THE VC “STRIPS OFF” – SILICON ROUNDABOUT VENTURES VC FUND DECK REVIEWED LIVE BY DRAPER ESPRIT LP

Originally published on the Silicon Roundabout community blog

Note: Since this was published, the pitch I use for fundraising has changed. In fact, it's completely different. The main reason is that I decided to launch on my own, as a solo GP with a smaller operator fund, instead of waiting to put together a larger, more complex fund.

I also changed the branding colours and themes completely (thankfully!). But the motivations behind the investment thesis remained virtually the same. Plus: the key insights you can get from this "deck dissection" are still extremely valuable to new fund managers! So I wanted to republish it here :)

PS: If you are looking for the the deck that eventually got me to the first closing, of my 1st ACTUAL fund, here is the article:

https://blog.francescoperticarari.com/the-deck-that-got-me-to-first-closing

After decades of secrecy and obscurity, the VC world is finally starting to open up (if only a tiny bit). Some funds, for example, decided for the first time to release a copy of the VC fund deck they had used during their fundraise.

Today we’re playing our part in bringing more transparency to the industry by “stripping off” too. In fact, we’re going beyond that. For the first time in the VC industry we’re sharing with you an actual LP investor reviewing a VC fund deck. Our VC deck. Live!

Why bother? A 2019 report from Diversity VC showed only 8% of UK VC for example ever had or worked for a startup in the first place. 🤯

Even less (4%) worked in a technical job. This of course means that diversity in the industry in any shape of form is ridiculously low. But guess what? Emerging VC managers have the stats to change that! So we thought of encouraging more entrepreneurship in venture capital by shedding some light on how new VCs like ours are raising funds and how open-minded LPs look at them.

Specifically, Jonathan Sibilia, Partner and head of the Fund of Funds division at Draper Esprit, joined me to do a slide by slide commentary of our deck, which he had never seen before , so that you’ll get the to see an actual LP’s thinking process when reviewing a new pitch deck.

FULL DISCLOSURE: This article is based on a recorded videocall that Jonathan and I had a few days ago. I’ve edited the transcript to avoid doing an unreadable text dump full of ‘ehm’ and ‘uh’. Other than that, and a few cuts and blurs for out-of-topic stuff and side comments, this is literally what happened in the call. AND THE DEAL WAS: that Jonathan had never seen our VC fund deck before , so I was actually quite a bit nervous for the outcome 😬😬😬… If you want to find out how it ended up for us: keep on reading!

“Too Long ; Didn’t Read” Summary

If reading the whole article scares you, here is a quick summary of the key learnings from the exercise, based on both what we managed to nail with our VC fund deck, as well as what we were told we could have done better:

What LPs really care about is what makes you and your strategy special (and why) – everything else is secondary ;

Any VC fund deck must include the following: 1) Strategy / Investment Thesis, 2) Portfolio Construction, and 3) Competitive Advantage;

Use numbers! LPs want to measure your past record in TVPI and IRR: If you don’t have a real portfolio of investments, make a virtual one based on your non-traditional work with startups!

Having a unique aspect to your fund (our is our community) is not a differentiator in the eyes of an LP UNTIL you can put NUMBERS behind it ;

Your team is your greatest asset: make sure you make it clear why you’re the best out there to execute on your thesis;

Don’t use too much text and don’t try and convey two messages with one slide;

Remember ‘6’ above, however: a deck file to be sent via email can allow a bit more text and content than a presentation deck: ours had some slides that I’d never use to present live without some serious cuttings but were clearer with some extra text (not too much);

15-25 Slides for a VC fund deck is a good number. We had 22. You can use appendices if you need to link more data;

You can give some market context if your thesis is sector, industry, or technology specific but you should not spend too much to convince LPs about your market choice – one slide is plenty, Appendices can be used to give further data to non-tech-savvy investors;

Selecting a few key demonstrators is OK, but make sure you represent your message in a way that does not make LPs think you’re hiding something;

Make sure you do your research on your portfolio construction strategy and that you know your numbers: it will pay off!

Show you have preferential access to your target startups (and put names and numbers to back it up!)

A single number can be more powerful than 1000 words: each “key” slide should have its key number you want LPs to walk away with;

Consider fee recycling (if you can).

Before we dive to the actual VC fun deck review session, I wanted to put in a quick plug for the broader initiative I’m part of, which aims to increase openness, diversity and meritocracy in European Venture Capital .

It’s basically a bunch of new VC partners like ourselves (the “GPs”) and fund investors (the “LPs”) that’s been spending time to organise initiatives like ALLOCATE : the first super-affordable European pitching and networking for emerging VCs and LP investors. Or publishing articles and reports on the “behind the scene” of Venture Capital.

We would love you to get involved! Whether you are a startup founder trying to decipher the review process from VCs, or an emerging GP looking to address a shortcoming in the industry with a new fund, or an LP investor looking to grill emerging European VCs like us on tech and startup trends: get in touch!

Feel free to send me your questions and blog ideas at francesco [at] siliconroundabout [dot] tech and I’ll try to write future blogs to address them! And if you have a story to share yourself, why not do just that? At a minimum it’ll get shared with the Silicon Roundabout community: siliconroundabout.tech/submit-guest-post

Now on to the Silicon Roundabout Ventures VC fund deck dissection! Be kind on us readers 🤓

The VC Fund Deck Review

Jonathan Sibilia (JS): Okay hang on just let me open the deck and share my screen… Can you see my screen?

Francesco Perticarari (FP): Yes

JS: I’ll start by sharing a quick intro that you (and your readers) might find interesting on the Fund of Funds (FoF) programme at Draper that I lead together with our Secondary activities: The FoF is £75 million programme, which is backing the best early stage managers in in Europe.

What we’re trying to do is to have a strategy that covers the market map from two angles: one is a regional focus, and the other is sector driven. We do this to ensure we have a broad cover and “feet on the ground” not only across the whole European ecosystem, but also across specific verticals and investment theses.

We’ve been running this program for about three years now and we’ve committed to 28 funds so far, which is close to £55 million of commitment. And it’s already working well because it’s giving us indirect exposure to about 400 companies now. And sometimes, if we can help fast track a round, we’ve also co-invested with our managers in companies that are now going from strength to strength like Cazoo or ThoughtMachine.

It’s only a small part of what Draper does, the bread and butter of the firm being Growth Stage Venture Capital, but investing in other emerging VCs is a strategy that’s being paying off and we are eager to keep exploring.

FP: That’s great Jonathan, as you know I’m a founding partner at a new VC fund, Silicon Roundabout Ventures (SRV), and I can see you have our deck right in front of you, so I’ll sit here quietly listening to your comments and hope for the best.

Just pretend I’m not here. Think out loud as you review the deck now that you’ve opened my email.

VC Fund Deck – Skimming and Opening Slides

JS: I’m now skimming through the deck… mmm… Eyeballing the deck… I like it: it’s quite visual. It does not have too much text, which I hate on a pitch deck. I’m seeing the key “items” or “sections” that I need to see, namely:

what the strategy is

what the portfolio construction looks like

some sort of competitive advantage depiction

So the overall structure seems to have all the building blocks. Now let’s go into it in detail, shall we?

FP: Cool, perfect! (** first hurdle passed 💪**)

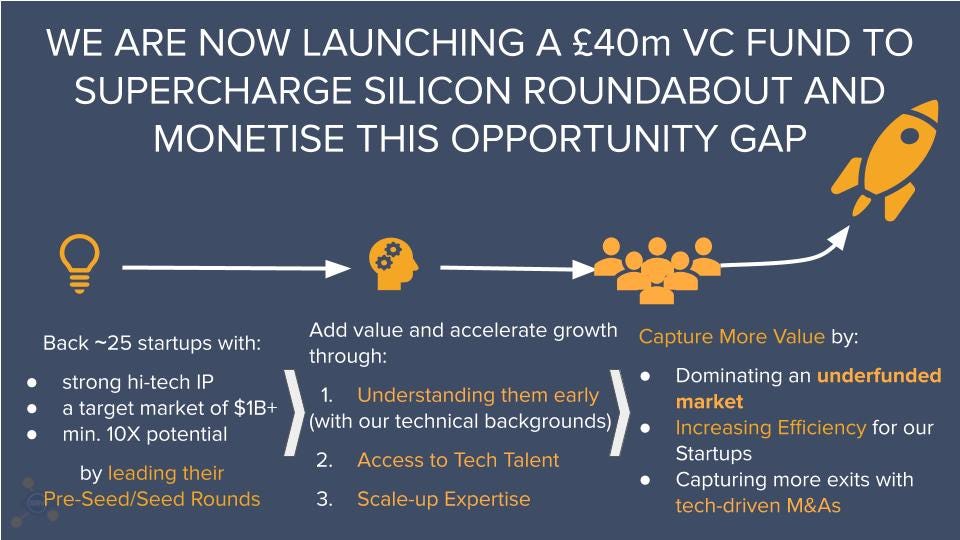

JS : Let’s look at the executive summary. A £40m GBP Fund, ~$50m, for 25 companies at seed… That’s about $2m per company not including writeoffs, which sounds about right. Here it says that SRV leverages a community, which is interesting but not necessarily a differentiator: everybody is boasting about communities these days.

From a network access perspective, being able to access and engaged community is not just a “nice to have” but really a “must have”. For me to see this a differentiator, I’ll need to understand what this is about in more detail as I go through the deck… Let’s go to the next slide.

The Investment Thesis Slides

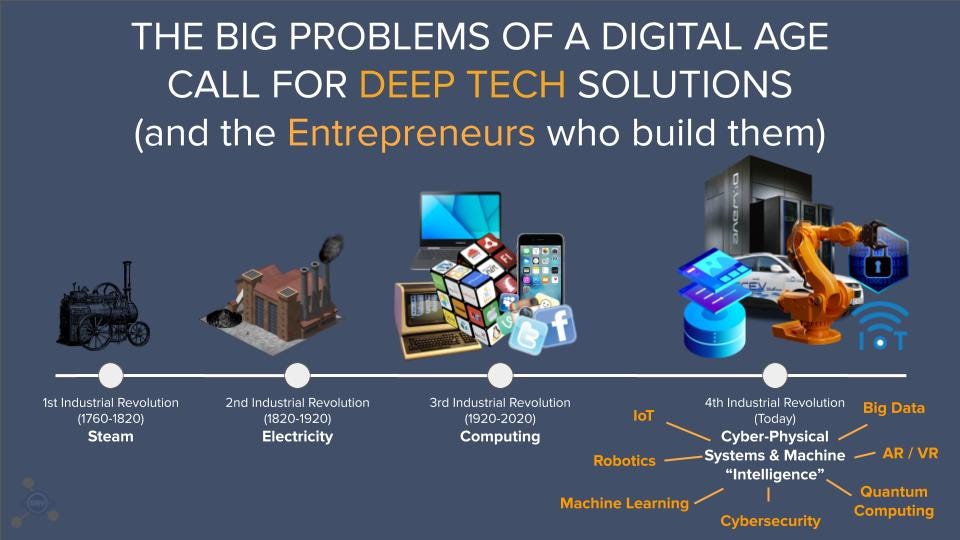

JS: Here the deck talks about the pain point and the “why now”. What I read from this is that there is a “deep tech” revolution, which you compare to what’s happened in history before.

I think it’s a fair play to give readers some context. It’s a slide I’d be going over very quickly as an LP and perhaps, if I were you, I’d possibly think also about today being a time of crisis, as crises create new needs. You could perhaps hint at the fact that such new needs are addressed by innovative startups. I could see a fair claim in saying there is a double-momentum to play in favour of this sort of deep tech, hardware tech, and the likes. But I like the slide, I think it’s very relevant.

FP: 😊

Note: I appreciated Jonathan’s feedback – and since I agree with his thought on new technology being fundamental in a post-covid world, we replaced (Today) in this slide with (Post-Covid), under the ‘4th industrial revolution’ heading.

JS: You made a case for the market opportunity, now how do you address that? Mmh… You start with “community”. You state you built a network of UK founders, technology professionals, which is a pretty light slide to me.

It’s good as an intro I guess, but as far as what I can see on paper here it’s basically propaganda. I think what is missing, and perhaps it’ll be addressed later, is that you might have 14,000 names on an excel list and 5,000 startups, but how do you actually engage with those people? What does it mean to be a network partner of Silicon Roundabout?

Since I’ve heard of you guys I’m sure in your case this network is working, but I don’t think it’s properly represented here.

JS: A connecting slide. You state you see an “opportunity gap” in the UK ecosystem because of your “privileged position”. Why are you privileged? Is it because of this “community angle”? If the answer to that is “yes”, then you really need another slide to convince me of how and why you engage with this community.

It’s a bit weird for me because I met you before and I know of the Silicon Roundabout community in the UK, but I’m commenting on the material here. I need to take the my hat off as someone who’s already heard about this community. If I had no clue about who you were, the deck would need more info on your differentiator.

FP: (We go into more details later, so I hope he sticks around)🤞

JS: Here you explain what this “opportunity gap” is. I completely understand and agree with the title.

I think it’s fair: a lot of VCs don’t do much hardware or deep tech software deals simply because they don’t understand them. They don’t understand the IP. So instead of looking “silly”, they walk away.

What I’ll expect next is a mention of your engineering background: you’re doing deep tech, you’re not the only one, but all the people I’ve seed doing that successfully have a strong engineering background themselves. Now, I know you’re an engineer yourself, but I think you should talk about this too if you’re sending this deck to people you haven’t had a chance to talk with you before.

JS: This one is a great slide.

You’ve built the case for a market opportunity in deep tech, which nobody (or not many at least) are exploiting, and you instead know how to address it, because of your backgrounds, skill set, and the momentum you can help build. These three things make this slide very powerful.

FP: I wonder if we’ve waited too long to start going into the value of our community and our technical backgrounds, since we still need to give more details around those. Something for us to mull over.

The Strategy and “why we are different” Slides

JS: Finally you start to go into the community aspect in more detail! I now wonder if this is something that finally answers my doubts from before… Let’s see, so here is the overview slide… let’s see how you develop these “1-2-3” step process…

JS: So this is your “community” slide. In which case, forget about my comments earlier and let’s have a look: What is your first differentiator here? It’s access to deals. So what you are saying is that because of this network you’ve built you have preferred access to deal flow. I think what investors want to see is that you have some kind of preferred or priviledged access. In other words, will you be limited to follow others, or will you be able to be the “first speaker” on deals?

We LPs ultimately want to invest in people that can execute well and make returns on their investment judgement, but also who have the ability to see deals when nobody else is looking yet. I think with your community you’ve got that edge and you could make it very plain that this is what you’re showing investors with those numbers.

Now what screams for my attention here is that you have built up an access to about 5000 startups and that you’ve screened about 1000 of these, then selected to pitch about 100. Those are big numbers. It might even be in the title: We have preferred access to 5000 or 1000 qualified leads early. That is powerful.

FP: I’m definitely pleased with these comments. We’ve built our meetup community for nearly a decade. Way before we even thought about raising a VC fund. So, for me that is a strong proposition that not many investors can make. I’m glad Jonathan agrees.

Note: We have since re-titled that slide “WE HAVE PRIVILEGED ACCESS TO GREAT DEALS EARLY AND FOUNDERS PREFER US!” to explicitly phrase our message in “LP terms” and added a row to show the growth of the number of events we organised for our community.

JS: Finally the team slide! The only thing is that it’s not entirely clear you guys have the technical backgrounds to assess deep tech deal. At least, not at first glance. Make sure you highlight it more. It’s the interesting bit about you guys and not many investors will take the time to look at your profiles other than by reviewing the deck you send. Hence this document should make it very clear you all are technical and understand “deep technologies”.

I can see you have skills and key experience points in the circles, and I like the idea of showing how the partners’ skill sets overlap, but visually it needs some work to make its point more evident.

Note: Point taken: we have since re-formatted the slide to stress the 3 partners are a former tech lead, a former tech entreprneur and a tech investor with a background in actual engineering and hi-tech development:

JS: Some funds, on team slide, show their track record, but I see you mention “value add record” below, so I’ll go ahead now and see where you go from here.

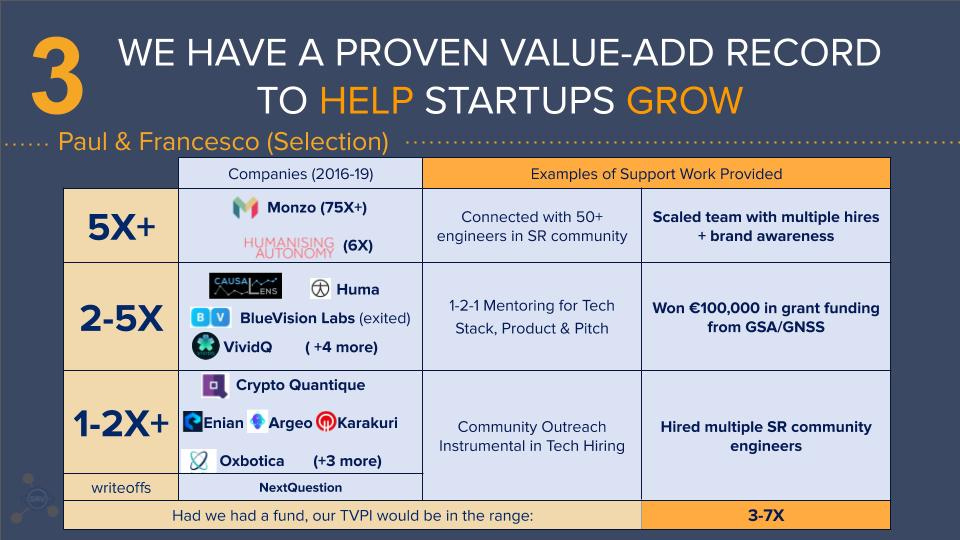

JS: What I don’t see here, and this is one of the most important aspects I want to see as an LP, is really the “track record” of your team. Now, I understand that the Silicon Roundabout community has not been an investor until now and I see that you have some companies listed in this slide, which, I presume, you first selected, then helped with your community. This is great because it shows you can pick companies at an early stage that can then scale, not only on the growth journey but also on the fund raising side. What’s missing, though, is showing this record in terms of numbers, in terms of TVPI really.

You don’t have to do it line by line for all the companies you’ve selected in a decade for your Silicon Roundabout events, but you should try to think of your non-traditional record “as if it were” an investment track record. What would it look like in terms of numbers?

Perhaps you can have 3 buckets of companies, for example you could try: “key value drivers” or “outliers”, “too early to say”, and “under-performing”. You could then think start to think in terms of how much it’s been invested in those companies, how much you could have invested yourselves if you had a fund, what would your NAV look like today, and what your multiples would look like.

I really want to see some form of TVPI here, because that will give a lot of strength to your pitch.

Even if it is your first fund and there was no money invested per se, you’ve got to find a way to show that for example Monzo was only worth say $20m or less when they pitch to you and now it’s worth over $1B.

You’re missing the opportunity to tell a great story here.

I like the slide in general and I understand you want to show your capacity to help companies and add value to these companies. Which makes sense because look at where those companies are today, but you could also represent it in a way that simulates the returns you could have had, had you had a fund in place back then.

Isn’t this, after all, the reason why you want to raise a fund? Because you’ve been fishing in the right pond and realised there is an opportunty?

FP: This was probably the ‘ugliest’ slide in our VC fund deck, with too much text and too small a font for my taste. I totally understand the feedback and got some good ideas from it on how to portray our non-traditional community track record. I think this is probably one of the best tips for industry operators who are looking to raise their first VC fund.

Note: After the call we modified the slide to look something like this:

JS: I like what’s coming up next…

The “Why we can deliver” slides

JS: I really like this slide.

There is a question I really like to ask the entrepreneurs I back, after they exit, when there is no emotion and the cash is in the back:“Assuming we would have not invested cash, how much our help was worth to the company?”

It’s a powerful way to measure the worth of smart money vs dumb money. And good founders always try to follow the first kind.

I can see you are effectively doing some of this here, by reporting that one of those founders you put down in the previous slide have told you that if you could have invested, they would have liked to have you on board.

JS: Another track record slide, this one showing some of the individual track record of one of the three partners and of your venture partners.

I like that.

You’re not mentioning multiples though, which is not good. Either you’re trying to hide information or you’re not doing justice to his success.

FP: I think the problem here is visual because except for live deals still ‘too fresh’ and some corporate venture deals with undisclosed exits, there are plenty of realised deals done by our partner Novica. We have a few in this slide which realised 2X for example.

Note: We reviewed the slide to capture with a single number all the realised deals with exits for which we can disclose multiples -the realised IRR:

Note 2: to double down on our credentials, we also moved a slide out of the appendix and back into the main deck, which gives more details on the core team’s bios.

JS: I see we now move out of your credentials and into your fund strategy…

Portfolio construction and execution

JS: This is really a “portfolio construction slide”. My advice would be to reverse your flow, going down from your sweet-spot of Seed and Pre-Seed and then going down to your follow on. Visually it is easier to grasp.

Besides that, I like that. I really like that slide. I think it’s perfect.

If you change the order, it’s perfect. It tells me very quickly that you will do 25 businesses, aim for 10-15% equity, that you invest on average £230k (you’re missing a ‘k’ by the way) for new cheques at pre-seed, £1m for new cheques at Seed, that’s great!

I like the clear division of “new investment” and “follow on”. I see you have over 60% for follow-on and that is very important. It means you “get it”.

Most of the funds we backed who went on to raise a new fund, be it their 2nd or 3rd, tell us that the biggest lesson learned from their previous fund was that they should have had more for follow-on investments. Definitely more than 50%, because:

It’s very frustrating when you can’t double down on your winners, and

This is how you drive returns.

Note: Flipped slide:

FP: Great. Thanks!

It’s good to hear our work is paying off! Maybe because we are engineers but we spent a long time collecting and crunching data to simulate and model different scenarios for our fund. In the end it’s all about the maths. VC returns follow a power law distribution and doubling down on the best performers is the best way to ensure top returns on the capital invested.

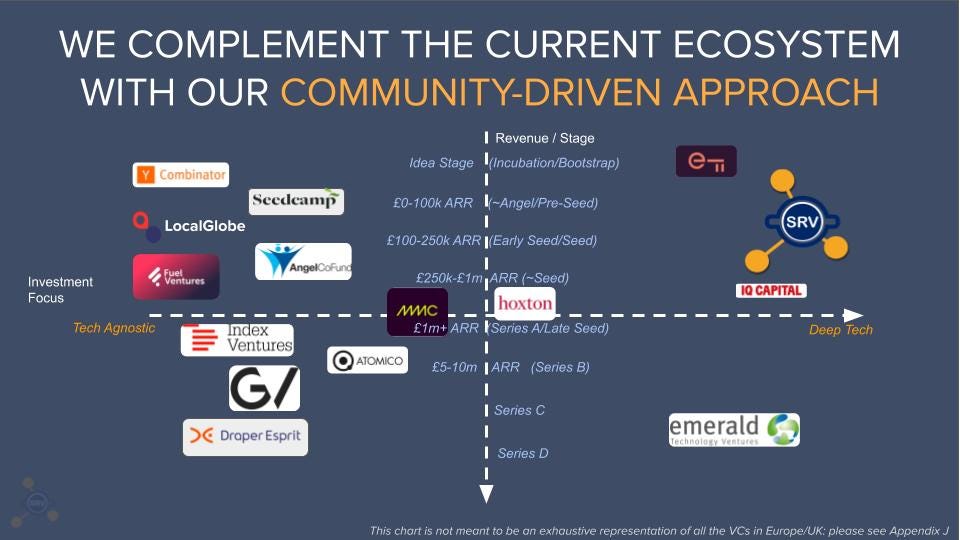

Market mapping and comparison

JS: Dangerous! You’re comparing yourself with great names here. I don’t think this is the way you should do it. It might be a perception issue, but I don’t think that is a conversation you want to have with your LPs. There is probably truth in what you are saying but I would make it simpler and less confrontational.

For example do a simple cross, an x/y chart. Maybe put on the x-axis the deep tech focus, and on the y-axis either the hands-on support, or the typical entry stage. Pick two. Like a “Gartner magic quadrant approach” where you have to appear on the top right.

That way it’s more visual, it’s less contentious, and people won’t read it as if the people you mention can’t do their job. But you have the right ideas here and this “market comparison” slide is very important in a VC fund deck, so you’ll have to come up with the right way to do it for you.

FP: This was another gem for us. We see ourselves as complementary to most players out there and we have great relationships with the majority of the other investors who do UK deals.

We’re different and we will fill an “equity gap” in the ecosystem but the last thing we wanted to communicate was that other investors are not good in their own niche. Because there are definitely great investors out there. Most of whom we’d like to actually co-invest in deals if the opportunity arises.

With a simple X/Y graph we can still tell LPs where to place us on the “map” and leave it to the other slides to show what’s in our DNA that makes us unique.

Note: we’ve since re-formatted the slide by focusing on our entry point focus into deals.

Closing slides: terms and pipeline

JS: Very generic slide. I don’t have a problem with it.

FP: I’m of the idea that what’s not of key value should be cut our from a deck. Some LPs, however, asked us about where we see ourselves going after our first fund and whether they’d have access to our pipeline of startups. Hence, we thought of making a slide to explicitly tell LP investors about our vision and about ways we are happy to get them involved with our fund activities.

JS: “Our pipeline is already in place”. That’s great. But you only show 3 companies. If you don’t want to give away too much on a deck, perhaps you can say that “these are three of our best picks”. Or something along these lines to make it clear your pipeline is not just three companies, but that this is just a sample.

FP: Got it.

JS: Now the key fund terms…

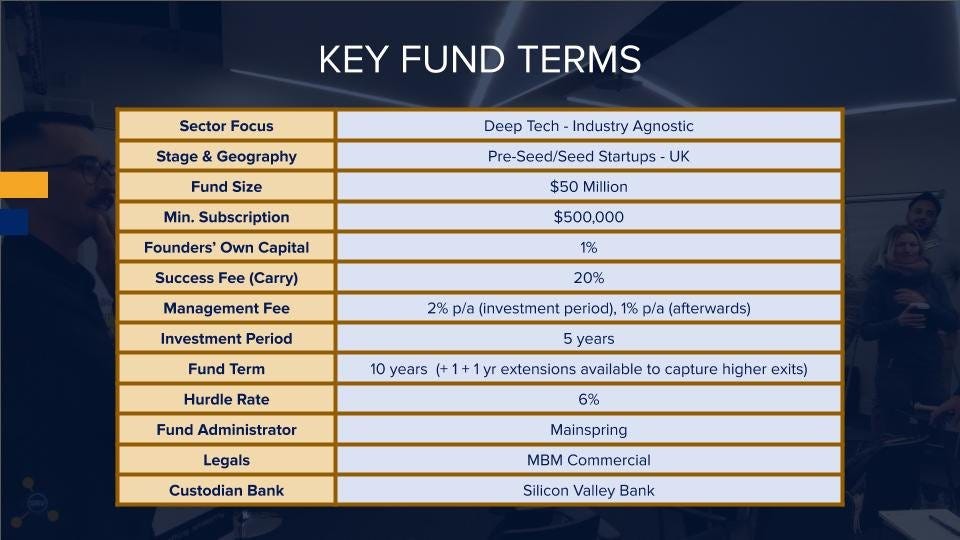

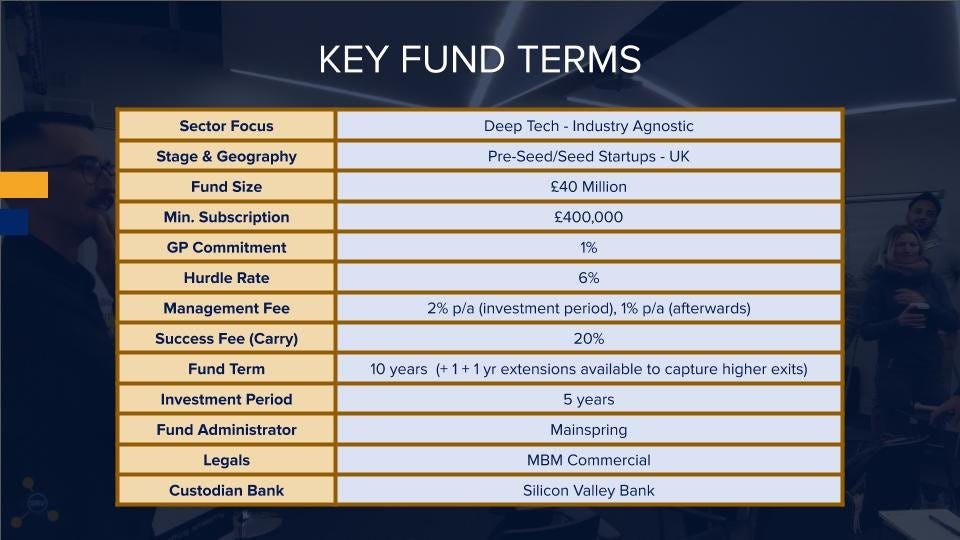

JS: Is it GB pounds or US dollars?

FP: It’s in pounds. We used dollars here in case LPs use different denominations, since the dollar is the normal international standard.

JS: Yeah but if your fund is in pounds, you should stick to that. Also I would call the “founders’ own capital” as “GP commitment”. So there is £400,000 from you guys. That’s a lot of money. It’s OK. Then you have “Carry”… I’d put that after the “hurdle rate”.

Are you guys going to recycle your fees?

FP: That’s something we’re discussing with the prospective anchor investor we are now in due diligence with. Can’t comment on that yet unfortunately.

Since we’ll publish your review and comments as an article that might help other managers, what is your opinion on fee recycling?

JS: I think it’s good. It’s good for me as an LP because I’d rather have less proceeds early on and a higher return at the end of the fund. Now, some LPs might want “quick DPI” and their cash back as soon as possible, so those LPs might not agree, but I think the majority of serious LPs will share my view that recycling is ultimately a win-win for everyone.

Note: We subsequently adapted our slide to look like this:

FP: The deck used to finish here, but we’ve recently added a slide to showcase a special deal that LPs will get with this fund. I will not include this “special” slide in this article, since it’s a very specific proposition we are able to do thanks to one LP that’s looking to become our anchor. It is only applicable to this very fund and it is effectively a line graph displaying how much more money LPs will get out thanks to these special terms.

Ending and Appendices

JS: It’s finished! 22 Slides. You managed to explain everything in less than 25 slides, which is good.

I think it’s a very good deck.

It needs to be fine-tuned a bit but it’s a very good VC fund deck.

FP: Amazing. Jonathan’s feedback has been great (by the way I just noticed as I type the irony of having strictly confidential on a deck I’m now publishing online 🙈. In this call, Jonathan and I went on to review the Appendices, which I won’t bore you with, since they are mostly support data and not really “deck-y”.

For reference, the Appendices to our deck were then 11 slides, mostly comprising tables and charts. At the time of writing, there are 10 as we moved one into the deck as previously noted.

The current list is as follows:

Industry References (Selection) [effectively some testimonials from founders, community partners and other investors]

Novica’s investment track record (table)

Francesco and Paul’s track value add record (table)

Projected fund returns [line graph with a bullish, expected, and conservative scenarios]

Why Venture Capital: Average IRR for VC vs PE and vs Public Equity (data Cambridge Associates 2019)

New Funds Outperform Established Ones (Data Prequin 2019)

The UK: Cradle of European Innovation [6 key numbers on why the UK is by far the leading market in Deep Tech and in VC overall in Europe]

Why Deep Tech [Market Potential showcased using the projected past and expected growth of AI and IoT alone vs the limited amount of capital invested in Deep Tech by VCs today]

Why Seed in the UK [Line graph showing that Seed investment in the UK has been declining for 2 years against a ballooning growth stage, data: Beauhurst 2020]

Why a UK Deep Tech Pre-Seed/Seed Fund Now [x/y chart similar to the new market comparison slide we made after Jonathan’s comments – this one however shows in details the breadth of typical 1st-cheques by current VCs (using lines instead of logos): it shows that there is a clear scarcity of funding at Deep Tech Pre-Seed/Seed in the UK whilst the whole growth stage and “generalist” pre-seed/seed are full of overlapping players]

VC fund deck review – Ending Comments

JS: Ending comments after reviewing the whole deck: I like the combination of your backgrounds, the community angle, and the need for more specialised early-stage deep tech investors.

Even if you guys are young, I’ve seen many worse decks. I’ve also seen some which are a bit better. Especially regarding the communication of your past record. But I think it’s definitely a deck in the top quartile for me.

Regarding the record part, even if you don’t have a traditional track record as a team of investors, I’ve seen first-time managers being very creative on that front. Just make sure you can portray your incubation, support or community efforts in a way that’s ultimately numerical.

In general, it’s good. I’d like you to send me the new version with the updates, so that I can start some due diligence.

When it comes to actual due diligence, by the way, make sure you have a reference list of contacts that can validate your background and the claims made in the deck. Founders, other industry players… That’s usually the only piece of real due diligence we would do after analysing your strategy, team and fund potential.

FP: I’m glad that despite our mistakes and imperfections we can move onto the next phase. I’ll make sure Jonathan and his team receive an updated version of our VC fund deck and that more LP investors join their ranks in opening their doors to emerging managers raising their first fund.

I hope this review will be useful to other managers and, who knows, maybe even startup founders and LP investors wanting to know what happens behind the doors of a Fund of Fund office (or video-call in times of COVID!): when the VCs take off the startup investor hat and go cup-in-hand to fundraise themselves.