Results! The Deeptech Demo Day + Silicon Roundabout Ventures, Community Updates Oct '24

Our Community & Fund update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

Deeptech Demo Day 2024: Finalists announced! Join us on November 7th as 4 top judges select this year’s winner, with 120+ VCs signed up to attend.

New Investment: We led the $500k angel round for Hippos Exoskeleton, a promising startup tackling physical injuries with AI-powered health robotics.

Portfolio Updates: Origin Robotics unveiled their reusable precision-strike drone, BEAK, and Greenjets secured an R&D contract with the UK MoD.

Co-Investment Opportunities: Origin Robotics prepares for its next funding round. Interested LPs, get in touch!

GP Reflections: A personal take on venture myths, unicorn founders, and the realities of investing beyond the hype.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

Our Community Deeptech Demo Day 2024

The Deeptech Demo Day 2024 is officially live!

Final numbers are in! 120+ VCs signed up, with 80 independent firms taking part in the scoring and representing $80+ Billion in AUM. 250+ teams applied from all over Europe and from inception to Series A.

Startup applications are now closed, and scoring by the VCs is complete. Here are the finalists:

The finals will take place on November 7th, with 4 superstar judges from amongst our friends in VC land, tasked with picking the final winner:

Register to watch the battle: thedeeptechdemoday.com

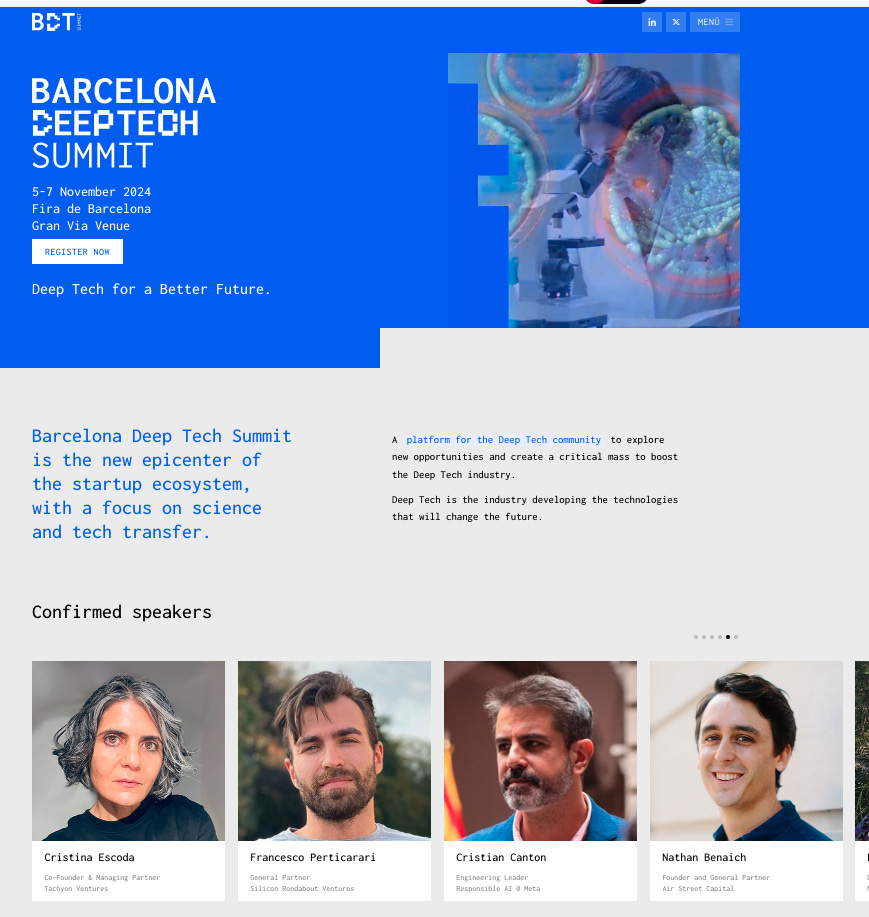

Francesco @ Deeptech Summit Barcelona

If you’re heading to the Deeptech Summit in Barcelona, are in the area, or know of an LP we should meet ahead of our next fund launch: drop us a message by replying to this email or send Francesco a whatsapp message and let’s arrange a coffee ☕

Meet Francesco in Barcelona: 5-6th November.

Markups

[REDACTED: ONLY FOR LPs]

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 11

Top-of-the-funnel Pipeline: 3

Key Deeptech Areas: Computing, Climate, and National Security Infrastructure

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

Portfolio

[REDACTED: ONLY FOR LPs]* is a snapshot of the current portfolio.

*Link to a private Airtable base with a list of all portfolio companies and include the company’s name, short description, why we invested, URL, and category.

Here is how we’re thinking about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

This month we led the $500k angel round for [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs] is working on eliminating physical injuries for humanity through health robotics devices.

The fund invested just under $200k (~£150k). After consulting with some of our LPs to take up the rest of the allocation and realising co-investment timelines did not align, we made a few intros to a couple of GPs we highly respect. Ultimately waived our co-investment SPV rights to let the founders onboard [REDACTED: ONLY FOR LPs], who had meanwhile made them an offer to complete the round.

Why we backed them:

The CEO is an insanely strong hustler and sharp entrepreneur with clear out of the ordinary talent. He's already sold a small business he built in his bedroom at 17. The CTO was the youngest ever hired at defence company [REDACTED: ONLY FOR LPs].

They are both at university but the progress they've made with limited time and capital blows our minds. They have early orders, strong industry references, and a path to address the massive orthopaedic market for the ageing population.

About the business:

[REDACTED: ONLY FOR LPs]

💸 Co-Investment Opportunities

[REDACTED: ONLY FOR LPs]

🚀 Portfolio Updates

Origin Robotics

Origin announced their round and came out of stealth, introducing BEAK, their autonomous drone designed for precision-strike missions. Unlike disposable FPV drones, BEAK delivers munitions and can be reused, reducing operational costs. We’re excited to be an investor!

Greenjets

Greenjets have secured an R&D contract with the UK MoD to support the development of their HS125 engine.

Nu Quantum

Roland Acra has joined Nu Quantum's Board of Advisors. Roland's extensive experience at Cisco (including leading their $10B data centre division and serving as CTO) and his recent role at Psi Quantum make him an invaluable asset Nu Quantum build the entanglement fabric for quantum computing scale-out.

[REDACTED: ONLY FOR LPs]

[REDACTED: ONLY FOR LPs] made the final of The Deeptech Demo Day!

The Deeptech Lowdown (Market update)

Despite the hype around generative AI (genAI), skepticism is growing among enterprise CIOs, bolstered by critical insights from major players like Apple and Meta. Apple’s recent report highlights significant shortcomings in genAI’s logical and mathematical reasoning, emphasising that LLMs (large language models) often fail under more complex scenarios, resembling advanced pattern-matching rather than genuine intelligence.

The IMF has issued a stark warning: Europe’s economy is at risk of falling further behind the US, largely due to stagnating productivity and an ageing workforce. Since 2005, tech productivity in Europe has barely moved, while the US has seen nearly 40% growth. Without reinvestment of private capital and pan European focus, not country by country, we will see a dwindling ability to defend ourselves, and no innovative industries (leading to more ambitious people leaving) - and the solution is NOT more government money into startups.

It's about solving the fragmentation and moving our private and pension capital into the system to create a flywheel in pan European venture capital and tech. Some more reading from Francesco here on how we need a culture shift in Europe.

Asks & Portfolio Roles 🙏

Archangel Lightworks are hiring for multiple positions in Oxford including Embedded Software Engineers, Cloud Engineers, and Optical Systems Engineers.

Origin are hiring for Robot Firmware Engineers and Embedded Software Engineers.

GP Personal Updates

In the last 2 months I had the fortune to catch up with several of you, amazing LP supporters!

And I was reflecting on some of the journeys from the exited founders in your ranks who ended up growing companies to some of the highest values in European tech history.

I started to see some pattern emerging, especially when comparing those with some interesting unicorn data I have been seeing recently.

(The gang in London)

🦄 A personal reflection on venture myths:

Here's what I found striking: the "hot founder" profile most seem to chase in VC appears largely to be a myth.

Several unicorn founders amongst you LP folks had no top-tier VCs at seed, pitched endless demo days, and struggled for early traction. The data seems to back this up as nothing abnormal ─only 10% of unicorn founders worked at other unicorns before, just 5% came from FAANG companies, not that many more came from the top European universities, and 40% were first-timers.

(The gang in Turin)

And very few had top tier funds invested early. Even Sequoia, the gold standard, only appears in just over 2% of major outcomes.

It's a humbling reminder that venture is a long game where the best founders often hide in plain sight. And a signal of hope for those of us in the GP camp who prefer to take a business and team fundamentals approach to investing (and prefer leading an obscure angel round) over squeezing into a hot deal of the latest tech hype wave.

I guess we’ll see in 10 years or so.

⛏️ Link to 2 LinkedIn posts I wrote with the data references HERE.