The Art of LP Communication 📣

Steal our template! Plus the live grilling of our investor update by a leading European LP 👨⚖️

Imagine you're an LP investor sipping your favourite coffee: you’re scrolling through an endless sea of emails. Among them, a newsletter from a venture capital firm catches your eye.

Why?

It's clear, concise, and feels like it's speaking directly to you. That's the art of effective LP communication, and it's precisely what we're diving into today.

I’ll share below what happened when I asked a leading investor in micro VCs in Europe, Ertan Can, to grill my own LP update LIVE and talk about how to best engage Limited Partners.

This article IS that live grilling and Ertan’s tips on best practices for GPs!

Key Insights TL;RD:

Readability is Key: Make newsletters readable and engaging ─quality over quantity.

Personal Stories: Personal anecdotes add a human touch on engagement.

Quarterly Reports Matter: They're critical post-investment and showing how KPIs evolve is useful to busy LPs.

Content Curation: Be selective on what you include and focus on high-value content.

Engagement Overload: Avoiding information overload in communications. Keep your content succinct.

Know Your Audience: Not all LPs are the same, so do write updates to resonate with your target LPs.

Free Template Giveaway: I’ll link at the bottom the template of our own update if you want to use it!.

Ready to make your LP updates not just seen but felt?

Let’s see how well or badly mine fared.

The Grill Master: Introducing Ertan and Multiple Capital

Francesco Perticarari: Recording! Before we start, could you tell me more about yourself, about Multiple Capital, and what you do as an LP? I'll include it at the beginning as an introduction to you. Then we can proceed.

Ertan Can: Should I start with the introduction?

Francesco Perticarari: Yes, please. How would you like to present yourself as an LP, your story, and what you like to invest in?

Ertan Can: Hi everyone! I'm the founder of Multiple Capital, which is a fund of funds for micro VCs. We invest in VC funds ranging from 5 to 50 million in size across Europe. I have been doing this for 11 years now, having invested in 45 funds so far, and am starting my third fund to continue investing in micro VCs.

Show me the numbers 💲💲💲

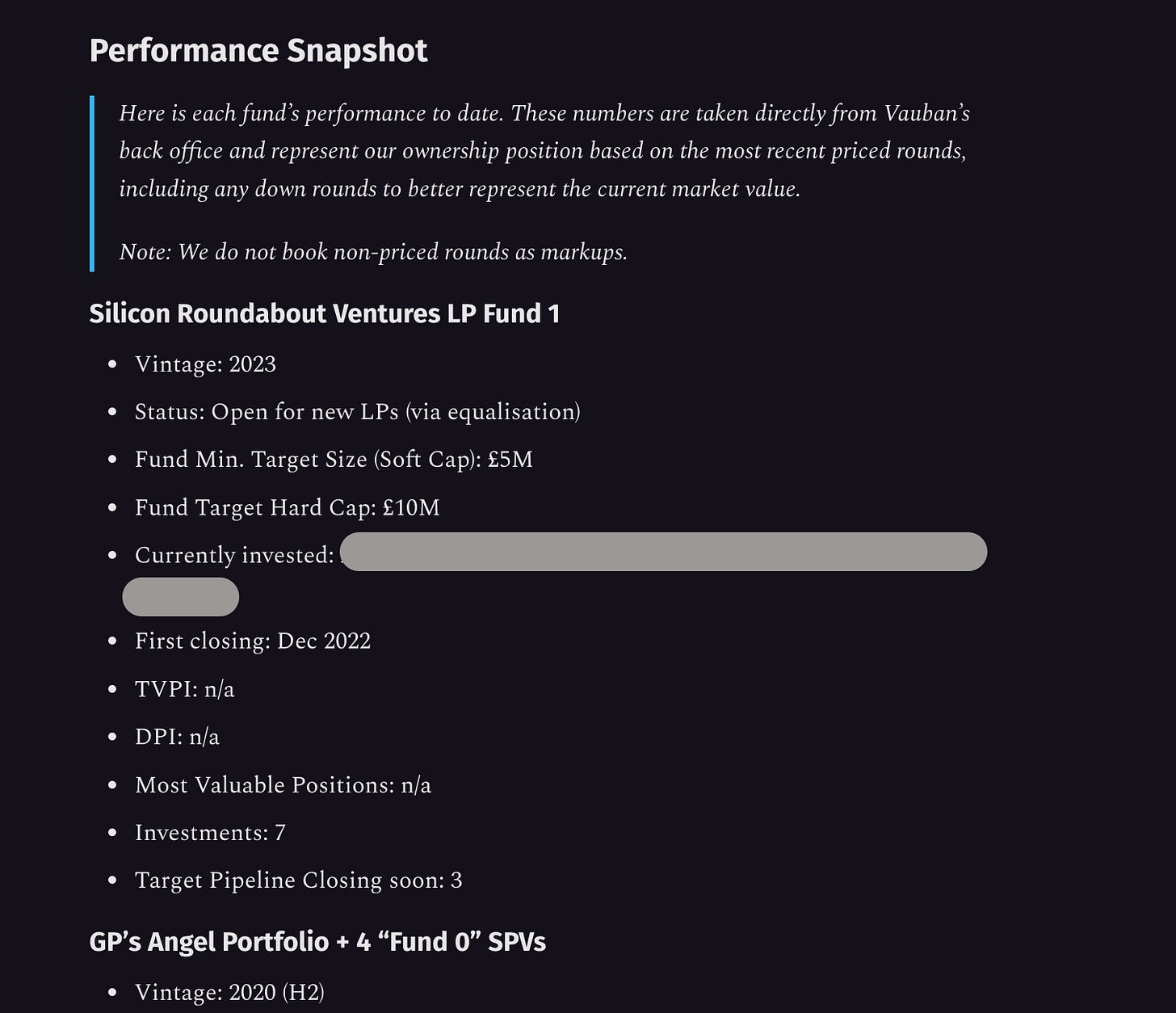

Francesco Perticarari: Cool, awesome. Let's start then. The idea is to discuss what you like as an LP, what could be improved, what might be missing, what other details you'd like to see in a report from VCs, and, n general, if you have any best practices on how GPs can keep LPs informed. This is a monthly update for January for us at Silicon Roundabout Ventures. We typically start with a brief introduction, some bullet points as a summary. Do you see my screen?

Ertan Can: Is this an official report or more of an investor update on top of your reporting?

Francesco Perticarari: This is an update that goes on top of the official reporting. Specifically, this is our January update that’s about to go out. Just to show you, we have some financial data here that we've taken this directly from Carta, our fund admin platform, but we're not yet generating the TVPI and DPI yet. We'll start once we have the full accounts finished from our first year. Of course, the figures will be preliminary, like a 0.95x TVPI, until we have a priced round, and the DPI will be 0, of course, because we haven't started returning capital.

Ertan Can: Do you have a more detailed quarterly report, or does this come directly from Carta?

Francesco Perticarari: The numbers come from Carta, but they also send LPs a quarterly financial report with our positions, capital called, capital left to call and all the KPIs you’d expect from that update. This newsletter update is what goes to LPs besides the quarterly figures. And we make a redacted version of this to share with LPs we’re courting for future closings or funds and, from this edition, also the broader community.

Ertan Can: Ok.

Francesco Perticarari: After the intro, there's a more text-heavy section, but you specifically asked about financials. In this update, we provide a summary of how much we've deployed, the fund's target size, the top line TVPI and DPI, and which ones are the most valuable positions right now. The fund hasn't had any priced rounds, only convertibles with an increased cap, but we don't use that as a price metric. Additionally, Carta sends out detailed reports on position ownership and all underlying portfolio companies.

Ertan Can: Regarding reporting, the general overview looks good. I would add the cross multiple, detailing what you are doing with each investment without the fees and costs, so not the total value paid in, but the total value to invested capital. So, include TVPI and DPI, but also, as another KPI to track: the multiple on invested capital (MOIC). For what I see IRR is also missing here, net and gross, but what's more helpful actually is the development over time of the KPIs you track. Showing development over time, like TVPI quarter by quarter, either in a chart or a table, really be helpful. Unfortunately, most funds don't do this. But if every quarter you keep updating the numbers, then you could also chart them, right? And then it's just 4 numbers or 5 numbers that you have to put in, and that the chart just continues to track ─and it is quite valuable to see what's happening over time.

Bullets & Events 👍

Francesco Perticarari: Alright! So that was a straight jump into the financial part. Let’s look at the update from the start: after the intro summary, we have a brief reminder of what the fund is about. I was inspired by one of our portfolio companies that always includes this in their updates. It's a quick way for people to understand what they've invested in, which might be more helpful for angel and individual LPs. What's your opinion?

Ertan Can: It can be useful useful. Why not?

Francesco Perticarari: We then provide a market update, which this month is generated by Joi, the LLM system we're developing. It summarises the articles and research I've been reviewing this past month, some of which I also posted on LinkedIn, where I’m quite active. This is a summary of things we've found interesting for our thesis.

Ertan Can: It makes sense.

Francesco Perticarari: Next, we mention events we've participated in or are planning to attend. In this particular edition, we included an event on data-driven VC that I moderated and an invite for LPs to an upcoming meetup with our community. This section keeps our community informed about our activities and where we can meet in person. Any feedback on this part?

Ertan Can: It looks good I think. Including events you'll attend in the next four weeks could also be valuable for people looking to meet you in person.

Francesco Perticarari: Makes sense: I'll consider adding a summary of future events I'll be attending. Now, let me ask you something that I think is going to be useful for other emerging managers: what are the best practices for building relationships with LPs? Meeting in person can always be valuable, especially for people without pre-existing LP relationships, yet both GPs and LPs are busy all the time: give us some practical advice!

How to Engage LPs Beyond Emails

Ertan Can: I think this is a double-edged sword: you want to engage regularly but LPs also receive a lot of noise and struggle with bandwidth. The key is authenticity and real meetings, which can be virtual or physical. It's more valuable to have a meaningful conversation every six months than a superficial email every four weeks. Being focused and authentic, not changing your strategy frequently, and reaching out occasionally for a substantial conversation is what GPs should focus on: stay on course, show that you are focused on what you are doing, remain authentic, stick with your thesis, and reach out from time to time for a solid 30 min or 1h conversation ─but not too often, because it doesn't help. After investing, the dynamic changes significantly. Many funds stop engaging or decrease their outreach efforts by even 90%, but whilst it’s expected that the “rush” ends, it’s a wasted opportunity if you don’t maintain an authentic relationship. Even if it's just one or two solid meetings a year, it is essential to have genuine one to one catch ups with your LPs. Besides that, the quality and timeliness of quarterly reports are paramount for us. These reports should be concise, contain all necessary details, and be delivered on time.

Relevant Performance Trackers 📈

Francesco Perticarari: Cool. Okay, great. That's actually a great insight. Now, going back to the actual update, the next section is still financial updates and is about markups. Here we would note priced markups, although in this case it was just a commentary, because there have been some rounds, but they were either equity-free or convertibles.

Ertan Can: In such cases, it would be useful to mention the new funds entering the company. It's important for LPs to know about significant new investors.

Francesco Perticarari: Alright, moving back onto performance snapshots, I also report on the SPVs and angel investments I've made, as well as the community “virtual” portfolio from before I started investing. I feel this section was more valuable when I first started raising, as I didn't have a fund performance history. I created it to show that the companies we selected through our community activities were performing well, and how that transitioned into angel investing, and eventually launching the fund. But I wonder if now it’s all less relevant for the regular updates, since we have our fund portfolio.

Ertan Can: What I really like is that you mention the vintage. Most funds mention TVPI or IRR but almost never mention their vintage. It's very different if you have a 1.5X TVPI with a vintage 2022, or with a vintage 2020. So that's very important: always mention the vintage. Other than that I don't have much to add. I think it's okay to have these 3 small updates on previous performances, if you think it's relevant. I don’t have strong views either way.

The Hard Truth About Portfolio News 📰

Francesco Perticarari: Cool. In the next section we delve into the portfolio's composition and highlights. We also advertise any co-investment opportunities for LPs. In this case, for instance, there are 2 portfolio companies that are raising their follow-on rounds and our investors are informed in case they’d like to do a direct investment. We then summarise significant developments within portfolio companies, such as technology advancements, contract closures, or funding rounds. If there were any new additions, I would add them here with a quick summary on why we decided to invest.

Ertan Can: If you do this monthly, is there sufficient new information to justify such detailed updates?

Francesco Perticarari: Typically, there's enough activity among our portfolio companies to warrant updates, though the extent varies. This update, being January, was particularly comprehensive due to the timing of reports from most companies.

Ertan Can: It feels like maintaining this level of detail could be challenging, especially for metrics that don't change monthly, such as TVPI or the angel portfolio.

Francesco Perticarari: We aim to balance the detail with relevance, utilising our LLM to streamline the compilation of updates, saving significant time and ensuring consistency. Because we route all of the portfolio updates into an inbox that then feeds our AI via its API and gives us bullet points for each company that has new updates in that month. That obviously saves a lot of time. If you remember my old updates, this section was still there but I had to do the work manually. Now it's just a matter of reviewing. After the portfolio section we have a market update section, where I include content I've found particularly interesting, such as industry movements, relevant activities for LPs, and highlights of our own initiatives. These may be courses or noteworthy investments in deeptech. However, there's a consideration to not overload LPs with information.

General Market News 👎

Ertan Can: If you ask me, it's already too much. Definitely too much. I wouldn't read the whole email, especially if it’s this long every month. If I were you I’d think about how to compromise on what you include and reduce its length. The key is to be concise and selective. Overly comprehensive updates can be overwhelming, diminishing their value.

Francesco Perticarari: That's a valuable insight, thanks for the transparency. We'll consider how to streamline our updates to focus on the most pertinent information without overwhelming LPs!

Ertan Can: Any time!

Francesco Perticarari: Alright. So other than shrinking down, is there any part you’d cut? So far we’ve seen that we have:

an initial intro in bullets summarising the update

what happened in the month including a market deep dive and our community work such as events we run and invite to future ones

the financial numbers

Portfolio update

and of course the market updates in general, which is where we were just now.

Ertan Can: I’d skip the market deep dive, at least in this format, because everyone is bombarded with this kind of information. If you really want to add something other than fund updates, you should consider how to make it really valuable to LPs. And if it’s just general updates of the kind you find everywhere, then I wouldn’t consider it relevant myself.

Francesco Perticarari: Cool. That's good to know. I see your point: if people are not gonna read it, then no point having it. It might distract from the rest. Next we have the penultimate section: our tech updates. Where we update LPs on the tech we are building. In this case it’s talking about how we are building the system that this update feeds from.

What About Firm & Personal Updates? 🤔

Ertan Can: Not all LPs may find monthly tech updates relevant. I wouldn't need a monthly update in a newsletter about how you are improving your tech stack. But then there may be LPs who are interested in data driven VC and they may find it valuable. The only way you can know for sure is if you speak to more LPs. Then it's about finding the right balance. Quarterly reports post-investment, focusing on financials and significant firm updates, are generally sufficient. For prospective investors, avoiding generic or lengthy updates can make your communications stand out more. As long as you “know your audience”, you can better tailor your communication. Each fund is different. Each LP is different. And you want to be relevant for as many of your LPs as possible.

Francesco Perticarari: Cool, okay, that's good to know. It's really valuable feedback, to be honest. You're becoming a reference point for emerging managers as an LP, so it's great to hear your perspective. The last section of our updates typically covers “asks” and personal updates from my side. For the “asks”, we include both portfolio asks and fund asks. What do you usually find useful in these kinds of updates?

Ertan Can: Asks are important and good to include. Regarding personal updates, I'd say keeping it succinct is key. Maybe a quick summary or a few lines about significant personal updates or milestones. If there's more to the story or if readers want more depth, linking to an external article could work well. A long text section in the newsletter might make it too lengthy.

It’s a jungle out there!

Francesco Perticarari: That makes sense, thank you. You've touched on some important points about IRR, MOIC, and the usefulness of charts to show progress. It sounds like making updates more succinct could help make the newsletters more readable for LPs. Also thanks for the feedback on the technology side, which might be too detailed from an LP's perspective, and how we might write too much on the market and personal updates. In general, from going through the newsletter and discussing it with you, what best practices or insights can you share on what GPs can do to keep their LPs informed and make these updates as relevant and engaging as possible?

Ertan Can: For us, once we’ve invested, the quarterly report is sufficient. It should consist of two parts: one focused on pure financials and the other on general updates about the firm, its companies, and the team. That's enough for us post-investment. There's always room for improvement in these reports, and we often provide feedback if we see potential enhancements. Good quarterly updates can be straightforward, involving continuous reporting on key figures. Before investment, there's no need for monthly or even quarterly updates from our perspective. Unfortunately, I'm becoming less fond of automated newsletters. They become less interesting when they're too generic and not specific about the fund and the team. It's challenging because we're in the same boat, sending out quarterly newsletters ourselves. We always debate what to include and exclude, aiming to keep it relevant and interesting. Generally, less is more. We try to reduce content as much as possible and add a personal touch to make it more engaging. For example, mentioning personal changes or milestones can add a personal touch without overloading the newsletter with information that might not interest everyone. Quality over quantity is crucial.

Francesco Perticarari: That's very insightful. It sounds like striking the right balance between being informative and not overwhelming is key. I'm picturing this as an investor myself when I receive startup updates, considering how crowded our inboxes can get. It's a challenge to stand out and ensure the updates are read and appreciated.

The Golden Rule of LP Engagement: Quality and Consistency over Quantity

Ertan Can: Exactly. Consider the sheer volume of newsletters an LP might receive. It's virtually impossible to read them all. Making your communication distinctive and valuable without adding to the noise is the challenge. After the investment, focus on perfecting the quarterly updates based on LP feedback. These updates become crucial documents for LPs, requiring clarity, sufficiency, and timeliness. On the raising side, sharing insights about specific markets or approaches in a way that educates and engages, without overwhelming, can add value.

Francesco Perticarari: Indeed, that's a great takeaway. Tailoring the content to ensure it's both informative and engaging, without being excessive, seems to be the way forward. Thank you, Ertan, for the valuable insights. I'll compile everything and turn it into an article. Your input has been invaluable.

Ertan Can: I'm glad to help. Looking forward to seeing the final compilation. Thanks again for the discussion, and enjoy the rest of your day.

Francesco Perticarari: You too, goodbye.

Ertan Can: Goodbye.

Free Template + Join the Conversation 🗨️

And there you have it, a front-row seat to the dissection of an LP update, served with a side of invaluable insights from Ertan Can, founder of Multiple Capital.

We learned that less is more and that striking the right balance between information and engagement can transform your LP updates from just another email to a meaningful touchpoint. Yet, ultimately, it’s your product and results, combined with one or two 1-2-1 catch ups, that can really make the difference in building LP relationships.

As we navigate the dense jungle of GP-LP communication ourselves at Silicon Roundabout Ventures, we found this “live grilling” really useful. I hope that by sharing it, you can all find it valuable too!

We're curious: How do you tailor your updates to stand out? Share your strategies or questions in the comments, or join the conversation on LinkedIn.

We’re on a mission to change the face of Deeptech and Venture Capital investing in Europe. And we believe that community building is core for this. So if you'd like to use our current (revised) template as a reference, feel free to copy this google doc HERE.

Happy LP-updating!

Hey Francesco, curious to know what the email AI to API is?