Silicon Roundabout Ventures, Community Updates Sept '24

Our Community & Fund update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In this edition

Ephos Announce Its $8.5M Total Raise to open the world’s first glass-based quantum photonic chip facility: a major milestone for our portfolio company.

Invites to Events we are hosting or joining in October-November: come meet us!

Anaphite Announces $13.7M in Series A to scale its EV battery technology, becoming the first seed bet in our fund to graduate to Series A.

Our Deeptech Demo Day 2024 is live, with applications open for founders and 80+ VCs already signed up.

Deeptech Market News featuring our portfolio founder, Nu Quantum CEO, Carmen Palacios-Berraquero, warning of potential competitiveness and innovation risks if government funding falls short in quantum technologies.

Plus, NEW CO-INVESTMENT opportunities, tech updates, and portfolio roles.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

Our Community Deeptech Demo Day 2024

The Deeptech Demo Day 2024 is officially live!

With 80+ VCs already signed up, this year’s edition is set to surpass last year's event, which saw over 100 founder-investor intros and 300 attendees.

Startup applications are now open, and the finals will take place on November 7th.

Founders can apply here. Please share this link.

You can apply to register to view or help screening as an investor at thedeeptechdemoday.com.

The first Judge has been announced, Max Bautin co-founder and Managing Partner at IQ Capital:

AllocatorOne x Silicon Roundabout Ventures LP Invite

Meet Ralph and Francesco at the AllocatorOne Summit in London on October 23rd. Invite only for Silicon Roundabout Ventures LP here: [If you’re not one of our LPs, but would like to come, drop us an email by replying here]

Francesco @ GTEX Dubai and @ Deeptech Summit Barcelona

If you’re heading to GTEX Dubai or the Deeptech Summit in Barcelona, are in the area, or know of an LP we should meet ahead of our next fund launch: drop us a message by replying to this email or send Francesco a whatsapp message and let’s arrange a coffee ☕

Meet Francesco in Dubai: 13-16th October / Barcelona: 5-6th November.

Markups

[REDACTED: ONLY FOR LPs]

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 11

Top-of-the-funnel Pipeline: 3

Key Deeptech Areas: Computing, Climate, and National Security Infrastructure

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 1.5X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

Portfolio

[REDACTED: ONLY FOR LPs]* is a snapshot of the current portfolio.

*Link to a private Airtable base with a list of all portfolio companies and include the company’s name, short description, why we invested, URL, and category.

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

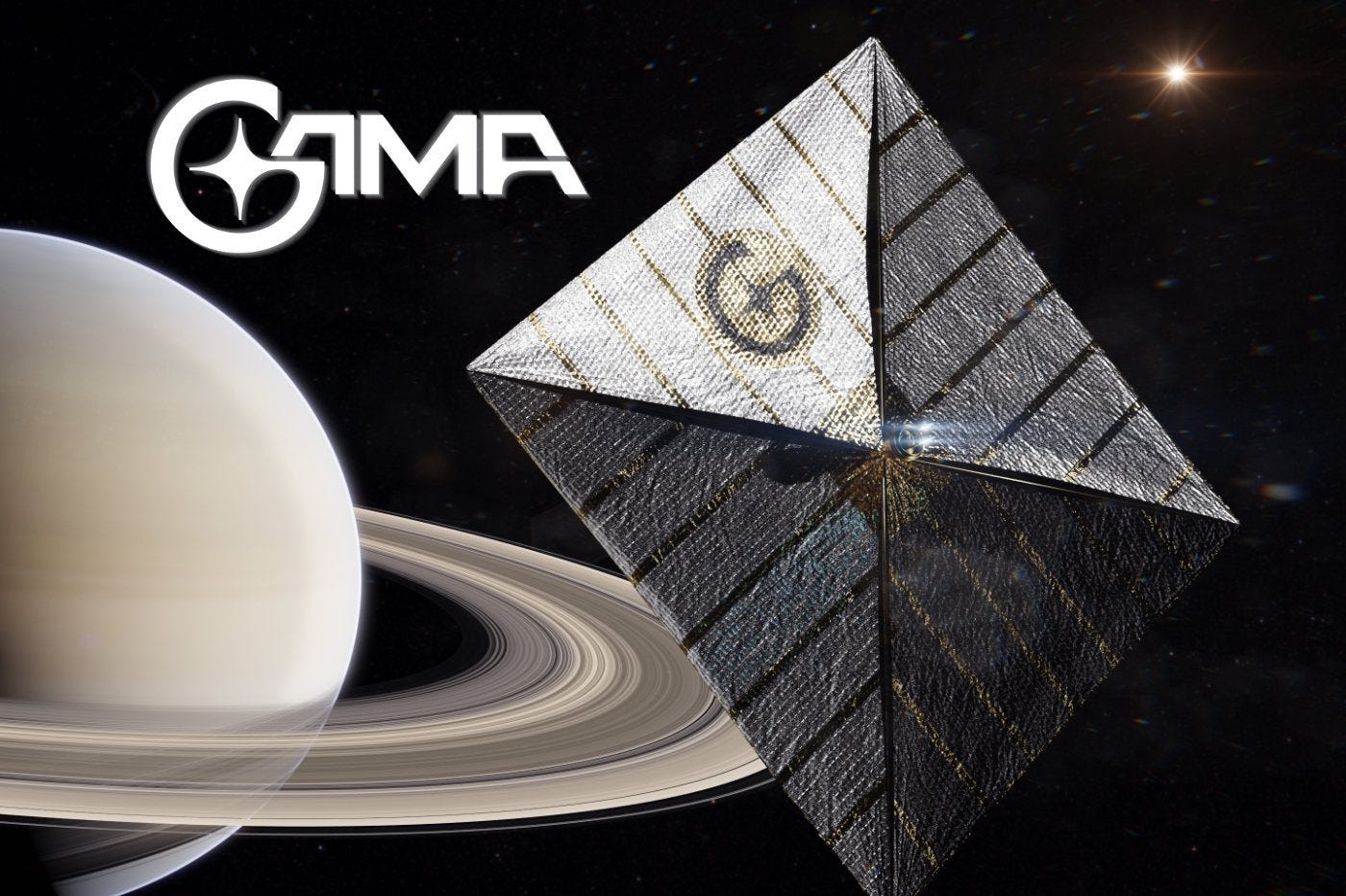

Gama

We’re excited to back the pre-seed for what we believe to be the most promising space hardware company coming out of Europe this year.

This month just gone we invested in Gama space to help them develop and take to market drag sail modules for deorbiting satellites to ensure space sustainability compliance.

Gama’s Astrobrake deorbiting drag sails module ensures compliance with new space sustainability regulations without consuming fuel or much space on a space vehicle or satellite. We believe [REDACTED: ONLY FOR LPs]

We extremely convinced by what we found, and by the exceptionalism of the team. Specifically we believe in [REDACTED: ONLY FOR LPs]. In September we [REDACTED: ONLY FOR LPs]

Supported by CNES and DLR. Gama’s include experts from NASA, CNRS, and Delft University of Technology.

[REDACTED: ONLY FOR LPs]

💸 Co-Investment Opportunities

[REDACTED: ONLY FOR LPs]

🚀 Portfolio Updates

Anaphite

Anaphite got $13.7M in Series A funding to scale dry-coating EV battery technology. They were the first investment we ever did with this fund and we are happy that, chronologically speaking, this means our first seed bet graduated to the first letter of the alphabet of venture rounds. Find out more and celebrate with us on LinkedIn.

Ephos

Ephos has finally announced its $8.5M in seed + grants round, and opened the world's first facility for designing and producing glass-based quantum photonic chips in Milan.

Nu Quantum

Nu Quantum has been named a Wired Trailblazer for 2024. This programme is to build a community of innovative, fast-growing scale-ups tackling today's social, economic, and environmental challenges.

The Deeptech Lowdown (Market update)

SpaceX has launched a rescue mission to bring back NASA astronaut Nick Hague and Russian cosmonaut Alexander Gorbunov from the ISS. This mission will also return astronauts Butch Wilmore and Suni Williams, whose stay was extended due to issues with Boeing's Starliner. After months of delays and testing, NASA opted to use SpaceX for their return over Boeing.

Carmen Palacios-Berraquero (CEO of portco Nu Quantum), warns that the U.K.'s leadership in quantum computing could be at risk due to a government spending review. While the U.K. has made significant progress, much of the promised £2.5 billion in funding has yet to be deployed. With companies now seeking crucial series B and C funding, Carmen stresses that continued government investment is essential to maintaining the U.K.'s global edge in quantum technology.

Tech Updates 🤖

Joi, the internal engine for our fund, has had some major upgrades in recent weeks. Joi now has access to almost every bit of data we have within the fund - contacts, dealflow, portfolio updates, co-investor information, fundraising pipelines, current projects, our high level missions - the list goes on.

We’ve built this out with a Data pipeline that ingests data from almost every document type we could think of, including both structured and unstructured data - allowing us to ask almost any question. We’ve hooked it up to a slackbot for experimentation…

Ralph will be writing a full post on how we achieved this soon.

Asks & Portfolio Roles 🙏

Archangel Lightworks are hiring for multiple positions in Oxford including Embedded Software Engineers, Cloud Engineers, and Optical Systems Engineers.

[REDACTED: ONLY FOR LPs] are hiring for Robot Firmware Engineers and Embedded Software Engineers.

Nu Quantum are searching for a Head of Engineering and Software Engineers.

GP Personal Update

Sorry folks! This month I’m sharing with our LPs a personal commentary on some market insights that need to stay between us.

Next time for a GP update from me :)

Francesco