Making a 5X+ Fund a Real Life Thing - Silicon Roundabout Ventures, Community Updates, June 25

Our LP update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

TL;DR – Key Takeaways

New deal in the fund: We invested in Kaikaku.ai (the “Tesla of restaurants”); full-stack robotics, live revenues, and a truly, truly outstanding founder profile.

Portfolio re-ratings:

– [REDACTED: ONLY FOR LPs] internal top-up at 2× last price → 4X MOIC on our entry.

– [REDACTED: ONLY FOR LPs] Series A priced → 3X MOIC.

– Six companies already >£1 m ARR.Pipeline & co-invest: room for value-add LPs in [REDACTED: ONLY FOR LPs] (subject to CEO) plus two upcoming Seed rounds—email if interested.

Events: meet Nu Quantum CEO Carmen Palacios-Berraquero on [REDACTED: ONLY FOR LPs] .

Company highlights this month:

– Archangel Lightworks shows TERRA-M optical ground station at ESA.

– Greenjets hires ex-Reaction Engines BD Director and unveils new brand.

– Nu Quantum launches world-first rack-mounted Quantum Networking Unit and forms Quantum Datacenter Alliance.

– Astral Systems breeds tritium in-house—a fusion first.Market pulse: IBM targets fault-tolerant quantum computer by 2029; fusion TAM forecast $40-80 bn by 2035.

GP Update: From Ancient Troy to The First Electrostate.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

Portfolio updates (NEW: Updated Link with more live info!)

Here is a snapshot of the current portfolio.

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

Kaikaku.ai —The Tesla of Restaurants: Vertically Integrated Robotics & Data Restaurants Driven By A Glass Chewing Founder

We approached Kaikaku when they weren't actively raising. The tip came from one of our portfolio founders, Kylin, founder of Hippos Exoskeleton, and someone we rank amongst the most exceptional generational founders we’ve ever backed.

In hindsight, we took too long to have the meeting.

This was due to our skepticism for the business segment. After all, several startups and incumbents failed to bring a robotic revolution to restaurants and food production, including a Silicon Roundabout community startup from the last decade, Karakuri, which was backed in 2019 by great VCs like Hoxton –and which ultimately failed like everyone else in the cut-throat, low margin food industry.

But in the end, we did reach out for a meeting, and we were truly blown away by Josef, the founder.

Lesson for next time: if someone you rate exceptionally high suggests a meeting with someone they think to be exceptional, you jump on it and do it quickly.

The combination of founder background, technical execution, and contrarian market positioning warranted exception-level diligence. And compelled, indeed, we were. Thankfully Josef could do with some more cash, so he was happy to let our standard ticket in to let us have our target ownership, after referencing our GP with 2 of our portfolio founders.

The Food Obsessed Glass Chewer

Josef Chen embodies the archetype we've learned to back: domain expertise from a previous life trauma converted into an obsessive huge vision and systematic technological advantage and manic detail-oriented execution.

Since age 6, he worked in his parents' Chinese restaurant in Austria, developing intimate knowledge of operational pain points that franchise operators face daily. In fact, this experience made him hate the food world. All he could think of was making money online and escaping this hell: at 13, he built one of the world's first Bitcoin faucets reaching 150,000 users—demonstrating early systems thinking and revenue model innovation. He eventually went on to work for a PE fund, Proterra, whose GP ended up being of Kaikaku’s early angels.

But what made Josef pivot?

In his own words from our last long meeting: by venting his anger at his parents a couple of years back, they told him that making him work in the restaurant was the only way for them to spend time with him, as running the place was absorbing them full time.

This realisation not only brought him immediately and intimately close to the emotional trauma they went through, and so do all small restaurant owners globally, but also sent him down a rabbit hole of a reflection on the future of human connection through food, which he extensively writes about on the company’s website and in his blog, with multiple takes including on the consequences of AI.

The drive and obsession and what Josef made out of his life journey is what drove us closer to a cheque, combined with an extremely focused and detailed technical execution that’s not just about building a product, but an entire full stack operation that’s bigger than any individual piece.

Maybe this will also fail in the food industry.

But if there is one person who can solve technology for restaurants and food, we believe this person to be Josef Chen.

The Tech

Unlike competitors pursuing piecemeal automation (burger-flipping robots, sushi rollers), Kaikaku built a complete vertically integrated stack from hardware to software to cloud infrastructure. Their food assembly robot processes 300-400 bowls hourly, replacing 4-5 employees at 26-second assembly times—achieving human accuracy through 2+ years of real-world iteration in their "living laboratory" restaurant.

The SpaceX comparison is apt: by manufacturing components in-house using 3D-printed food-safe parts, they achieve 95% cost reduction versus traditional conveyor systems ($100 vs $2,000+ per foot). Sub-daily hardware iteration cycles enable rapid optimisation impossible with traditional 3-month metal component lead times.

Besides the food production, we were blown away by the level of precision they are going through in assessing, predicting, monitoring and working on.

From the aromas people should smell in the restaurant to correlations between weather or locations and consumption by the hour, and including just-in-time supply chain and production planning driven by data models and their in-house full stack software suite, all the way to the layout of the furniture in the restaurant and to how waiters should serve and what should people use screens for in the ordering process.

Nothing is left to chance or unstated assumptions.

Market Validation Through Real Operations

Common Room, their Russell Square restaurant, serves as continuous product validation. Daily repeat customers over 30-day periods demonstrate utility beyond novelty. Critically, 95% of customers ignore the robotics, focusing on food quality and experience—validating genuine value creation rather than gimmick positioning. Elderly customers comprise core demographic despite technology assumptions, citing "genuine care", “great taste”, “catchy venue brand”, and "non-transactional experience."

Business Model Differentiation

The franchise strategy targets structural economic advantages: 5-10% of GMV capture versus 0.1% for traditional SaaS models. Recent enterprise distribution agreement covering 50,000+ locations provides immediate scaling pathway. Three-phase approach: (1) owned restaurant validation, (2) franchise licensing, (3) restaurant acquisition mirrors successful franchise models where operators capture significantly higher revenue percentages. If Kaikaku can achieve their modelled margin improvements of over 30%, through sales improvement as well as cost cutting, this business could even scale through debt and restaurant rollups. They are currently working on bowl food, but there is no reason their team and robots can’t adapt to sandwiches, pizzas or wraps.

Our GP tried the food himself when assessing the restaurant and mystery shop on various customers live, and he rated it substantially better than Mexican London chain Tortilla, or “health conscious” fast food chain Leon.

Team Assessment

8-person core R&D team including 3 "10x engineers," PhD molecular biologist/Michelin-trained chef, and operations manager with McDonald's franchise experience. The distributed team prioritises iteration speed over traditional credentials—manufacturing wizard discovered through hospitality job platforms, exemplifying hidden talent arbitrage Josef systematically exploits.

Regulatory and Market Tailwinds

UK restaurant sector faces acute labor pressures: 78% turnover rates, 20-30% revenue consumed by labor costs, 9.8% minimum wage increases in 2024. Only 36% of operators meet profit targets. Annual labor savings of ~£300K per robot versus equipment costs of "few thousands" demonstrate compelling unit economics. The stats are equally worrying across the globe, especially in the US, where small food shop owners can’t compete with large chains, who often also struggle with specific locations.

Risk Analysis

Primary execution risk: single-location validation insufficient for franchise scalability proof. Well-funded competitors (Sweetgreen's $173M Spice acquisition, Bear Robotics' venture backing) possess superior marketing reach. Restaurant automation requires perfect reliability across food safety, mechanical systems, customer experience—areas where many predecessors failed despite significant funding.

Market timing risk: early-stage adoption with unclear winner-takes-all dynamics. Franchise expansion may be premature given competitive intensity from better-capitalised players.

Investment Rationale

Our investment targets exceptional founder executing contrarian vertical integration strategy in massive addressable market.

Real-world operational validation differentiates from laboratory-based competitors. The combination of proven technology, franchise economics, and Josef's systematic approach to solving childhood industry trauma justifies backing despite early execution stage.

Fund return scenarios viable through franchise scale (100+ locations generating £50M+ annual revenues) or strategic acquisition by restaurant operators, food tech players, or automation companies seeking proven restaurant robotics platform. We don’t see this business being acquired for a couple of hundred millions. They may well end up failing, but if they succeed, whether fast or slow, they are shooting for a multi-billion market cap. We believe this founder can pull it off.

Fund Impact Projection

[REDACTED: ONLY FOR LPs] x+ return achievable if Kaikaku becomes the McDonald's of robot-powered restaurants. $[REDACTED: ONLY FOR LPs] exit scenario would return the fund assuming 50-60% dilution. When we enter a company we really favour the pre-seed terrain where a $[REDACTED: ONLY FOR LPs] exit can be a fund returner at similar dilution levels, but we found Josef’s personality, work ethics, tech results, and team building capacity to just be too exceptional not to back.

The funding supports product refinement, business model testing (rollup strategy vs selling the full stack to smaller restaurant chains), and manufacturing scale-up—critical milestones for proving scalability beyond single-restaurant proof of concept. If the company can validate these, we expect a Series A to be above $100m. The business is actually generating revenue through their restaurant location, by true paying customers, which is not the goal of their restaurant, but helps the small team increase their cash position.

Play Yourself With Their Full-Stack Ambition

In the spirit of going above and beyond just building a robotic product that makes food, Josef, recently announced their own AGI. Or their ironic take on AI with an “Artificial Gastro Intelligence” platform.

Have a play with Epicure, the world’s most advanced culinary model, powered by actual science of how food ingredients are paired.

Inspired by IBM's now abandoned "Chef Watson", Epicure builds on two key recent papers:

- "Flavor network and the principles of food pairing" by YY Ahn, Sebastian Ahnert, James Bagrow, Albert-Laszlo Barabasi (2011)

- "FlavorGraph: a large-scale food-chemical graph..." by Donghyeon Park and Kim Keonwoo (2021)

Try their recipe generator at the above Epicure link and have a go pairing flavours and generating recipes in seconds for free. No paywall, no sign-ups.

If you’d like to hear Josef explain the business, here is great video from early this year.

💸 Co-Investment Opportunities

There may be space for a couple of value-add co-investor from our LPs in [REDACTED: ONLY FOR LPs] current round (subject to CEO approval). Two other portfolio companies are preparing for their Seed round.

📅 Upcoming Events and Community Updates

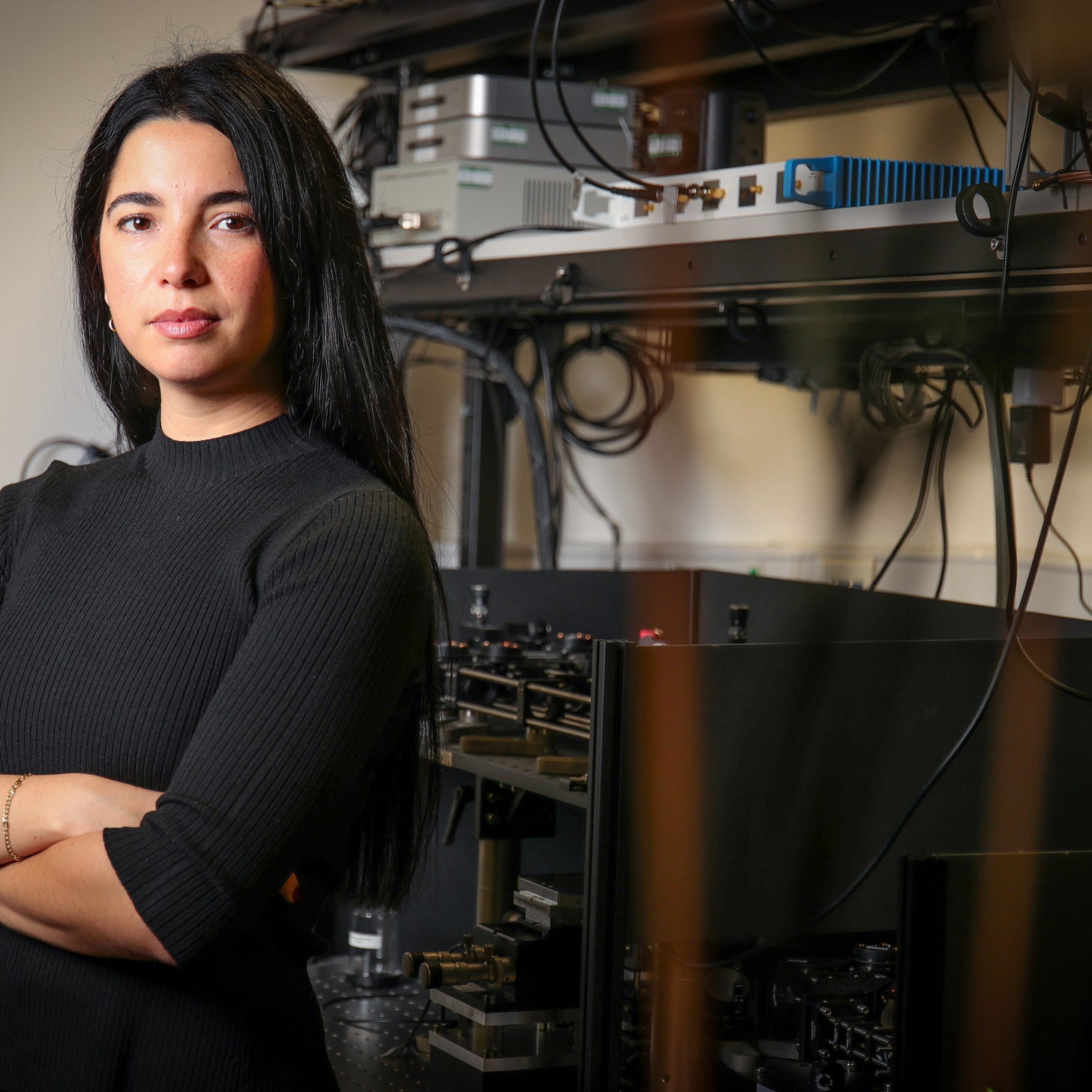

Nu Quantum - Meet the CEO | [REDACTED: ONLY FOR LPs]

A unique opportunity to engage directly with Carmen Palacios-Berraquero, quantum physicist and Co-Founder & CEO of Nu Quantum.

Nu Quantum is a UK-based company pioneering quantum networking infrastructure to enable scalable quantum computing.

Founded in 2018 and headquartered in Cambridge, they’re developing what they call the Entanglement Fabric™—a modular architecture that connects quantum processors into powerful distributed systems.

Their technology includes: Qubit-Photon Interfaces (QPI) to link different types of quantum bits (qubits) into a unified network. Quantum Networking Units (QNU) that act as the backbone for entangled communication between processors. A focus on qubit-agnostic design, meaning their system can work with various quantum hardware platforms.

Nu Quantum is backed by funds such as Amadeus Capital, IQ Capital, and Silicon Roundabout Ventures and has raised over $66 million in funding, [REDACTED: ONLY FOR LPs].

They collaborate with data centre providers, quantum hardware companies, and government agencies to push the boundaries of quantum computing. If you're exploring emerging tech or investment opportunities in quantum infrastructure, this one’s definitely worth keeping an eye on.

Carmen Palacios-Berraquero is the business’ Founder & CEO. She’s a quantum physicist and a driving force behind the company’s vision and partnerships.

Markups

[REDACTED: ONLY FOR LPs] has received formal offers from internal investors to raise an inter-round financing at twice the valuation from the last round. We believe this is fair as they increased their revenue to [REDACTED: ONLY FOR LPs] and looking to grow further this year, and are well on track to hit their milestones for a much larger Series A that could double or triple valuation levels from here. We are therefore in the process of marking our investment up to [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs] is closing their Series A, having already closed the main tranche of the round. This is a [REDACTED: ONLY FOR LPs] markup on our investment.

Both include dilution and are therefore boosting our fund to nearly [REDACTED: ONLY FOR LPs], but what’s more important, we now have 6 companies with revenue exceeding $1m.

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 19

Top-of-the-funnel Pipeline: 3

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

🚀 Portfolio Updates

Archangel Lightworks

Archangel Lightworks continues to strengthen its leadership and expand its presence in the space communications sector. The company recently welcomed Scott White as the new Chair of their Board, bringing valuable experience from building and scaling multiple optical communications companies.

The company showcased its TERRA-M Optical Ground Station technology at the European Space Agency's Scylight Conference in Dublin, where Owain Pryce-Jones presented the latest developments in their proliferated Space-to-Ground laser communications capabilities.

Greenjets

Greenjets has made significant progress in team expansion and brand development this month. The company welcomed Dr. Kathryn Evans as their new Business Development Director, bringing extensive experience from her role as Head of Aerospace at Reaction Engines and a PhD in turbomachinery aerodynamics from Cambridge University's Whittle Laboratory. Her expertise in both commercial and technical strategies for breakthrough sustainable aviation technologies strengthens Greenjets' commercial capabilities.

The company also launched a major rebrand, revealing a new logo featuring interlocking Gs that form spinning arrows symbolising a Greenjets fan in motion. This rebrand coincides with a refreshed website designed to better communicate their mission and showcase their high-performance electric propulsion systems. Greenjets continues to demonstrate their technology at major industry events, including DSEI Japan 2025, where they exhibited their electric propulsion solutions for defense applications.

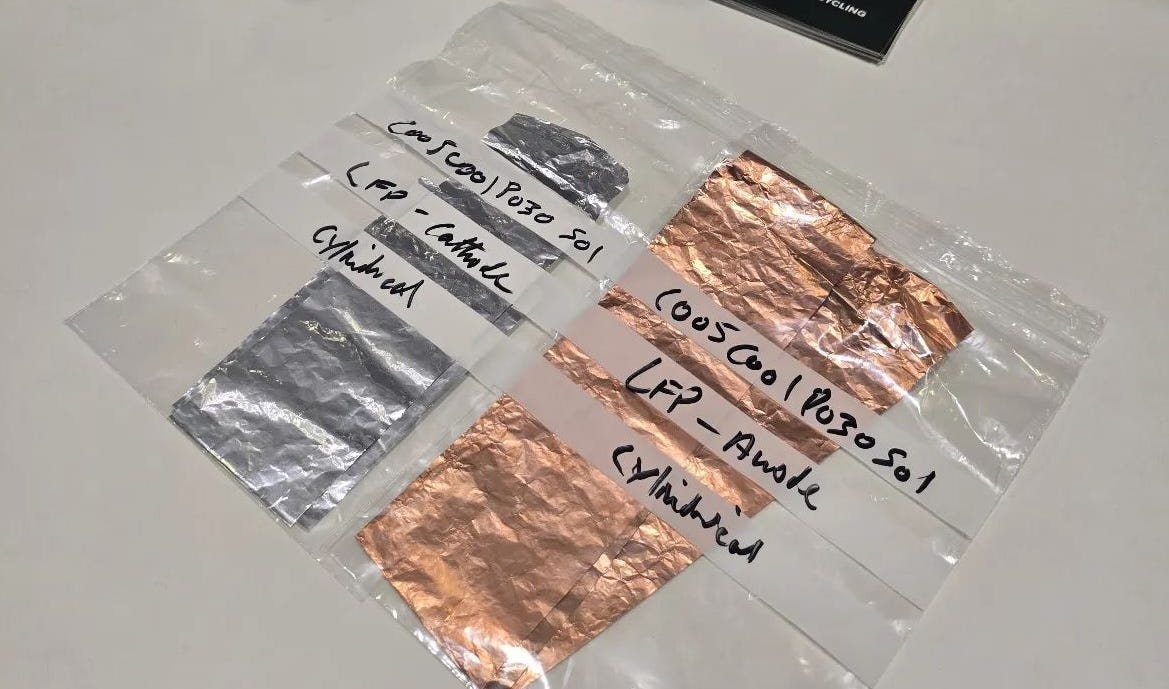

Infiniti Recycling

Infiniti Recycling has been highly active in business development and showcasing their direct recycling technology for lithium-ion batteries. The company successfully exhibited at MOVE 2025, one of the world's leading mobility events, in London's ExCeL Centre, where they showcased their novel direct recycling technology designed for gigafactory waste streams and demonstrated their ability to recover active materials efficiently and sustainably.

The team has also been participating in the Autobahn accelerator program in Stuttgart.

Nu Quantum

Nu Quantum has achieved a major commercial milestone with the launch of the world's first modular, rack-mounted Quantum Networking Unit designed for datacentre-scale quantum computing. This enables dynamic entanglement distribution between quantum processors, allowing multiple quantum processors to operate as a unified, more powerful system. The QNU represents a critical step in moving quantum networking from laboratory demonstrations to commercial infrastructure, achieving impressive technical specifications including up to 99.7% entanglement fidelity, 300 ns control latency, and MHz entanglement attempt rate while maintaining datacentre-ready design with standard rack-mounting and air-cooling.

Developed under the UK Government's Small Business Research Initiative and featuring collaboration with CERN for White Rabbit timing technology integration, the QNU launch demonstrates Nu Quantum's leadership in scaling quantum computing systems beyond current physical limitations. The company is simultaneously organising the inaugural Quantum Datacenter Alliance (QDA) Forum on June 26th in London at Battersea Power Station, bringing together key industry players to address quantum computing infrastructure challenges.

Anaphite

Anaphite is participating in the Advanced Automotive Battery Conference (AABC) in Mainz this week, with COO Alex Hewitt and Head of Cells and Electrodes Dr Alex Madsen representing the company. Recent coverage by The EV Report highlighted the significant cost advantages of Anaphite's technology, with Dr Jennifer Channell noting that dry coating both anode and cathode can save approximately 2% of the total cost of a battery-electric car—savings that become "genuinely transformative" at mass production scale of millions of vehicles.

Origin Robotics

Origin Robotics continues to advance their defence technology capabilities with the development of BLAZE, an autonomous high-explosive C-UAS interceptor designed for modern battlefield applications. This man-portable, rapidly deployable interceptor is equipped with an HE fragmentation warhead to defeat fast-moving aerial threats including loitering munitions and hostile UAVs.

Astral Systems

Astral Systems has achieved a historic milestone in fusion energy by becoming the first commercial fusion company to successfully breed tritium using their own fusion reactors. During a 55-hour deuterium-deuterium fusion irradiation campaign in March, the company successfully produced and detected tritium in real-time using a lithium breeder blanket, addressing one of the most critical challenges in making fusion energy commercially viable. This breakthrough was accomplished in collaboration with the University of Bristol and supported by the UK Atomic Energy Authority's Fusion Industry Programme.

The Deeptech Lowdown (Market update)

IBM announced on June 10, 2025, its roadmap to build the world's first large-scale, fault-tolerant quantum computer by 2029. The IBM Quantum Starling is expected to perform 20,000 times more operations than today's quantum computers, with computational requirements that would demand more memory than a quindecillion of the world's most powerful supercomputers. The roadmap includes key milestones with IBM Quantum Loon (2025) for testing qLDPC code architecture and IBM Quantum Kookaburra (2026) as their first modular processor combining quantum memory with logic operations, marking a crucial transition from physical qubits to logical qubits for practical quantum computing applications.

New market analysis released in May 2025 projects the global fusion energy sector could reach $40-80 billion by 2035 and exceed $350 billion by 2050 if key technological milestones are achieved. The projections coincide with Lawrence Livermore National Laboratory achieving its eighth successful ignition experiment in April 2025, delivering a record 8.6 MJ of energy yield. With private fusion companies preparing to demonstrate working reactors throughout 2025 and over $7 billion in private investment since 2021, the sector continues to accelerate toward commercial viability, supported by major infrastructure investments including the UK's £2.5 billion commitment to the STEP fusion power plant project.

GP Personal Update

Merhaba!

I took a week-long break to reconnect with my family after 4 months of late night work, early raises, and traveling everywhere to meet founders around Europe and some handpicked LPs for our next fund.

We picked Turkey, where we’ve never been, and I’m super thankful to all my friends in VC land who spoiled me with tips on where to go from Istanbul down and back across the Aegean cost and western inland.

But as I was enjoying visiting Troy’s, Pergamon’s, Smyrna’s or Helicarnassus’ ruins with little Catalina on my back and my better half next to me, and as I was refreshing my lyceum memories of the lines that shaped our culture, from Homer to Thales and from Anaximander to Heraclitus, I suddenly fell into a Chinese rabbit hole.

Not physically, I didn’t trip on any China-made pottery that somehow traveled the ancient silk road that connected Constantinople and Bursa to Asia, but mentally, as I realised the old adage “Gradually, then suddenly” is always true of technology cycles and becoming now quite evident when it comes to the EV revolution and energy.

I traveled for hours on with a full EV. No need for oil. Energy produced by massive wind and solar farms visible everywhere you go in Turkey, which is also (contrarily to most of the political West, like Germany) doubling down on Nuclear, which the country admittedly doesn’t have live on the grid just yet.

And if the tourist who doesn’t read about energy trends globally may be surprised to find this infrastructure in Turkey, with wind farms popping up everywhere, fast chargers along all roads, and trucks loaded with solar panels heading off to a new site, you must be really living under a rock not to see what’s happening with China becoming the world's first “electrostate”—an economy where electricity's rising share of total energy use drives fundamental transformation. Ex The Family’s Nicolas Colin wrote quite compelling about it as he links it to the economic theories of one of my favourite technology financial historians (if you can call her that), Carlota Perez.

Meanwhile, ex TechCrunch European legend Mike Butcher, scooped on China’s BYD announcing a deal with Octopus Energy in Europe to turn domestic EVs into a fleet of grid balancing batteries, rather than being mere juice takers.

Instead of overwhelming the grid, like the petrol-heads in the automotive industry used to say while laughing at Tesla early on, EVs and data-driven automation are creating a new grid that’s not just a passive mesh of cables carrying electrons from source to consumption, but becoming a “smart” infrastructure that’s becoming embedded with its deployment, from vehicles (who are destined to be ever more autonomous and electric) to data centres (which are driving massive energy needs but also who can orchestrate how energy best flow in massively digitised networks).

For context, China added more solar capacity in a single year than the United States has in its entire history. In 2023, China installed approximately 216.9 GW of new solar capacity, surpassing the cumulative total installed by the US up to that point, which was about 175.2 GW according to BloombergNEF estimates. They also jumped ahead of everyone else in nuclear fission, and while still lagging behind on AI reasoning and semiconductor capacity, as the cost of AI and compute approaches the cost of energy, they are already reducing the distance by leveraging their energy lead to mitigate individual chips shortcomings.

This technology and production capacity shift has a very striking parallel with the revolutions that helped overturn empires in ancient times all the way to Victorian Britain and the Ottomans before WWI.

As technology investors, we may be in a very peculiar phase where global powers are transitioning just as we struggle to reach the final (golden) age of the digital revolution period and possibly seeing the onset of the future cycle (still to be defined).

The consequences may be more dramatic than we could foresee only a few years back.