Hippos Goal ⚽ 2 Opposite Bets & More Defence Wins - Investor Updates Feb '24, Silicon Roundabout Ventures

Our LP update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

Fund Performance: Silicon Roundabout Ventures LP Fund 1 (2023 vintage) now holds 16 companies, with £[REDACTED: ONLY FOR LPs] in unrealised gains from 2 markups.

New Investments: Closed two deals:

[REDACTED: ONLY FOR LPs]: $[REDACTED: ONLY FOR LPs] seed+ SAFE in quantum software stack, targeting fault-tolerant quantum middleware.

SCI Semiconductor: [REDACTED: ONLY FOR LPs] pre-seed in cybersecurity chips and services company taking to market the CHERI/CHERIoT architecture.

Portfolio Highlights:

Greenjets and Origin Robotics grow their booked revenue into the multi-millions with more contracts.

[REDACTED: ONLY FOR LPs]: Secured 4 pilots ([REDACTED: ONLY FOR LPs]GWh LOI) and patented recycling tech.

Hippos Exoskeleton: Demonstrated AI-powered injury prevention devices to Juventus/Arsenal; consumer trials starting in London.

Nu Quantum: Published breakthrough distributed error-correction paper and formed Quantum Datacenter Alliance.

Co-Invest Opportunities:

[REDACTED: ONLY FOR LPs] (early seed) and [REDACTED: ONLY FOR LPs] ([REDACTED: ONLY FOR LPs] logistics) open to angels.

Market News: Microsoft’s quantum chip claims challenged; Intuitive Machines lands second lunar spacecraft.

Events: Meet our GP Francesco in Paris at Hello Tomorrow or help us finalise our Amsterdam & Poland LP dinners —reply to join.

Hiring: 15+ roles across Archangel Lightworks, Origin Robotics, and Hippos.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

Our GP Francesco spoke as a keynote speaker at the Mobile World Congress, in the 4YFN summit, and is now packing to head to Paris, to moderate a panel at Hello Tomorrow on Deeptech funding.

Drop us an email by replying to this email if you’re in town in Paris and want to catch up :)

We are also organising an LP dinner in Amsterdam and Poland, so please do let us know if you’re local and would like to join those or can help co-hosting or inviting folks interested in deeptech in those areas.

Markups

No markups this month.

Although both Greenjets and Origin Robotics closed more defence contracts, taking their booked multi-million revenue even higher this year.

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 2

Total Portfolio Companies: 16

Top-of-the-funnel Pipeline: 7

Key Deeptech Areas: Computing, Climate, and National Security Infrastructure

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

Portfolio

[REDACTED: ONLY FOR LPs]* is a snapshot of the current portfolio.

*Link to a private Airtable base with a list of all portfolio companies and include the company’s name, short description, why we invested, URL, and category.

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

February was our busiest month to date. Never before we closed two investments in one month.

However, this is also due to a recent accumulation of due diligence and one round delayed from December, which resulted in this.

The two investments could not be more different.

One being an exception and outlier in our model for a variety of reasons, not least their valuation. The other being the core examples of what we do: namely to go super early in hyper talented technical founders and back them with their first cheque.

Without any further ado:

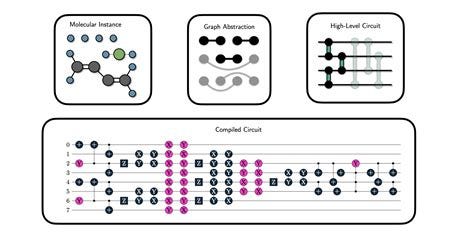

[REDACTED: ONLY FOR LPs] —The Ultimate Software Stack For Quantum Computers Today and Tomorrow

We always wondered who would ever back a pre-seed team at “5 at 25” or “4 at 24” (million round, million post-money SAFE). Those apparently mystical founders who can compel investors to back their idea as the top team out of a YCombinator cohort or similar.

That’s not one of those stories.

But the team is.

While we did not participate in the 20[REDACTED: ONLY FOR LPs] pre-seed, which was indeed a “[REDACTED: ONLY FOR LPs]”, when the Ukranian startup was only 2 co-founders and a few devs in [REDACTED: ONLY FOR LPs] and a very rough MVP, fresh out of [REDACTED: ONLY FOR LPs], we just did something possibly even more against our rules and models.

We approached the founders to discuss what they were building when they were not raising, knowing it was likely a huge waste of time. Why?

Gut feeling would be a short and unfair explanation, because there were a few interesting pointers to generate such a “feeling”:

The main technical founder, [REDACTED: ONLY FOR LPs], is a prolific theoretical physicist with a strong practical engineering and eclectic development bug, which he demonstrated in his previous position, having become [REDACTED: ONLY FOR LPs].

He co-founded [REDACTED: ONLY FOR LPs] with an interesting match: a [REDACTED: ONLY FOR LPs] CEO, physics and ML engineering [REDACTED: ONLY FOR LPs].

They achieved several world-first since their pre-seed, including some [REDACTED: ONLY FOR LPs] simulation work, and some very exciting results in [REDACTED: ONLY FOR LPs] that point to an at least plausible quantum advantage in the area for applications like molecule or aerospace modeling.

They embody both the Ukranian top-notch tech engineer and scientist who’s defying the war to build a technology that can give technology advantage to democratic nations (an archetype we developed as the war unfolded), as well as the US-facing spirit of those European teams with global ambitions we favour at our VC (due to the current dominance of the US market to scale startups) —in this case with a US [REDACTED: ONLY FOR LPs].

So our GP went “outbound”. Secured an intro. And started talking and seeing the behind the scene of what [REDACTED: ONLY FOR LPs] actually built.

We discovered that the CTO grabbed some top engineers from his previous firm, which he left in excellent terms, and the founding pair scouted some exceptional quantum talent globally. They chose a distributed strategy, despite the VC industry valid skepticism towards it, as a trade-off to find the absolute best minds to solve the herculean task of making quantum computer usable in real world applications in the very near future —yes, even in the NISQ era. As well as to eventually create the future cloud platform for end users to have a meaningful interface to run quantum programmes once (and if) we reach fault tolerance.

For 3 months we discussed physics. Business strategy. Quantum physics. We checked their current interface and operators, which enable even non-quantum expert programmers to use it. And we referenced unpublished trade secret results and papers —including customer feedback from a large enterprise who ditched a well funded large quantum company to work with them instead. We even had a discussion with our LPs at Molten about what prompted them to back Riverlane at growth stage and what metrics a growth investor would expect from an exceptional company that’s not just shooting for unicorn status, but industry defining world domination.

Eventually, we were convinced that: a) we should keep our skepticism with respect to the quantum industry achieving Fault Tolerance in the current decade, maybe even during the next 10 years; b) If humans achieve FT, something like [REDACTED: ONLY FOR LPs]’s platform would still be needed to build quantum applications, just like we use middleware today, we don’t go and buy a server stack to write and deploy our own programmes; c) [REDACTED: ONLY FOR LPs]’s approach as a business makes perfect sense and has already shown to be competitive in the right way (winning R&D contracts with leading corporations, convincing globally relevant investors, mindset to raise a global-leading Seed that’s likely more ambitious than as Series A in European standards); and d) [REDACTED: ONLY FOR LPs]’s platform has a credible path to achieve quantum supremacy for world-useful applications in either financial or physics modeling within 2-3 years and sub 100 logical qubits, maybe even [REDACTED: ONLY FOR LPs] (we’re heading there, Microsoft entangled 24 of these last November).

Now given the above, joining [REDACTED: ONLY FOR LPs]’s seed round would have been impossible for our model. And also because if they pull it off right, it’s going to be way out of our funding capacity and hard to access.

But we built mutual trust and respect. And [REDACTED: ONLY FOR LPs].

So we agreed on a [REDACTED: ONLY FOR LPs].

We understand this means such an investment will only return the fund (assuming 50-60% dilution) if the company achieves [REDACTED: ONLY FOR LPs].

We mentioned this is not our usual play.

Different stats point at just over 1% of VC backed companies achieving unicorn status. Maths is [REDACTED: ONLY FOR LPs].

Yet we figured that our job is ultimately to spot outliers that convince us to have over-the-odds capacity to return our fund and ideally more. One (extremely important) way to do so is by keeping benchmarks into account. And with [REDACTED: ONLY FOR LPs], and their team, we decided that for what we’ve seen, they have an outsized chance to be an industry re-defining company. A 1 in 10 or 1 in 20 kind within a portfolio, especially if they do end up defying the global expectation timeline on making quantum computers useful. Since we’re writing 20-25 cheques out of this fund, we decided to write a slightly bigger one to increase ownership a bit ([REDACTED: ONLY FOR LPs]), and take this exceptional bet to back the duo.

Welcome to the family!

SCI Semiconductor —The RedHat For CHERI: The Capability Architecture And Chip For Fearless Code Deployment

We invested in SCI Semiconductor’s [REDACTED: ONLY FOR LPs] pre-seed round as the first institutional commitment.

This investment aligns with our core thesis that memory-safe computing is the next frontier in cybersecurity, with a major global push to adopt CHERI specifically as a “safe by design” architecture backed by governments and tech giants as the number of hackable devices globally skyrockets.

The global cost of cyberattacks is projected to exceed $10T this year, with memory vulnerabilities behind the lion share of attacks and legacy architectures increasingly vulnerable to exploits like buffer overflows —a problem entrenched by decades of reliance on memory-unsafe languages like C/C++ as a tradeoff to achieve performance and low level control. This will only increase as more and more code gets generated by AI, given that the world already doesn’t have enough coders to engineer stacks and fix safety issues today, and it’s getting worse, not better.

SCI’s CHERIoT-Ibex-based ICENI processor family directly addresses this via hardware-enforced memory safety, reducing vulnerabilities by ~70% while maintaining backward compatibility.

Regulatory tailwinds are now pushing disruption through to avoid a technology development collapse globally: CISA mandates memory-safe critical infrastructure software by 2026, and the UK’s £1B semiconductor strategy prioritizes secure compute.

Even with the best opportunity and timing, execution is what matter and we found convincingly exceptional people at the helm of SCI: Haydn Povey (UK-based security/IP veteran, former CSO at IAR.com and exited founder of SecureThingz) and Krishana Anne (West Coast based serial entrepreneur, RVSKT president, and former senior at Rambus, Broadcom, AMD, and MIPS).

As the CEO and full time executive leader, Haydn recruited two CHERI/CHERIoT heavyweights, David Chisnall and David Jackson, to lead the technology development. Their pre-funding progress is already noteworthy with early contract wins with hyperscalers, the UK Government (DSIT), and a partnership with Quantum Dice for quantum-backed cryptography.

Risks include slower-than-expected OEM adoption and competition from well-funded incumbents like Arm’s Morello or the world finding a way to make code memory safe purely on a software level, though SCI’s focus on retrofit compatibility and lower latency (critical for IoT/edge) differentiates and we don’t think that a) a whole global code rewrite in Rust is feasible, nor that is is b) a panacea solution for all memory safety globally.

Exit Scenarios & Fund Impact

Our [REDACTED: ONLY FOR LPs] investment [REDACTED: ONLY FOR LPs] targets a [REDACTED: ONLY FOR LPs] return, with various options open to SCI. If they do become a cybersecurity RedHat for CHERI, revenue in the 100s of millions or even billions are possible. RedHat makes over $3 Billion. Cybersecurity scaleups like Darktrace (before acquisition) often exceed 100s of millions once they hit scale-up hypergrowth. This would open up a path to billion dollar exit scenarios, which the founder Haydn would love to push for. He already achieved an exit before. Now he wants to go for the big moonshot.

Of course for the fund, a [REDACTED: ONLY FOR LPs] fund returning exit could also be achieved via strategic acquisition. The $540B semiconductor market is consolidating around security: analogies include NVIDIA’s $40B Arm bid (2020) and Synthara’s $11M raise (2024).

[REDACTED: ONLY FOR LPs]

The funding will go towards chip design and IP licensing service setup for initial product offering, team development, sales channel opening, and both software and hardware engineering for early production.

💸 Co-Investment Opportunities

While the rounds are looking complete, founders are open to smart value add angels for these 2 rounds:

The Battery Recycling Disruptors: [REDACTED: ONLY FOR LPs] (Pre-Seed / Early Seed)

Our portfolio company [REDACTED: ONLY FOR LPs] is talking to investors about their upcoming round, and if you’re keen to get involved directly, they are open to have angels join them directly.

For their progress, see updates in the section below.

If you’d like an intro to the founder, just click [REDACTED: ONLY FOR LPs].

Hypersonic Logistic Next Portfolio Entrants: [REDACTED: ONLY FOR LPs]

We’ve made a commitment to [REDACTED: ONLY FOR LPs]

🚀 Portfolio Updates

[REDACTED: ONLY FOR LPs]

By 2030, over 145 million EVs will be on roads worldwide, creating an urgent need for sustainable recycling solutions for batteries containing critical materials like lithium, cobalt, and nickel.

Progress made:

Tech

Submitted 2 highly detailed patents which cover their unique recycling technology and recovery and production of active material from battery cells

Their samples of recycled [REDACTED: ONLY FOR LPs] cathode came back as industry grade and have proven electrochemical data (it works in a battery!)

Their recycled [REDACTED: ONLY FOR LPs] anode is also industry grade and have proven electrochemical data

Currently designing and producing their [REDACTED: ONLY FOR LPs] along with upscaling their delamination technology ready for scale up

Commercial

4 pilot studies:

EU Gigafactory 1 - Slurry recycling. [REDACTED: ONLY FOR LPs] slurry with the potential to do [REDACTED: ONLY FOR LPs] slurry in the future ([REDACTED: ONLY FOR LPs]GWh)

EU Gigafactory 2 - Slurry recycling. [REDACTED: ONLY FOR LPs] slurry and [REDACTED: ONLY FOR LPs] slurry ([REDACTED: ONLY FOR LPs]GWh)

1 UK bus & energy storage operator (LOI) - [REDACTED: ONLY FOR LPs]Gwh (approx. [REDACTED: ONLY FOR LPs] over 5 years) of batteries in the UK. Entirely [REDACTED: ONLY FOR LPs], no competition

1 UK based e-mobility company (LOI) - [REDACTED: ONLY FOR LPs] in 2025 raising to [REDACTED: ONLY FOR LPs] in 2027

The company has now a permit for the recycling of [REDACTED: ONLY FOR LPs] which aids in unblocking them for generating revenue in 2025.

Hippos Exoskeleton

Hippos Exoskeleton continues to advance their revolutionary AI-powered knee injury prevention technology. The company recently demonstrated their solution to football legend Giorgio Chiellini and representatives from Juventus Football Club and Arsenal F.C. Their innovative technology is a lightweight 100g sleeve that uses AI to detect injury risk in real-time and inflates within the crucial 60ms injury window, providing protection before an injury occurs. Unlike traditional bulky metal braces, the Hippos solution feels like a second skin when not activated. The company is planning to begin consumer trials in London this year to bring this technology to more users.

Nu Quantum

Nu Quantum has been featured in an IEEE Spectrum article titled "The Future of Quantum Computing Is Modular", highlighting their recent theory breakthrough in adapting error-correction schemes to modular architectures. Their paper, "Distributed Quantum Error Correction Based on Hyperbolic Floquet Codes", demonstrates how linking multiple quantum processors together can build computers large enough to tackle real-world problems. According to Nu Quantum's CEO, Carmen Palacios-Berraquero, "This is a really big result because, for the first time, distributed quantum computing and modularity are real options."

Additionally, Nu Quantum has announced the launch of the Quantum Datacenter Alliance (QDA), a collaborative initiative bringing together industry leaders including Cisco, NTT DATA, Oxford Quantum Circuits, QphoX, Quantinuum, and QuEra Computing to address opportunities and challenges in building scalable quantum computing services.

🔗 Read the quantum error correction paper

🔗 Read the QDA press release

Archangel Lightworks

Archangel Lightworks is currently showcasing their laser communications technology at Mobile World Congress 2025 in Barcelona, in partnership with Innovate UK and the Department for Business and Trade.

🔗 Learn more about their involvement with the Technology Missions Fund

Anaphite Technologies

Anaphite is currently exhibiting at InterBattery 2025 in Seoul, South Korea, where they've also unveiled their new brand identity. The team is showcasing their innovative Dry Coating Precursor (DCP®) technology platform at the UK Pavilion (stand A420), demonstrating how their solution unlocks dry battery electrode coating for the EV industry.

Finchetto

Finchetto has kicked off 2025 with an exciting nomination as a finalist for Innovation Product of the Year at the Data Centre World London Awards. This recognition celebrates their groundbreaking work on the world's first fully-optical, passive network switch, which addresses critical challenges in cost efficiency and compute optimisation for data centers. The award ceremony will take place on March 12, 2025, at Tech Show London in Excel London. Additionally, CEO Mark Rushworth recently discussed with Machine's Jasper Hamill how Finchetto is helping to address AI's growing energy demands, as data center electricity consumption is projected to double by 2028.

🔗 Read the full article on AI's energy challenges

Origin Robotics

Origin Robotics has just wrapped up their participation in Enforce Tac 2025, where they strengthened existing relationships and connected with potential new partners in the defense technology sector. Origin is actively expanding its team - they're currently hiring for several key engineering positions including Control System Engineer, Electronics Engineer, Embedded Software Engineer, and Mechanical Design Engineers.

Panakeia

For International Women's Day 2025, Panakeia AI highlighted the critical health disparities affecting women, who spend 25% more time in "poor health" relative to men. The company is addressing these inequities through their PANProfiler Breast and Colon molecular profiling solutions, which bring rapid, cost-effective cancer diagnostics to clinics worldwide. Panakeia also recently recognised Triple Negative Breast Cancer (TNBC) Awareness Day, emphasising how their AI-powered molecular profiling software helps healthcare professionals make informed decisions for breast cancer patients, particularly for this aggressive form that accounts for 10-15% of all breast cancer cases.

🔗 Read the McKinsey Health Institute study on women's health disparities

Greenjets

Greenjets is currently participating in the fourth cohort of the Global Incubator Programme in Toronto, hosted by MaRS Discovery District and Innovate UK. Their Technical Program Manager, Jordan Eriksen, is representing the company in Canada, working to scale their advanced electric propulsion technologies and engage with the Canadian market. The company is focusing on sustainable aviation solutions through advanced manufacturing and innovation, leveraging the MaRS ecosystem to form strategic partnerships and accelerate their growth in North America.

The Deeptech Lowdown (Market update)

Microsoft's Quantum Computing Breakthrough Faces Scientific Scrutiny

Microsoft unveiled their "Majorana 1" chip on February 19, 2025, claiming it's the world's first quantum chip with a "Topological Core" architecture. However, a March 7 Nature article reports that physicist Henry Legg has challenged the validity of Microsoft's "topological gap protocol" used to detect the Majorana particles essential for their approach, casting doubt on the company's claims of creating the first topological qubits.

Intuitive Machines Lands Second Lunar Spacecraft

Intuitive Machines has landed their second spacecraft "Athena" on the moon's surface on March 6, 2025, at Mons Mouton near the lunar south pole. While the landing was successful, CEO Steve Altemus indicated the lander likely tipped over upon touchdown - a repeat of issues from their first mission. This marks the second private spacecraft to reach the moon this week, following Firefly Aerospace's Blue Ghost landing on March 2.

Google Co-Founder Larry Page Launches AI Manufacturing Startup

Google co-founder Larry Page is building a new AI company called Dynatomics focused on product manufacturing, according to The Information. The stealth operation, led by former Kittyhawk CTO Chris Anderson, aims to develop AI systems that create "highly optimised" designs for objects and automate their factory production. The venture joins a growing field of AI-enhanced manufacturing startups but benefits from Page's considerable resources and experience.

Asks & Portfolio Roles 🙏

Archangel Lightworks are hiring for multiple positions in Oxford including Embedded Software Engineers, Cloud Engineers, and Optical Systems Engineers.

Origin are hiring for Mechanical Design Engineers and Embedded Software Engineers.

Hippos Exoskeleton are hiring for multiple positions!

Spread the word…

GP Personal Update

To go from seeing Italy’s now retired football legend Giorgio Chiellini from this…

…to this…

And even watch him being kicked by our portfolio founder, thanks to the efforts I put in to find him, contact him, and make this meeting happen to discuss product trials with Juventus FC in Italy, was priceless.

European Venture can really bring incredible people together.

Every month I feel more and more privileged in building this deeptech firm within it.

But most of all to “wing-man” entrepreneurs like Kylin from Hippos or Carmen from NuQuantum in building companies that can truly change the course of history.

Their thank you smile for any intro made or any other tiny bit of helpfulness we can give them, makes this job truly rewarding.

🥂 To our founders who are making the impossible, possible :)

And to all of you, LP backers, who are making it come true with your support.

Francesco