Trillion-Dollar Crash

Why Markets Consistently Misprice Breakthrough Technologies & The Opportunity Beyond The AI Rush

Francesco Perticarari - September 2025

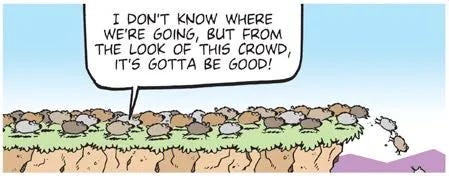

Almost every venture capitalist, tech analyst, and retail investor I’ve encountered recently shares the same unwavering conviction: Artificial Intelligence, especially generative AI, is the biggest value creator tech has ever seen, and getting in now, often at “any valuation”, will lead to the investment of a lifetime.

At Mobile World Congress earlier this year, I warned that finance had likely broken innovation and the AI hype was mostly misplaced. Yet, despite mounting evidence since, public markets continue to strike record highs, while in VC WhatsApp groups I’m part of, 9 out of 10 companies mentioned involve AI or “agentic” platforms.

I believe this to be a mistake.

My analysis, as both a Computer Scientist reviewing technology fundamentals and a Venture Capitalist studying historical parallels, suggests that we’re heading instead for a major bear market within the next 3-18 months. While a crash may help true progress and reward those who dare to be real contrarians, there will be real casualties. Financial for sure. Political, almost certainly.

Abstract Summary

This essay will analyse the risks of overhyping mainstream AI trends, current market dynamics, and the reasons investors consistently misprice innovation. It reviews overlooked opportunities and methods for finding long-term “alpha” returns, proposing the “Warsaw PhD Blueprint” to identify high-impact companies beyond short-term hype cycles. We will then discuss likely endgame scenarios for the present AI frenzy and techno-economic cycle.

What we do as investors will dictate whether we make or lose fortunes. What we do as a society will determine whether we usher in an age of genuine prosperity or perpetuate a dystopian cycle of speculative booms, busts, and rising inequality.

Few will hear this now. My hope is that a few may be enough and that more will, once the train wrecks.

The Technical Reality of AI: A Systematic Breakdown

To understand why industries and markets consistently misprice breakthrough technologies, we must examine what they’re actually pricing. Current large language models (LLMs) excel at pattern recognition and text manipulation within their training distribution: writing coherent prose, translating languages, generating functional code. These capabilities have genuine commercial value and explain initial excitement - I use Claude and GPT myself, both professionally and to help with personal searches.

But serious limitations arise when early enthusiasm meets commercial reality. A 2025 MIT study found that 95% of corporations gained zero measurable return on generative AI. Swedish scale-up Klarna dramatically U-turned on plans to replace staff with AI after poor results; METR found AI tools even slowed skilled engineers despite perceived speed gains. This matters because LLMs today aren’t expected to be merely useful, but to unleash superhuman general intelligence and billion-dollar outcomes for platforms repackaging them.

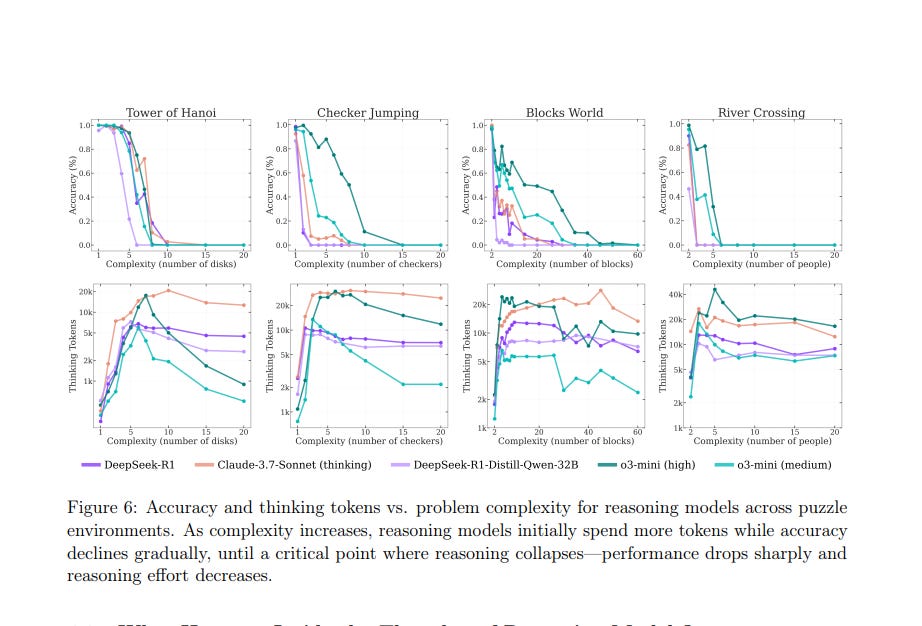

In June 2025, Apple researchers delivered what LLM sceptic Gary Marcus called “a knockout blow for LLMs” with “The Illusion of Thinking”: “reasoning” models face “complete accuracy collapse” beyond a certain complexity, with “no evidence of formal reasoning.”

The findings were brutal: “Adding even a single sentence that appears to offer relevant information to a given maths question can reduce accuracy by up to 65 percent.” Researchers concluded: “There is no way you can build reliable agents on this foundation, where changing a word or two can give you a different answer.”

Despite critiques about benchmarks and token limits, Apple’s core findings stand. A key rebuttal was even meant as a joke, while serious analyses confirm LLMs routinely fail with changed problem structure, regardless of context. Earlier work by the same team also shows these models rely on pattern-matching and memorization and not genuine reasoning. So, despite some caveats, the study highlights AI’s struggle with robust, generalisable understanding.

Independent research confirms this pattern-matching ceiling, chronic hallucination, and unreliability:

Fluid-intelligence ARC-AGI-2 benchmark: humans ≈ 75%, GPT-4o 19% (Zhang et al., 2025)

Simple graph-colouring: nine frontier LLMs mis-colour ≥ 60% (Chen et al., 2025)

Clinical diagnostics: “none-of-the-above” probes halve accuracy from 80% to 42% (Bedi et al., 2025)

30—70% hallucination rates on unanswerable questions, intrinsic to autoregressive decoding (Wu et al., 2025)

Thus, evidence keeps piling up and showing that mainstream AI‘s capabilities are more about optimisation and prototyping than problem understanding and revolutionary disruption.

Latest Models Underwhelm, Resources Skyrocket

While larger models do show performance gains, these are becoming more modest while energy costs and infrastructure needs rise super-linearly. OpenAI released GPT-5 in August 2025, which was estimated to require >10 GWh to train and several kWh per million tokens at inference, whereas the human brain functions on ≈ 20 W all day.

GPT-5 was hyped as the “great leap forward,” with Sam Altman predicting it would deliver AGI, if only they could raise and spend enough money on compute power.

Instead, benchmark gains were “marginal at best” across nearly every metric, even losing to Grok on ARC-AGI-2 reasoning. In maths tests like AIME 2025, GPT-5 Pro’s lead over previous models was minimal. Users also noticed that the emperor had no clothes. Noah Giansiracusa, associate professor at Bentley University, called the launch “underwhelming,” saying improvements were “much more marginal than I would’ve hoped”.

With models already trained on most data on the Internet and data centre electricity outpacing some national grids, piling compute onto autoregressive large models looks an increasingly costly route to get mere incremental improvements in real reasoning.

AI bubble deniers claim that future models can ingest synthetic data and private records like medical files, and that LLM progress still continues “exponentially” on certain metrics like independent runtime length. Yet even their own data shows these gains are actually either linear or sub-linear, not exponential. Meanwhile, both research and user experience increasingly show that longer runtime, adding synthetic data, and pure model and data scaling all show practical limits that are inherent in the way AI works and won’t be fixed with more compute power.

This is the pattern I predicted in my MWC keynote: diminishing returns from throwing more capital and compute at fundamentally limited approaches.

FOMO-Driven Investment

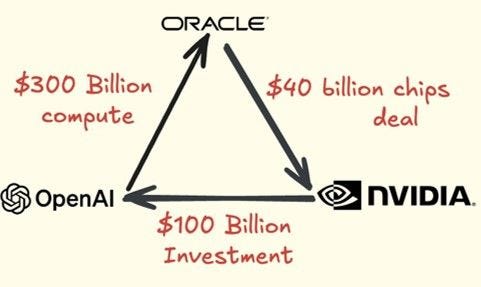

Meanwhile, FOMO-driven funding props up an industry that’s growing like a dangerous house of cards:

VCs and cloud providers invest in foundational model companies, which then burn through that cash in cloud spend while selling at a loss

Future growth projections on that spend send cloud provider stocks higher, justifying more investment (probably why some analysts don’t see the bubble yet)

Capital gets reinvested into infrastructure projects and application layer companies, which mark up VC bets and boost foundational model revenue, despite these too having negative economics and relying on funding to stay afloat

Revenue and investment circle, with future projections staked on unsustainable metrics and AGI promises that look ever more elusive as performance gains plateau

Goldman Sachs defends the data centre buildout as a productive infrastructure investment. But productive for whom? By which year?

When hyperscalers like Oracle and Microsoft both invest in and consume from the same infrastructure, and a few unprofitable companies like OpenAI rely on fundraising to fulfill obligations, revenue becomes circular - and the system extremely fragile.

Mark Zuckerberg candidly admitted the rush may be just a speculative bubble: “there’s definitely a possibility, at least empirically, based on past large infrastructure buildouts and how they led to bubbles”.

His rationale: tech incumbents accumulated so much cash in the last 20 years that FOMO is now a bigger driver than optimal investment calculations. “If we end up misspending a couple hundred billion dollars - Zuckerberg continued - that’s going to be very unfortunate obviously. But I would say the risk is higher on the other side… If you build too slowly, and superintelligence is possible in three years but you built it out were assuming it would be there in five years, then you’re out of position”.

Elon Musk predicted Grok 5 to deliver AGI by the end of 2025. Should this claim also fail, as our technical analysis suggests, it will become harder to defend limitless AI explosion in the near future. At least without further breakthroughs in fundamental research and infrastructure architectures, which will require much longer timelines to emerge.

The Financial Forces Behind AI Speculation

This technical reality (powerful yet limited tech tools misrepresented as almighty revolution) and a FOMO-driven gold rush create the perfect setup for a market bubble.

What I described as far back as 2022 as a “functioning alcoholic” cycle has only intensified: bigger funds demanding bigger tickets demanding bigger valuations demanding bigger stories, such as Marc Benioff saying that “Generative AI is the most important tech of our lifetime” or Marc Andreessen branding AI “a universal problem solver”.

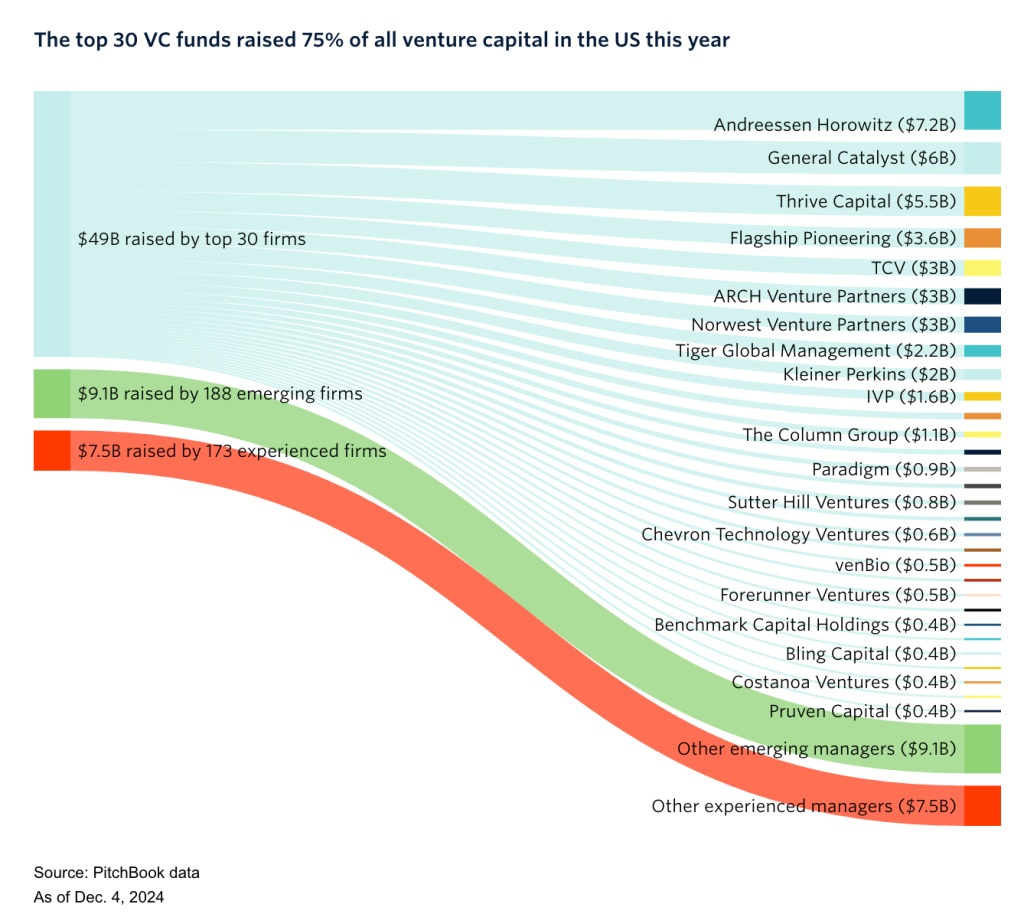

The numbers tell the story. Nine US firms control half of all venture capital raised, with 75% of all US venture capital in 2024 going to just 30 firms and AI startups consuming over half of all funding. OpenAI, days after its flagship model’s lukewarm reception, increased its valuation to half a trillion dollars, matching Mastercard and Netflix. Early-stage startup valuations are also setting new record highs.

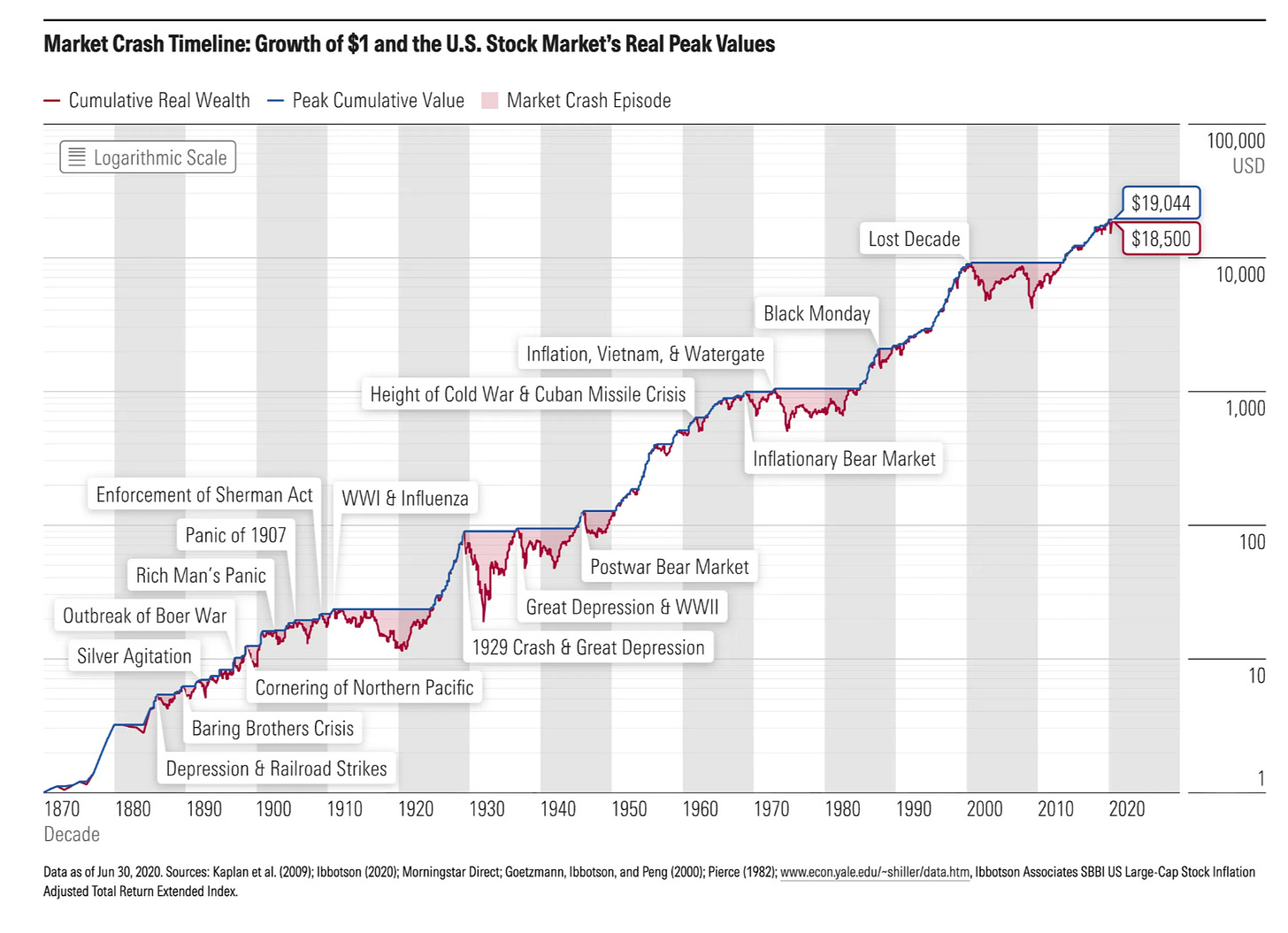

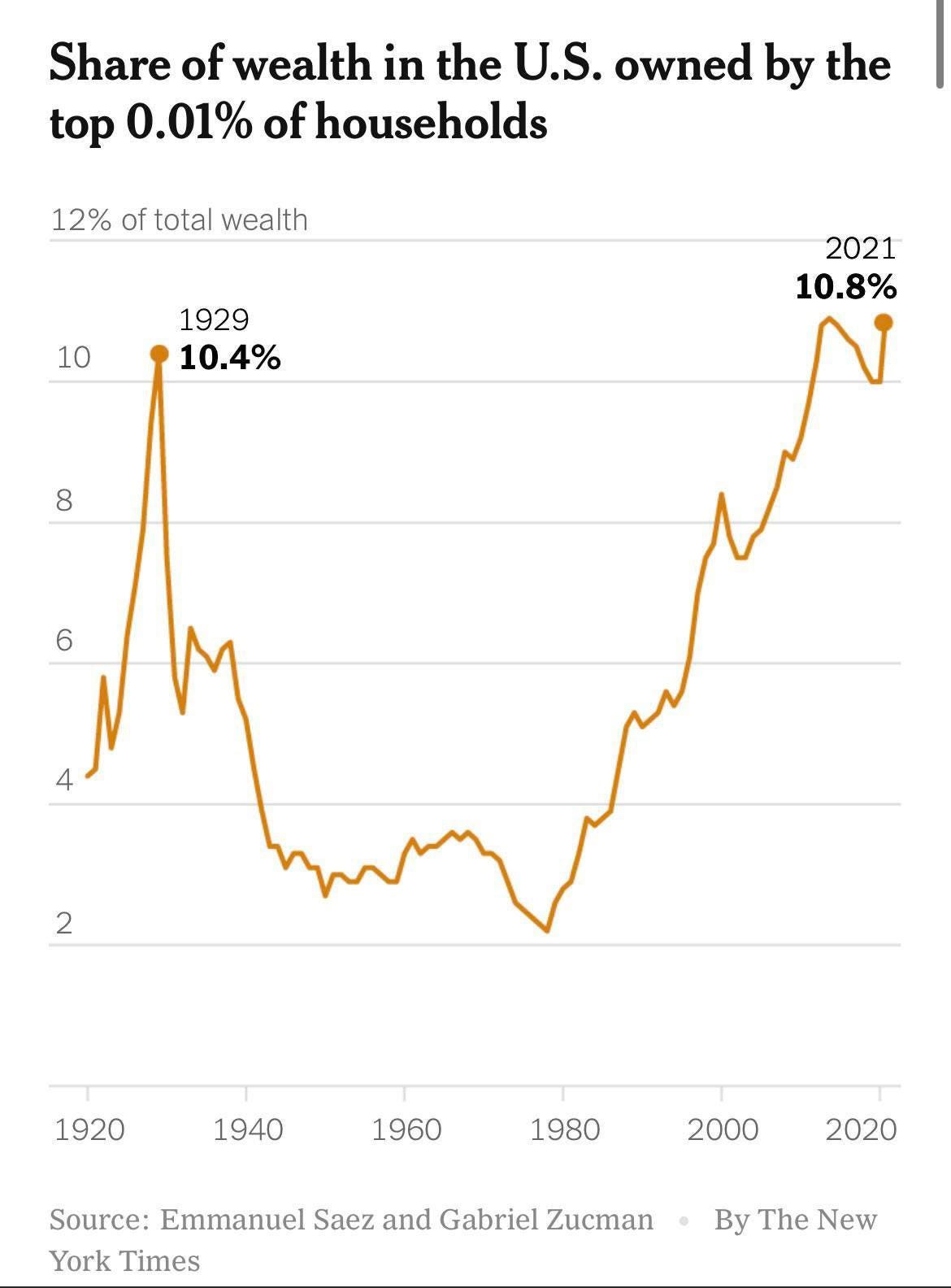

Public markets mirror this distortion. The S&P CAPE Ratio sits at 39, approaching the 40-42 dot-com record. The Total Market Cap over GDP has shot above 210%. The Mag7 account for nearly 35% of the entire S&P 500, with the 5 largest 4.9x more valuable than all small-cap stocks combined - concentration exceeding dot-com bubble times.

Remember 2021’s meme stock rushes and dubious reverse mergers? It’s all back. From IPOs for unprofitable companies to SPACs (even the “SPAC King” returns after losing investors’ money). Meanwhile, retail investing hits all-time highs whilst PE and VC funds offload stranded assets to retail investors via continuity funds.

Yet surprisingly, expert consensus remains this time it’s different. Economists don’t see crashes coming. Investment houses remain bullish. National Security joins the AI party. Analysts agree: markets are ultimately heading up and right.

Not only that, but productivity will soar, and we’ll all be out of jobs (but universally wealthy) because AI and robots will handle everything.

The few who disagree mostly worry about AI going rogue. In that scenario, machines still take over most human activities by 2027 or thereabout, but we then get wiped out or end up in a Blade Runner dystopia.

Following mainstream financial news, you’d think slot machines are open and everyone’s raising bets to win big. Market consensus says AI is where money will be made like never before.

The Historical Pattern: Markets Always Make the Same Mistakes

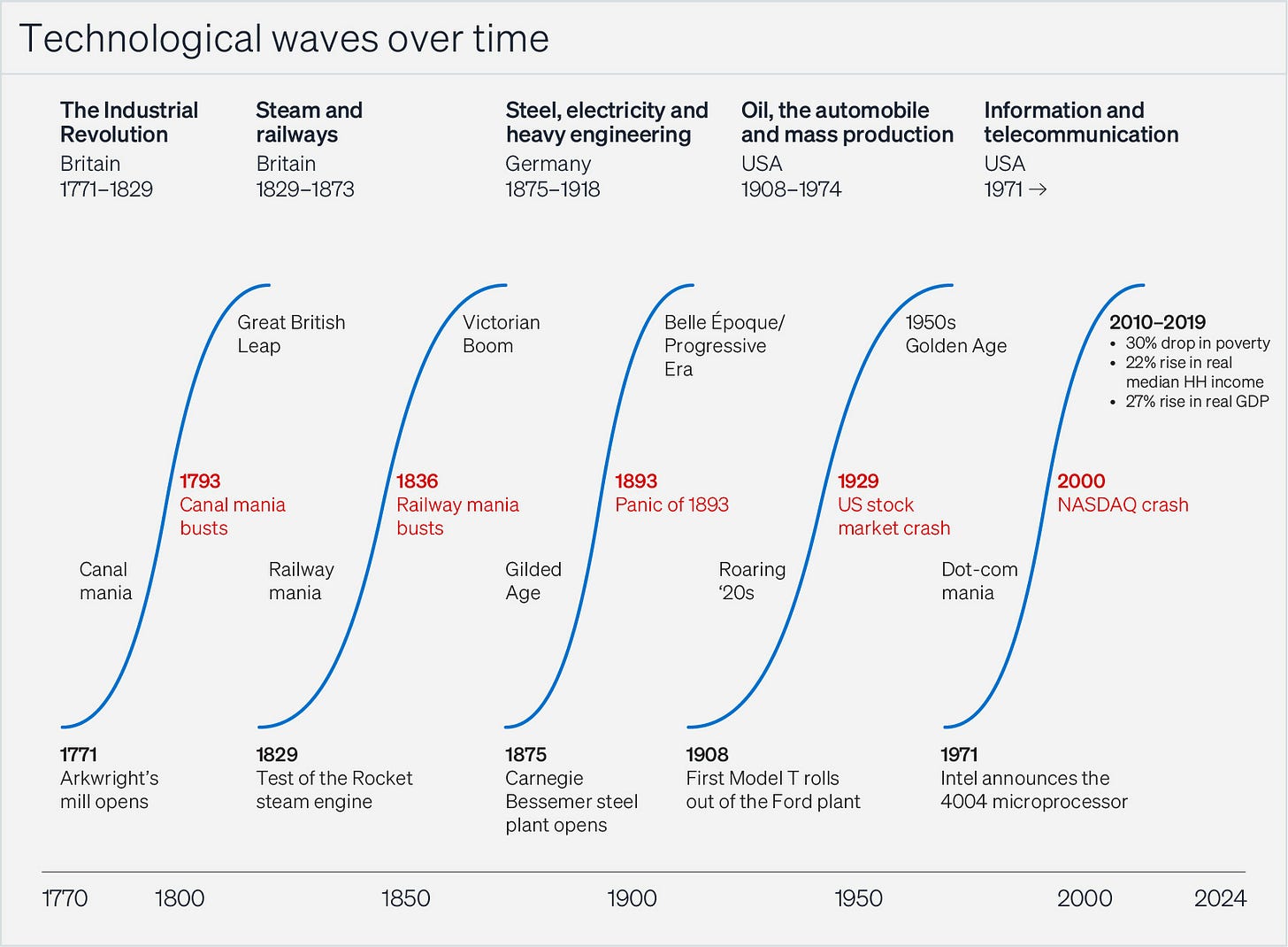

Rather than an anomaly, this behaviour matches exactly what you would expect in a late techno-economic cycle environment, as well as in the phase before a golden age of stability is reached.

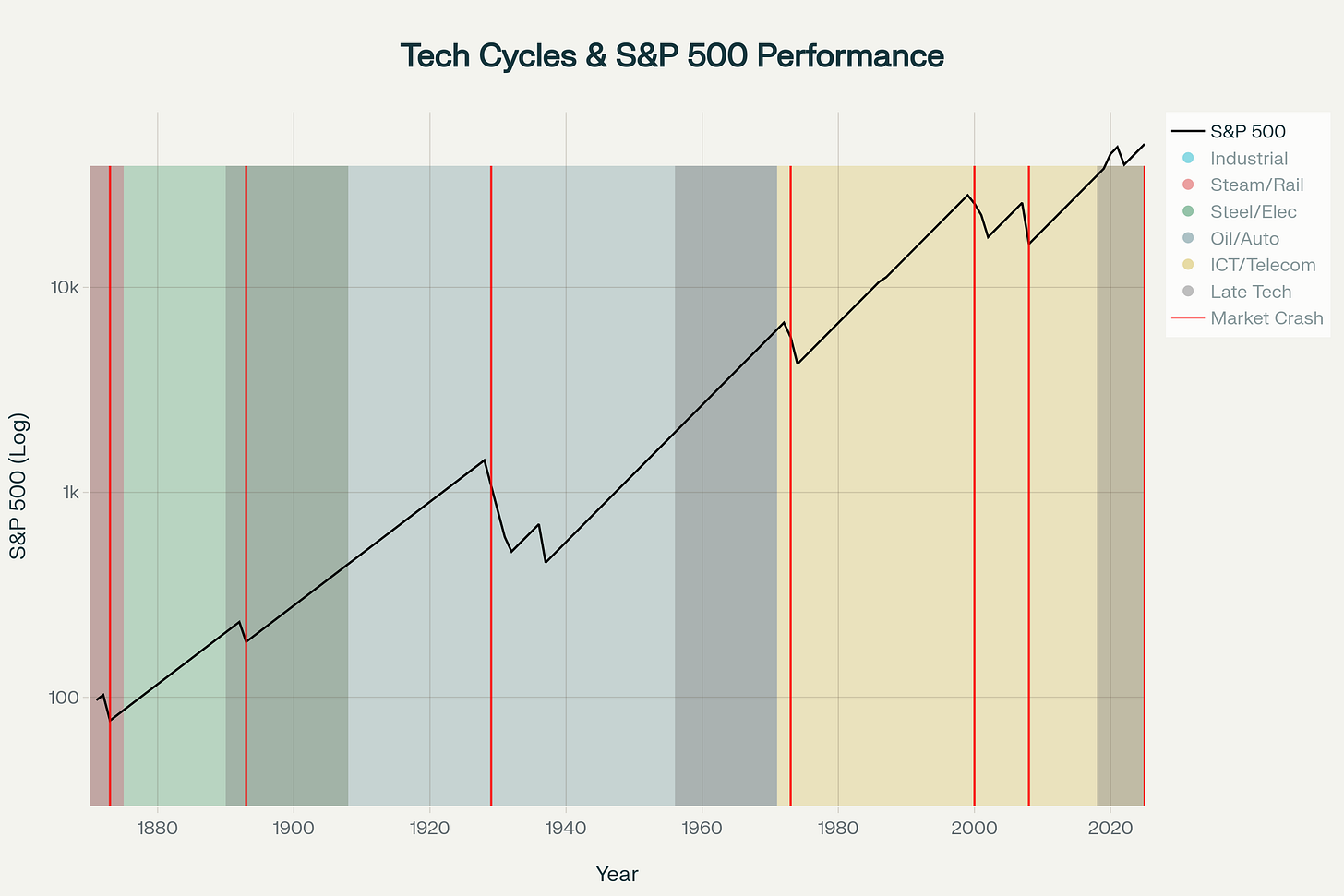

Economist Carlota Perez documented this pattern in “Technological Revolutions and Financial Capital“. Perez recently noted: “I have not seen a golden age happening without a crash.”

Over two centuries show that mature technology innovation, like containerisation in the 1970s, make the tech obvious and the whole market rushes to invest in it and adopt it - triggering speculation, overcapacity, and severe downturns. Today’s AI frenzy has arrived late in the ICT technology cycle and also lacks any “surprise arbitrage”, as incumbents move in quickly, investors cram in, entry valuations surge, and rampant competition destroys margins.

The transition from technology “installation” to “golden age” is also chaotic and characterised by bubbles and busts, as demonstrated by the Great Depression during the Age of Oil, Automobiles, and Mass Production (1908–1971). Unlike previous cycles, the current ICT era hasn’t delivered a clear golden age of widespread prosperity; therefore, repeated bubbles, social tensions, and inequality remain dominant. Meanwhile, capital keeps chasing speculative waves (dot-com, great financial crisis, web3, AI) without genuine techno-economic integration.

Since today’s AI frenzy bears hallmarks of both late-cycle technology bubbles and installation phase speculative excess, conditions mirror the S&P 500’s largest declines (1873, 1893, 1929, 1973–74, 2000) with the two concurrent factors sharpening risk.

The setup is therefore in place for a harsh valuation reset, funding drought, and an ensuing bear market potentially rivalling the Great Depression or the 1970s.

Perez herself noted that, while AI as a whole will continue to help technology advance and potentially even “lay the groundwork for breakthroughs in biotech, nanotech, and other fields that may be at the centre of an eventual sixth revolution”, it does not represent a novel disruptive revolution itself.

Therefore, besides the technical limits to current AI systems, we must also consider that even when past innovations have proven useful in the long run, investors and industry consistently fail to correctly predict where and when value actually accrues, provoking hype, bubbles and crashes.

The Technology Improvement Curve Framework

The problem with most investors is that they follow financial news and hype instead of academic research on technology trajectories. MIT and Santa Fe Institute studies demonstrate instead that technology improvement rates, measured by price-performance, energy density, or manufacturing yield, predict long-term winners far better than market consensus.

This framework explains seemingly counterintuitive outcomes across technology cycles. Two lessons stand out:

The Amazon lesson: Long-term cash-flow and operating leverage improve as infrastructural moats compound when taking risks as contrarian pioneers, even trading early profitability for market expansion.

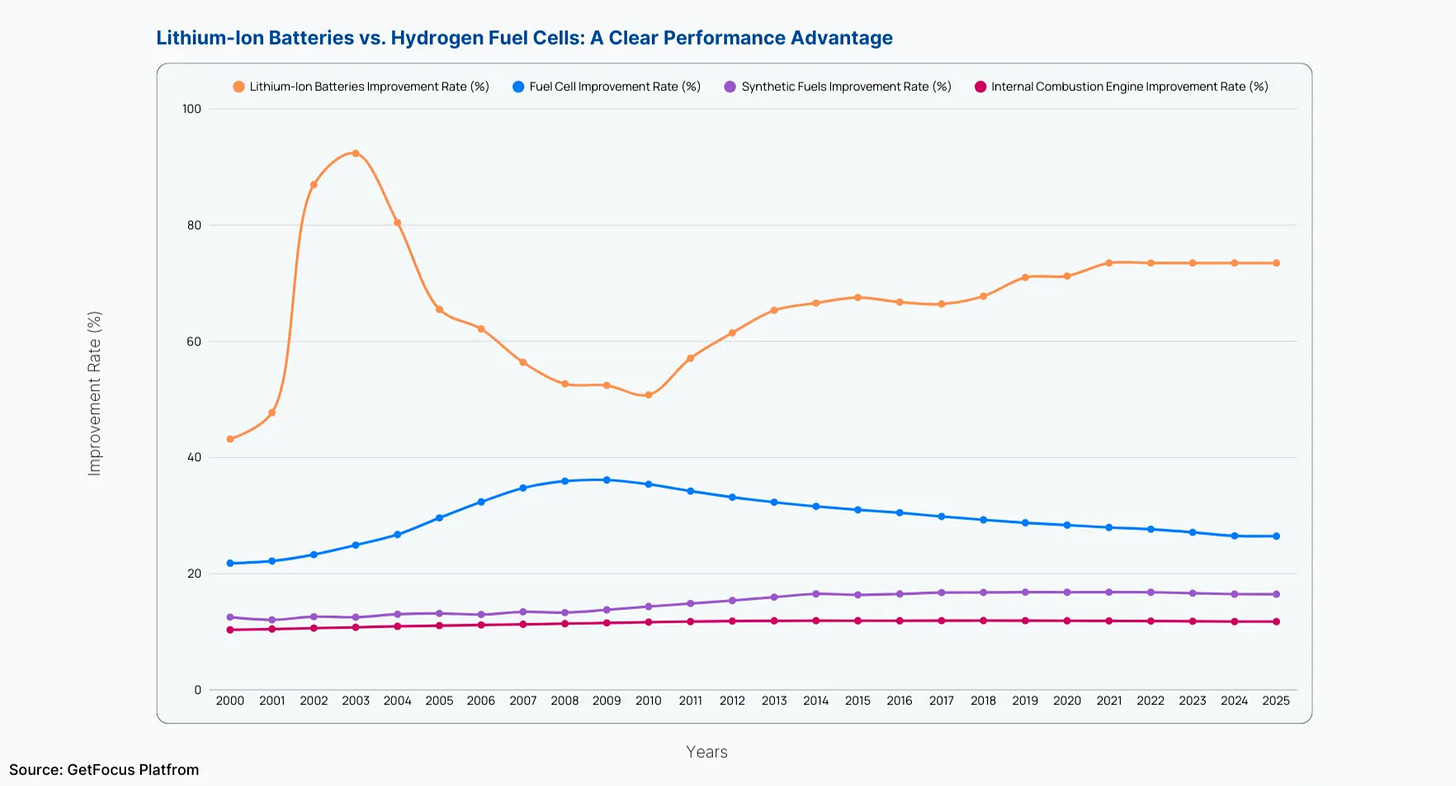

The Tesla lesson: EV makers gained an advantage over automotive incumbents because battery energy density was improving 7-10% while internal combustion plateaued. Tesla, BYD and NIO prevailed over incumbents or Nikola’s hydrogen trucks, because batteries were on faster learning curves than mainstream technologies or fuel cells.

As Jeff Bezos noted in his 1997 shareholder letter, “we set out to offer customers something they simply could not get any other way.” While critics at Slate called them “Amazon.con”, Bezos was betting on the Internet expanding faster than retail incumbents could adapt, while building a proprietary infrastructure and offerings that no other direct competitor thought necessary; meanwhile, now defunct companies like Pets.com were busy spending on marketing to win customers’ “mind share”.

Today, it’s AI application layer startups who compete for “mindshare”, but infrastructure plays are no longer contrarian as everyone builds similar data centres for similar models.

The hard truth is that advances in core technology are more powerful than following investor trends. Be cautious of rapid revenue growth when losses grow even faster, and sceptical when infrastructure bets seem obvious. Prioritise research papers over CEO hype.

As Bill Gates noted in 1996, “People often overestimate what will happen in the next two years and underestimate what will happen in ten”.

Where Real Innovation Is Happening: The Warsaw PhD Blueprint

Moving beyond market consensus dynamics, historical analysis confirms that trillion-dollar companies rarely emerge from obvious places or follow consensus paths.

Looking at past ICT sub-cycles, most game-changing companies weren’t obvious initially. Apple raised $250,000 for a third of the business after credible VCs passed. NVIDIA’s $2m seed was a speculative founder bet, rather than a hot round at crazy valuations. Bezos struggled to raise the first $1m for Amazon, with investors asking, “What’s the internet?”

Today, with capital and information globally accessible, and the main tech hubs saturated with AI startups and investors, seeing through the hype requires openness to even more unusual origins.

I call this the “Warsaw PhD Blueprint”.

The Warsaw PhD Blueprint recognises that, today, breakthrough companies may very well emerge from:

A PhD in a lab far removed from startup hotspots. Important breakthroughs often happen where you least expect them. Think DeepMind from London academic research when expert systems like IBM Watson were the AI rage, ASML as an unlikely Philips R&D spin-out, DeepSeek surging from China when nobody expected it.

Problems incumbents abandoned. Large corporations under-invest in technologies cannibalising revenue streams. They are more afraid to lose battles in an obvious field than to take risks and swim against the tide. The innovator’s dilemma forces them to maintain direction while ignoring disruptive niches.

Ignoring VC mega-trends. Whilst everyone chases AI applications, the biggest opportunities require solving fundamental physics, chemistry, or engineering problems that can’t be wrapped in venture-friendly software metrics. Leading investment brands managing large AUMs must prioritise deploying capital at scale, leaving low-consensus areas underexplored. Even SpaceX wouldn’t exist if a younger Musk had taken the consensus path and kept building internet companies.

Lean, globally-minded hustlers. Non-consensus companies have harder starts, so winners must have their “backpack half-packed” to conquer customers and find backers globally. Incidentally, this has never been more possible: Israel proved this by building locally while raising growth capital from and exiting to the US. These opportunities can generate true alpha for the investors who can spot them before consensus catches up.

This blueprint worked for every previous technology cycle, and is even more critical now: as the seeds for the next techno-economic paradigm will likely be born alongside the maturity phase of the current one.

Interesting Trends Outside of the AI Mania

So, while most investors and Silicon Valley builders continue to focus on a late-cycle technology development with the wildest expectations, let me propose some alternative trends worth exploring:

Europe’s Deeptech Renaissance. Currently dismissed as a tech backwater to Silicon Valley, Europe is increasingly producing companies leveraging world-class technical hubs and scaling globally. Europe excels in deeptech, such as quantum computing, advanced materials, synthetic biology, and space technology. DeepMind was European before Google’s acquisition. Cambridge’s Nu Quantum demonstrated the world’s first commercially viable quantum networking unit. TSMC couldn’t manufacture the world’s most advanced chips without Dutch ASML’s lithography machines.

Industrial Manufacturing 2.0. Companies like ABB led markets for over a century without disruption. Now opportunities exist for rebuilding infrastructure with novel materials and advanced computation - predictive maintenance and self-optimising systems rather than chatbots. Pioneers like SpaceX (vs Airbus), Tesla (vs traditional automakers), and Anduril (vs Raytheon) prove rewards can be huge.

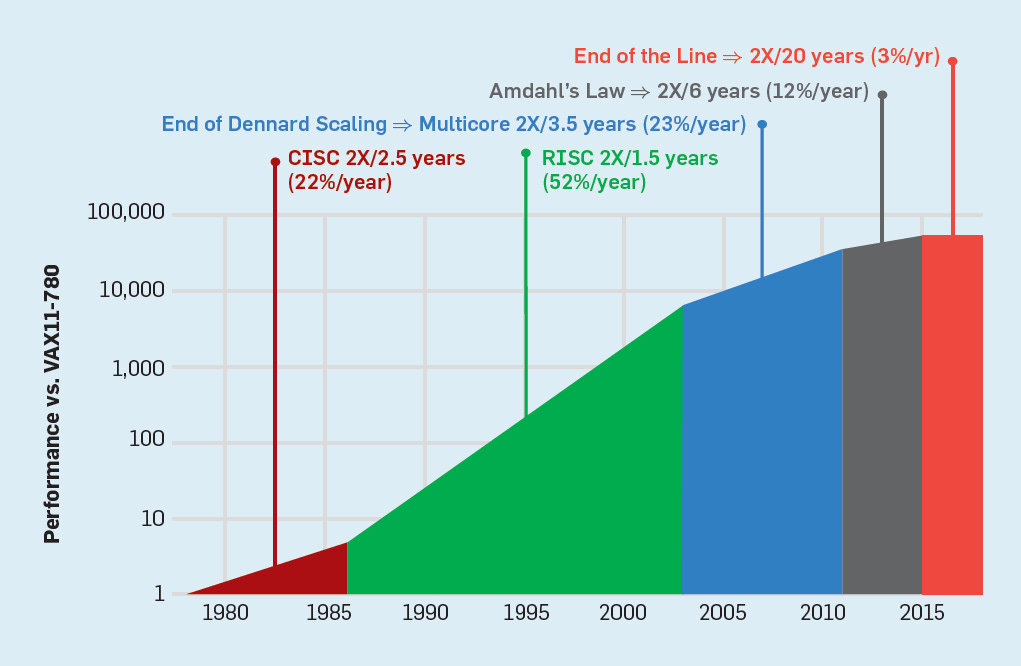

Computing Beyond Silicon. Moore’s Law is ending, forcing alternative architecture searches. Quantum computing approaches commercially meaningful advantages in some areas. Neuromorphic architectures, Photonic semiconductors, and Edge computing may define the next paradigms. Just as gaming-focused GPUs found unexpected synergy with deep learning algorithms, the next paradigms may arise from entirely new architectures meeting currently half-forgotten algorithms.

Energy Infrastructure and Abundance. Despite massive renewables investment, fossil fuel consumption hit new records in 2024. Companies solving this at scale (fusion, advanced reactors, revolutionary batteries) will enable compute abundance for true machine intelligence and new types of manufacturing. China’s dominance is accelerating Western innovation pressure, making abundant energy generation a critical 21st-century battlefield. Blockchain and tokenisation may find an unusual but suitable application in international exchanges of energy, compute power and resources that don’t require governments or third-party trust mechanisms.

Space and Defence Disruption. Launch costs continue dropping whilst Ukraine demonstrated how $500 drones disable multimillion-dollar assets. This reshapes military procurement whilst opening aerospace and space-based manufacturing to private capital. Expanding beyond the limits of our planet could at some point be part of a novel industrial revolution altogether.

These are just a few of the massive opportunities that sit outside what your typical “YCombinator” startup would be building, and which defy the current investors’ fetishism with vibe-coded companies. They are also valuable lenses for assessing public companies beyond the AI sector.

The critical factor is seeing past bogus trends that don’t lead to true breakthroughs or are likely to bottleneck when cheap funding or resources run out, and instead spotting accelerating trends like lithium-ion batteries and Moore’s law in the past, which completely reshape competitive balances as they compound.

The Coming Reset and What Follows

Given the technical limits of current AI progress and the matching historical patterns, the cycle of hype will likely continue until a crash becomes inevitable.

Billions will be pledged, funds raised, and valuations increased, despite lacking technological or commercial means to fulfill promises in meaningful timelines.

Autoregressive AI approaches will hit scaling limits, doubt will creep into collective sentiment, funding will falter, adoption will slow. As Sir John Templeton said: “Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

We may already be past peak euphoria, since public market investors almost unanimously believe stocks are over-valued but continue piling in.

Unlike the internet bubble, however, a full-scale AI bubble burst could touch everything from real estate to data centre construction to consumer products, due to sector interconnectedness and tech being far more global. Google, Amazon, Microsoft and Meta alone will spend a staggering $750 billion on data centres by 2027, with Morgan Stanley forecasting total global spending reaching $3 trillion by 2029. When this spending cycle reverses or if unprofitable major infrastructure customers like OpenAI fail to raise enough money to meet liabilities, impact will be severe.

As seen in the 1920s and 70s, speculative bubbles often trigger increased inequality, social unrest, even dictatorships and major conflicts. Fear replaces speculation, investment dries up.

Industry data shows the dot-com bust scared LPs from markets, bled VC firms dry over decades, made exits rare, and triggered long bear markets.

We’re already living through many of these issues as the world de-globalises, meaning an AI crash could have far worse consequences than the dot-com one.

Replace FOMO with FOND

But collapse creates opportunity. As the market recalibrates, capital and talent will shift toward new breakthrough waves.

AI, like railways, container freight, or the internet, will become a standard optimisation tool - likely draining value from AI companies but boosting those who integrate it effectively.

The challenge will be to avoid the disruption and social divisions we witnessed in the 1930s. We should not forget to develop long-term AI Safety plans and to push for policies to channel technology progress and investment into fair, green and inclusive growth for everyone, not just a handful of “AI leaders”.

Instead of asking “How can we raise bigger rounds to win customer mind-share?” or “How to out-invest my competitor’s models?”, we should obsess over:

What technology paradigms will make current approaches obsolete?

Which companies will leverage technology breakthroughs to disrupt seemingly untouchable business verticals?

Where are the unsexy infrastructure and energy problems bottlenecking everything else?

What long-term compounding trends haven’t industries and markets priced in?

We should obsess over fundamentals: spotting hyper-driven, exceptionally smart and bold entrepreneurs who don’t fear going against accepted wisdom, backed by unique insights into long-term technology trends.

Even within AI, let’s not forget that machine intelligence existed before genAI and will continue to exist after a potential crash. The challenge is to avoid justifying speculation for the sake of greed and fear, and instead focus on long-term impact and value for society. Whether it’s leveraging AI or any other technology wave.

Ultimately, we should replace FOMO (Fear of Missing Out) with FOND (Fear of Not Daring).

As we saw with BioNTech, a German-Turkish couple working from the middle of Europe developed technologies solving a global pandemic crisis. In the case of Exscientia, a Welsh professor started with £2k initial investment and went on to develop the world’s first computationally designed drug entering human trials.

Incidentally, cheaper, more powerful computing and manufacturing will let resourceful “Warsaw PhD”-type founders build technology moonshots with less capital.

Capital constraints in Europe or Asia may also drive stronger unit economics than in Silicon Valley, creating opportunities for both non-consensus founders and smaller, early-stage investors.

Case in point: Through my VC firm, I backed a novel steel-making company integrating AI capabilities from inception, and an aerospace propulsion startup using it for manufacturing before LLMs made it popular. Another investee of mine proved Europe’s resourcefulness by generating commercial revenue from nuclear fusion through finding new use cases besides building power plants. Meanwhile, in China, humanoid robotics made news for hitting strong revenue growth despite significantly lower funding than US counterparts.

It’s too early to say if these companies, specifically, will be successful, but the critical notion is that most long-term winners won’t be AI players but AI “exploiters”. IKEA became a billion-dollar business using containerisation’s advantages for a high-volume, low-cost strategy without capturing value from containerisation itself.

The Next NVIDIA Won’t Be Built on GPUs

Here’s my prediction: The next half a century will see a machine intelligence and energy abundance revolution, but it won’t necessarily come from AI startups raising the biggest rounds from the biggest US VC firms.

It may instead emerge from the intersection of novel computing architectures that solve the energy/performance crisis and take us beyond current deep learning paradigms, energy breakthroughs, advanced manufacturing building complex systems at scale, and space tech, biotech, and nanotech that help us transcend natural limits.

The next NVIDIA, therefore, won’t be led by a Silicon Valley AI guru nor trained on hordes of GPUs. It’ll be built by someone solving the fundamental physics problems that may even make GPUs obsolete.

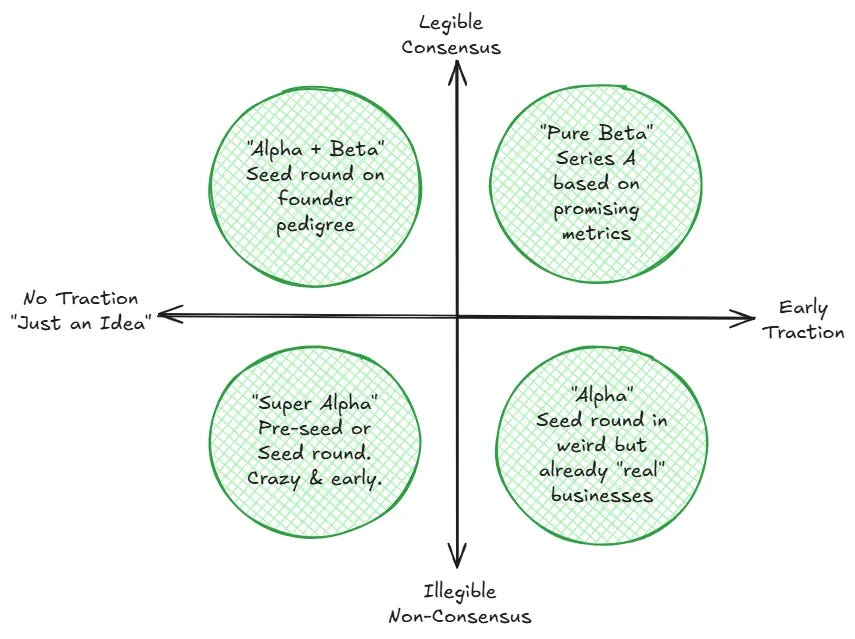

For investors, there will always be some “beta” returns by backing consensus teams that solve obvious problems with big rounds. But true long-term alpha, especially if we enter an extended bear market, lies in backing entrepreneurs tackling hard engineering challenges that need patient capital, deep expertise, and a contrarian vision.

Of course, this prediction has a degree of uncertainty. Maybe current AI leaders do build some runway intelligence explosions before the market turns on them. Maybe world leaders follow Carlota Perez’s advice, restrain casino economics and help spread prosperity from the ICT boom, instead of letting inequality and societal divisions get out of control. We should prepare for either scenario.

The job of risk investors, however, should be more than following greed and fear narratives just because everyone else is.

Our job should be financing enterprises bringing meaningful change.

Future bear markets may remind us that venture capital’s true origins were backing the whalers and explorers nobody else would fund.

While everyone else mourns the death of the AI dream, I’ll be looking for the Warsaw PhDs quietly making it obsolete.

For those investors daring to join this expedition, it could be a journey worth a lifetime’s dedication.

Edit 12/12/2025: Adding a further source on the physical computational reality behind the “trillion dollar crash” HERE

Francesco Perticarari is General Partner at Silicon Roundabout Ventures, a deeptech VC firm based in London and investing across Europe. He has a background in computer engineering and built the largest deeptech meetup community in Europe.

Very good analysis. 💯 But isn’t this part of bigger problem?

Western tech companies are no longer focused on creating great products for happy customers. Instead their only soulless mission is to drive up market valuation.

That’s what they scaling, and that’s why they are producing more narratives than products.

Because trying this with innovative products is risky. Those can be evaluated, have to generate sales or, even worse, profits. And no competition is forcing them to do this.

Narratives about a glorious future just have to be believed. And this belief can be assured through eye-popping demos ("look, we can make cooler videos!“), great vision (AGI tomorrow) and huge investments that would be totally insane if the future were not glorious.

So isn’t AI just the latest iteration of a problem that we have had much longer: a market economy without competition but lots of monopolies that have no idea why they are doing what they are doing?

Really insightful piece, Francesco — especially your framing of hype vs fundamentals. At Qognetix we’ve come to similar conclusions. Our work on biophysically faithful spiking-neuron engines shows that biology offers something today’s LLMs can’t: predictability, bounded precision, and efficiency closer to how the brain actually works. Instead of chasing diminishing returns on scale, we’re building tools that match canonical neuroscience benchmarks (Brian2, NEURON, NEST) while being deployable on standard hardware.

If the “trillion-dollar crash” is inevitable, the next wave won’t come from ever-larger black-box models, but from substrates that combine scientific validity with commercial accessibility. That’s the opportunity we’re pursuing at Qognetix — a path beyond the bubble to systems that are trustworthy, transparent, and fit for real-world use.