Now we have.

We thank the seed co-investors, our friends at [REDACTED: ONLY FOR LPs], and we look forward to supporting [REDACTED: ONLY FOR LPs] take to market their Brain-inspired Chips for the Intelligence Age.

💸 Co-Investment Opportunities

[REDACTED: ONLY FOR LPs]

🚀 Portfolio Updates

Archangel Lightworks

Archangel Lightworks is pushing the boundaries of space-based data infrastructure! The company has signed an MOU with Lumen Orbit to integrate its TERRA-M Optical Ground Station with a new constellation of space-based data centres. This partnership will enable high-speed, secure optical communication networks, unlocking near-instantaneous Earth Observation (EO) data processing.

By eliminating traditional bottlenecks in EO data handling, this initiative is set to accelerate climate monitoring, disaster response, and real-time environmental research. CCO Paul Davey described the collaboration as a “paradigm shift for Earth Observation,” paving the way for faster, more secure space-to-ground data transmission.

Infiniti Recycling

Infiniti Recycling has been shortlisted for the 2025 #21toWatch List, recognising groundbreaking innovations that are set to shape the future! Their direct recycling technology, designed to recover materials from battery chemistries previously deemed uneconomical, is gaining traction as demand for sustainable, local battery material manufacturing continues to rise.

Vypercore

Vypercore has also been shortlisted!

The #21toWatch List, run by cofinitive, evaluates companies on Innovation, Challenge, Influence, Viability, and Memorability. The final list will be announced on March 6th—congratulations to both teams, and we’ll be rooting for them!

Hippos Exoskeleton

Hippos Exoskeleton is advancing its AI-powered knee protection system, recently validating its ability to reduce valgus knee movements—a key factor in ligament injuries. The team is now preparing for clinical trials with Edge Hill University and the University of Bologna, aiming to establish robust medical validation.

With strong early interest from sports teams, physiotherapists, and athletes, Hippos is moving toward pilot trials and regulatory approval in the US and EU as it refines its product for wider adoption.

Nu Quantum

Nu Quantum has released a theory paper on Distributed Quantum Error Correction (QEC), outlining how modular quantum processors can be interconnected to achieve fault tolerance. The research demonstrates that distributed-QEC is feasible, efficient, and comparable to monolithic approaches, paving the way for scalable quantum computing.

This work provides a framework for building large-scale quantum systems using smaller, modular QPUs, addressing key challenges in quantum error correction.

🔗 Read more: arXiv paper | Press release

Origin Robotics

Origin Robotics was invited to speak at the Latvian-US Defense Drone Technology Symposium in Washington, DC, highlighting how small democracies are driving disruption in defense. The team emphasized that Europe can no longer rely on outdated models and must adapt to cost-effective, precision-strike capabilities.

With its innovative approach, Origin is reshaping the future of defence technology—delivering high-impact solutions at a fraction of traditional costs.

Finchetto

As AI’s energy demands continue to grow, Finchetto is tackling the challenge with photonics-based infrastructure to enable more compute with less power. In an EE Times feature, CEO Mark Rushworth outlines how fully optical, passive network switches could dramatically reduce data center energy consumption while increasing performance.

With AI workloads straining global power grids, Finchetto’s approach offers a scalable solution to improve efficiency without compromising speed. Read more on their vision for the future of AI infrastructure:

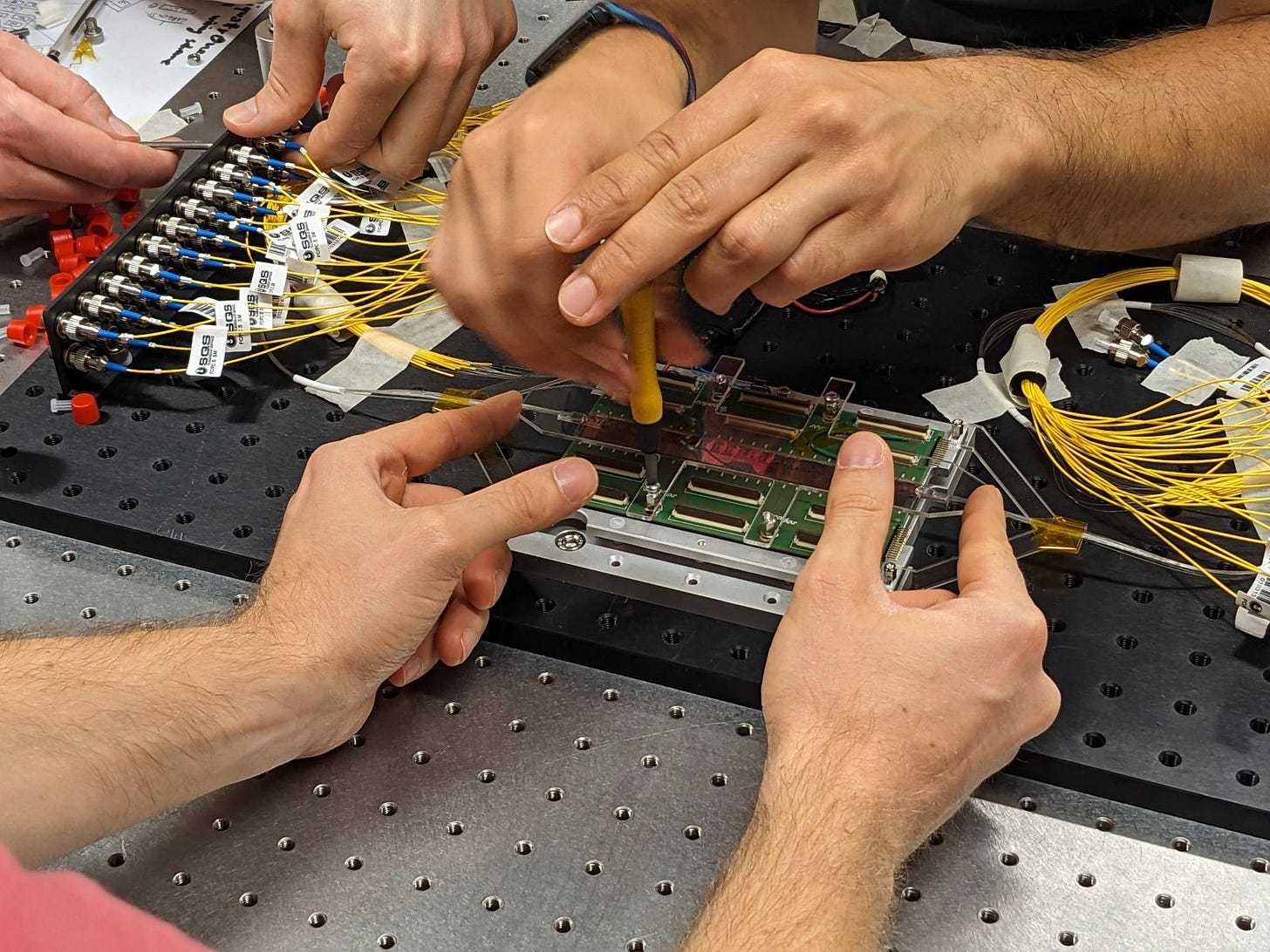

Ephos

Ephos has delivered its latest generation of quantum photonic chips, now directly in the hands of clients. A fantastic milestone for the team.

Panakeia

Panakeia has launched PANProfiler Colon, an AI-driven software that detects Microsatellite Instability (MSI) and mismatch repair deficiency (dMMR) directly from H&E-stained images of colon cancer tissue. This fully digital approach enables rapid molecular profiling in minutes, improving accessibility and efficiency in precision oncology.

Already registered for use in the UK and deployed in multiple hospitals, PANProfiler Colon will be featured in a multi-site validation study at the upcoming ASCO Gastrointestinal Cancers Symposium.

🔗 Read more: Full announcement

The Deeptech Lowdown (Market update)

🚀 AI’s Energy Problem—And How to Fix It

AI is pushing global power grids to their limits, but Finchetto’s Mark Rushworth argues there’s a smarter way forward: fully optical, passive network switches. These could slash data centre energy use by nearly 20% while boosting compute performance 50×—without waiting for more grid capacity.

🔗 Read how photonics could reshape AI infrastructure: Full article

Asks & Portfolio Roles 🙏

Archangel Lightworks are hiring for multiple positions in Oxford including Embedded Software Engineers, Cloud Engineers, and Optical Systems Engineers.

Origin are hiring for Mechanical Design Engineers and Embedded Software Engineers.

Hippos Exoskeleton are hiring for multiple positions!

Spread the word…

GP Personal Updates

This month I’m deep back into computing, physics and philosophical reflections… When I find cuttings of time given dealflow has literally exploded —if you haven’t noticed the 9 “top of the funnel” companies in the Snapshot above is quite extraordinary and will force me to say no to some really good founders!

On one side I’m finally reopening a bookmark that’s been lingering for too long: going through the whole Wolfram’s Physics Model. Here a quick intro:

But of course I’m also going deeper into the skeptics’s challenges (like the fact the model may be too vague and flexible to end up moving from a qualitative conceptualisation of physics to a practical physics theory).

And in passing through this the search allows me to form, challenge, throw away, or strengthen views about tech market dynamics. For example going from a computational review of Wolfram’s practical problems to market dynamics on whether we are at a bubble peak. Or whether we should be doubling down on quantum computing and if so, which founders-market fits and approaches to fund now that we are in the NISQ (noisy intermediate scale quantum) age.

Besides this I also started seriously thinking about our next fund, now that we are moving into the last 3rd of fund deployment. If you’re curious or want to get involved, I am, as you might expect from me…. Building it in public :) So do check out LinkedIn updates and comment away suggestions!