The inevitable logic of improvement trends: Deeptech ≠ Crazy Stuff - Silicon Roundabout Ventures, Community Updates, Nov 25

Our Community update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In This Edition

Our events - Invites for you to our Slush side events and The Deeptech Demo Day

Portfolio Deep Dive: Swisspod - Eight months after investment, they’ve built the world’s largest hyperloop test facility in Colorado. Why passive infrastructure changes everything - an insight into our investor mind.

New Investment: [REDACTED: ONLY FOR LPs] - We backed this steel reinvention company relocating from France to Hong Kong. LP co-investment opportunity still open up to [REDACTED: ONLY FOR LPs].

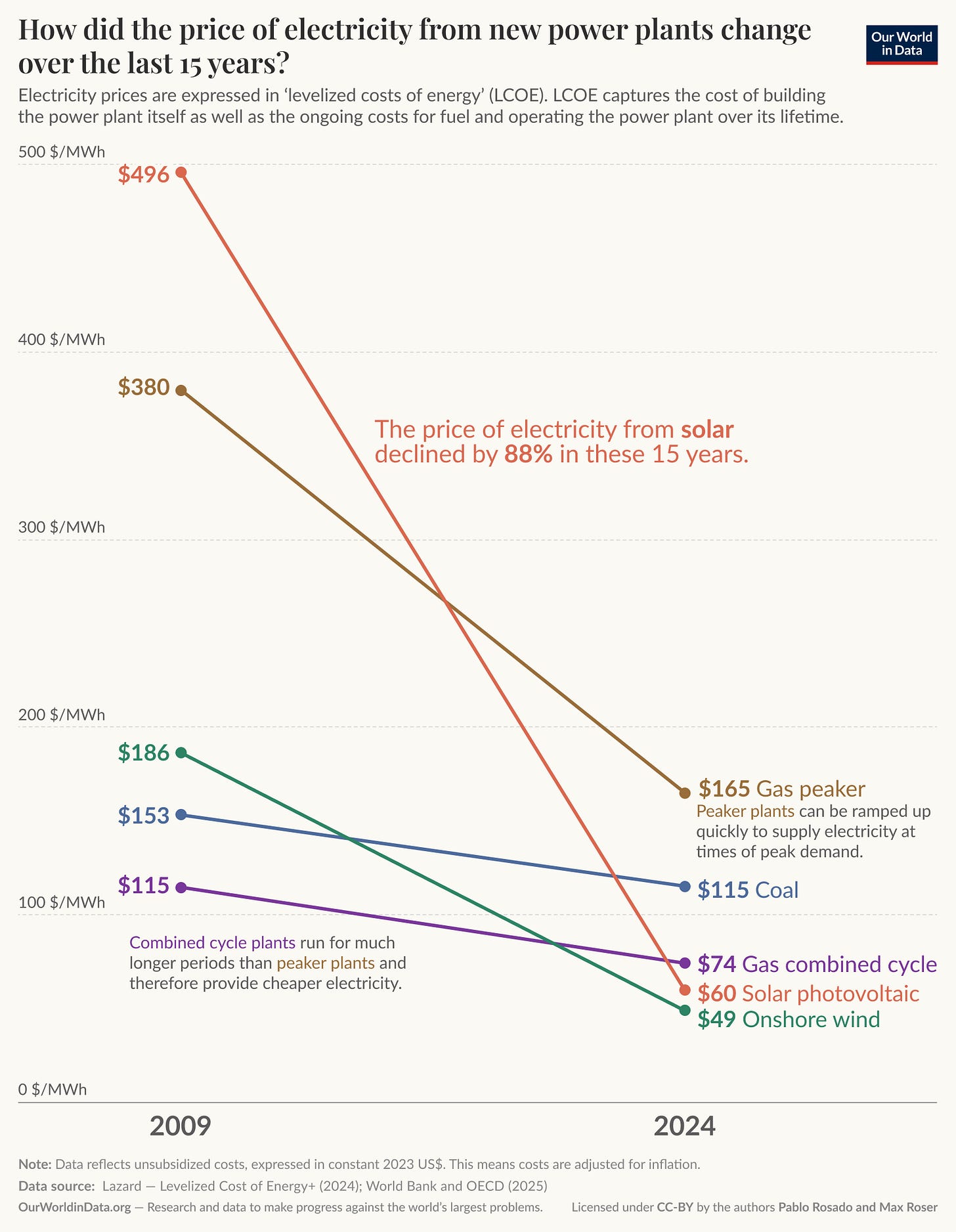

The Energy Economics Reality - Why electricity-powered technologies win not because they’re “green” but because they’re riding the winning cost curve.

Deeptech Demo Day Finals - November 25th live event featuring the top 10 European deeptech companies raising pre-seed to Series A selected from 200 applicants.

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

The Deeptech Demo Day - September to November 2025

100 VCs scored nearly 200 applicants from our European deeptech community to pick the finalists! Our event co-host, Cristina from Frontier Deep Tech, just announced them. Now it’s up to our 4 judges to pick a winner live. If spotting deeptech trends is your thing: join us to watch the Finals live on November 25th - register here: https://lu.ma/zijex7xx

Slush, November

We are once again attending Slush (Helsinki, November 19th+20th) and will be hosting a Breakfast for those interested in Data and AI use within VC. Sign up here!

We’re also running a Solo-GP roundtable on Tuesday as part of Slush’s UK House at a fabulous hotel near the main station. Only a few seats left. Only for soloGPs and LPs backing them ;)

Portfolio Deep Dive: Swisspod

The Tubes Rising from the Desert

You may remember when we spoke about Swisspod upon investing, and Francesco’s love of trains 🚂 and his visit to Lausanne

Standing on the windswept plains of Pueblo, Colorado, as massive steel tubes rise from the dusty earth like some alien infrastructure, it’s hard not to feel the gravitational pull of the future.

This sprawling 43-acre elliptical track-soon to become America’s second-largest vacuum chamber-bears little resemblance to the beaches of Costanza, Romania, where Swisspod CEO Denis Tudor once hawked t-shirts to help support himself and his family while studying.

Yet both spaces represent the same relentless human drive: to create something from nothing, to build pathways where only barriers existed before.

Science Fiction becomes Fact?

Eight months ago, we invested in Swisspod Technologies. Since then, they’ve built the world’s largest hyperloop test facility in Pueblo, Colorado - 1.6 kilometres of actual steel tubes, not AI renderings. Governor Jared Polis visited in December 2024 to see what’s becoming America’s second-largest vacuum chamber.

They’ve also been selected by 100+ VC scorers as one of the top 10 deeptech companies in Europe and will be pitching at our Deeptech Demo day!

This is worth paying attention to, given the hyperloop sector’s struggles. Virgin Hyperloop pivoted to freight only. Hyperloop TT went quiet. Others have exited entirely. Yet here’s Swisspod, welding tubes in Colorado with state backing.

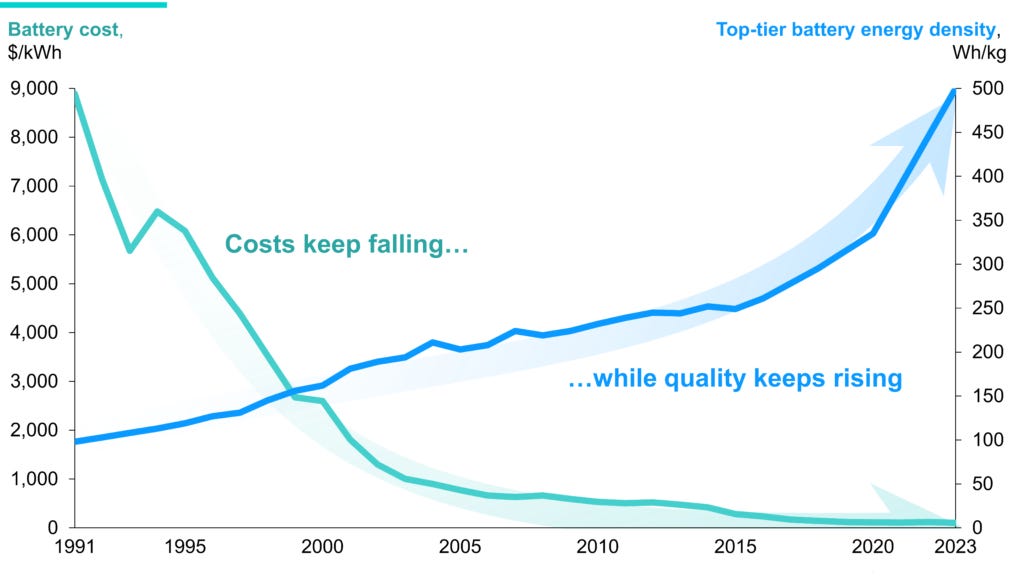

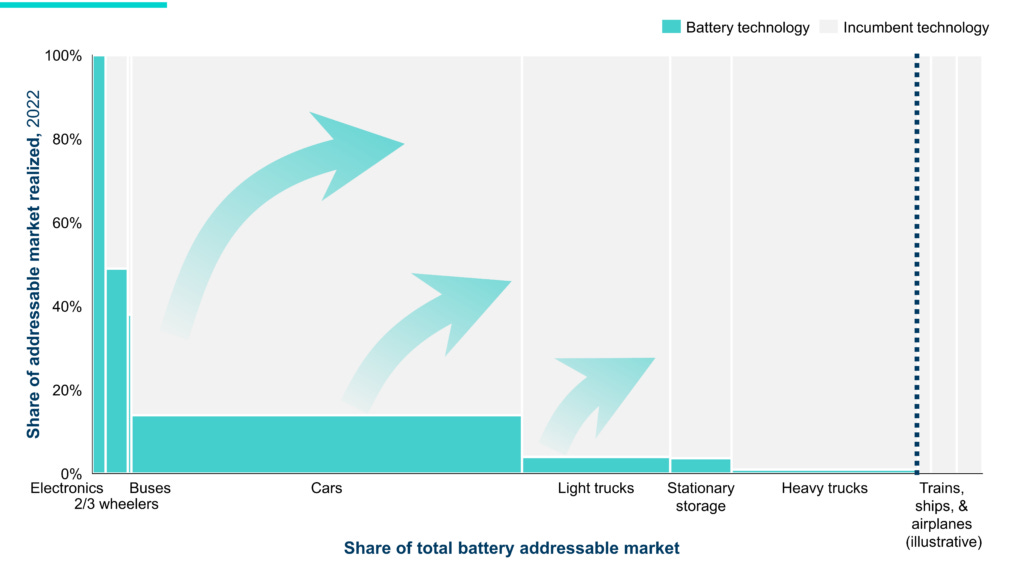

We believe it comes down to 3 things. Besides having a voraciously ambitious (but also technically brilliant) polymath as founder and CEO, and besides its technology capacity to be deployed without the hyperloop vacuum (more on this below), Swisspod’s unique tech and business thesis insight are riding what we see as an inevitable technology “train”. Pun very much intended. They are riding the right energy and underlying supply chain train, which also underpinned our backing of Greenjets in the aerospace/defence sector and [REDACTED: ONLY FOR LPs] in the steelmaking world.

What They’ve Actually Built

The company operates two test facilities. LIMITLESS in Lausanne, Switzerland - a scaled circular track where they’ve run 82 tests in low-pressure environments. MATTERHORN in Pueblo, Colorado - the full-scale facility that will complete its 1-mile loop in Q2 2025.

The technical achievements are specific: speeds scaling to 488.2 km/h, distances scaling to 141.6 km, all in 50 millibar pressure. Fast iteration and real-world testing, rather than theoretical studies. You can compare it to SpaceX blowing up rockets to get one finally in orbit, rather than building a business on spreadsheets, renderings, and industry assumptions.

Colorado loved this and backed it with $900,000 in state tax incentives. El Paso County added $1,041,609. In return, Swisspod will be creating 107 manufacturing jobs in Colorado Springs. When states write checks before ribbon cuttings, they see economic development potential.

Why The Economics Are Different

Swisspod’s approach differs fundamentally from other hyperloop attempts. Their linear induction motor technology puts complexity in the pod, not the infrastructure. The track is passive, essentially dumb metal rails.

This changes the cost structure entirely. Swisspod projects under $20 million per kilometre. For context: Spain and France spend €18-25 million per kilometre on high-speed rail. Germany spends €71 million. The UK’s HS2 has reached ~£200 million per kilometre.

At those ratios, the UK could build London to Edinburgh transport at Swisspod’s cost for what they’re spending on 50 kilometres of HS2.

The Business Model That Works

Virgin Hyperloop needed billions in infrastructure before generating revenue. Swisspod doesn’t. They can generate revenue from pod sales and leasing before any commercial track exists. Companies buy pods to test at the Colorado facility. Each customer becomes locked into the eventual network.

They’re starting with freight, specifically their SWIPT system - urban pods for smaller payloads and line pods for pallet-scale cargo. No passenger certifications needed. No station infrastructure. Just fast cargo movement.

Who’s Engaging

Several stakeholders have shown concrete interest. Peru’s Instituto de Ingenieros de Minas del Perú invited them to present - mining companies need efficient transport through challenging geography. Etihad Rail gave them the main stage at their Global Rail Transport Infrastructure Exhibition in Abu Dhabi. The Swiss government continues funding through Innosuisse, with EPFL and HEIG-VD as ongoing partners.

Felix Porsche invested personally after meeting CEO Denis Tudor at Richard Branson’s Necker Island event in April 2024. Board members include Prof. Michael Horodniceanu, former NYC Traffic Commissioner and MTA Capital Construction President.

They’re also part of the Muspell Consortium, which secured €3.5 million from the European Innovation Council to develop thermal energy storage systems - addressing heat management in low-pressure environments.

The Challenges

No country has hyperloop regulatory frameworks yet. This is both the biggest risk and the biggest opportunity. The first country to create standards owns the global framework, like the US did with aviation or the UK did with railways. Whoever moves first sets the rules everyone else follows. That’s why Colorado’s engagement matters beyond just tax incentives.

Competition is real and already operational. Aurora launched commercial autonomous trucking Dallas-Houston in May 2025. While limited to specific corridors, they’re generating revenue today.

Capital requirements remain substantial. Even at $20 million per kilometre, a 200-kilometre commercial route needs $4 billion. But that’s why we invested early - to help them prove the technology works so institutional capital follows. The Colorado facility demonstrating full-scale operations, changes the funding conversation entirely.

The Path Forward

Swisspod has signed an MoU with the Indian government and TuTr Hyperloop for technology licensing. They’re in discussions with mining companies, rail authorities, and logistics providers. The 1-mile loop completion in 2025 enables full-scale demonstrations.

Their retrofit capability matters. They can run on existing rail at atmospheric pressure - not full hyperloop speeds, but still faster and cheaper than traditional rail electrification. This opens immediate markets without waiting for vacuum tube infrastructure.

The founder and CEO, Denis Tudor, sold t-shirts on Romanian beaches to support himself and his family while studying. He got to EPFL, won Elon Musk’s hyperloop competition, and earned the world’s only doctorate in Hyperloop Electrical Energy, Optimal Design, and Operation Strategies. Now he’s building in Colorado with government backing.

Rail infrastructure companies command multi-billion dollar valuations because they own critical transport networks. Swisspod is not interested in stealing market share as much as creating a new transportation category. When you can move cargo at 400 km/h for less than the cost of traditional rail, you don’t need people to buy into your dream to win contracts.

Most importantly, they’re building. Not just presenting and promising. Welding steel in Colorado while others write white papers. That’s the difference we see between this and every other hyperloop story. Failures will happen along the way. But as long as they stay on track, their unique technology and founder approach will continue to give them growing margins and cost advantage not only against other hyperloop startups, but against traditional HS rail.

We believe they stand a significant chance of giving this industry its Tesla or BYD moment.

Portfolio updates

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions (+ COINVESTMENT OPPORTUNITY)

We invested in [REDACTED: ONLY FOR LPs], a French company that relocated to Hong Kong, reinventing steel with low-cost, electric, sustainable tech.

They blew us away as we discovered them in our community, and we invited them to [REDACTED: ONLY FOR LPs].

[REDACTED: ONLY FOR LPs] just finished their [REDACTED: ONLY FOR LPs]kg reactor POC and are targeting a 2026 HK pilot able to generate $[REDACTED: ONLY FOR LPs]M/year. In line with our views on energy and technology compounding rates being critical for large-scale deeptech success (see our deep dive on Swisspod, above), we believe steel will soon get its Tesla moment. [REDACTED: ONLY FOR LPs] is one of maybe 2-3 global contenders that we deem credible to shape it.

Tech edge:

[REDACTED: ONLY FOR LPs] electrolysis: 6.7% tech improvement rate, 57% less energy, direct renewables, modular

Any ore grade accepted, fully automated, no hydrogen headaches.

Beats coal, hydrogen, and molten oxide incumbents on cost/flexibility.

Market angle:

1.95Gt steel/year, 19% of the global economy, 8% of CO₂ emissions. $300-400B needed for the green transition.

Modular economics drive cost parity by 2030 - well ahead of legacy players.

Positioning:

First-mover, compoundingly improving tech, regulatory tailwinds, supply chain fit, and strong learning curves.

Bottom line: [REDACTED: ONLY FOR LPs] step-change in economics and renewables integration puts the old steel cost base on notice. Latest: [REDACTED: ONLY FOR LPs]

Markups

A recap of our markups: (latest round)

Greenjets Limited: [REDACTED: ONLY FOR LPs] (Seed)

Nu Quantum Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Infiniti Recycling Ltd: [REDACTED: ONLY FOR LPs] (Angel round)

Haiqu, Inc.: [REDACTED: ONLY FOR LPs] (Seed)

Anaphite Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Panakeia Technologies Limited: [REDACTED: ONLY FOR LPs] (Seed+)

Notable performers preparing for a follow on round:

Origin Robotics - $[REDACTED: ONLY FOR LPs]m in defence contracts closed (Latvia and Netherlands)

SpiNNcloud Systems - $[REDACTED: ONLY FOR LPs]m in contracts closed (US and Europe)

Astral Systems - $[REDACTED: ONLY FOR LPs]m in annual revenue and word’s first breeding of tritium in a commercial reactor

Ephos - $[REDACTED: ONLY FOR LPs]m in annual sales crossed in 2024; also the first startup to receive EU Chips Act funding: secured 41m EUR to build the world’s most advanced photonics fab for glass-based chips

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 21

Top-of-the-funnel Pipeline: 0 → Fund 1 fully deployed! :)

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 2X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

GP Personal Update

Since my early days in computer science, I discovered that AI (we called it Machine Learning then) was 2 things:

- Incredibly more powerful than I thought

- Incredibly more dumb and inherently stupid than I thought

In the post-ChatGPT world, I ultimately believe we have exactly the same state of affairs.

Meaning: I believe there are opportunities for those willing to see past the hype and current bubble (yes, yes, yes we are in a bubble) and embrace these 2 assumptions.

What would you build if AI weren’t intelligent, nor will it be for years to come? But it was also extremely powerful... And in a way that power is becoming more and more of a commodity?

Think about that.