Unicorns are Dead: The Age of Titans Begins

Reflections On My First Year As A Solo VC And Why Deeptech Is The New Tech

Brave New (Deeptech) World

Picture this: I’m sitting across from a pre-seed portfolio founder, barely six months into my solo VC journey.

Next to us, a senior head of procurement from a major European government. Eyes alight with the kind of interest usually reserved for industry giants.

It was a scene that would have been implausible a few years ago, especially in Europe –a testament to how the landscape is evolving, accelerated by the same forces that have propelled firms like A16Z to start an American Dynamism practice in the US in 2022.

This encounter wasn’t just another meeting. Especially since, weeks afterwards, that same founder went on to close actual contracts with a major US prime contractor. It was less than a year after their deeptech startup incorporated and set up shop in a little known European town, in the heart of the rural UK Midlands.

It was a stark reminder of the changing face of entrepreneurship and investment: gone are the days when chasing unicorns –those billion-dollar digital darlings– via copycat apps and delivery business investments reigned supreme in the VC kingdom.

We’re entering an era where deeptech startups, the underappreciated Titans of innovation, are beginning to claim their rightful throne.

Deeptech Is The New Tech

Think of the early VC successes.

First to come to mind are probably Fairchild Semiconductor, Intel, Apple, Genentech, or even NVIDIA.

However, as the computing and internet infrastructure got built, venture capitalists increasingly flocked to business model bets instead of technology ones.

Software ate the world. And Peter Thiel coined his famous sentence on decades of VC investing resulting in Twitter instead of flying cars.

Today, the pendulum is swinging back.

We may not have flying cars yet, but investors started funding commercial and war drones, as well as eVTOLs. US scaleups, not Uncle Sam, are behind a new, commercially-driven space race. And the tech entrepreneur of the moment, Elon Musk, holds a head-of-state's level of power because of his Starlink satellites and Tesla success, rather than his early PayPal exit.

As digital and pseudo-tech unicorns continue to crash and disappear, we are back to an era when the technologies we build and fund matter.

For years, the venture capital narrative has been dominated by software-centric companies, celebrated for their rapid scalability and asset-light models.

But after 4 years studying the market, and as I navigated my first year as a solo VC, a different truth is moving from downright contrarian, to evident for all to see: the real game-changers, the true architects of tomorrow, and the potential for a new golden age of venture capital, lie in the depths of the deeptech arena.

I’m going to call these tech infrastructure builders “Titans”: because of the titanic mission they are on and the magnitude of challenges they are solving (and market potential if successful in solving them).

These Deeptech Titans, similarly to the legendary Titan Atlas from ancient Greece, and unlike many of yesterday's unicorns, will hold the future’s ballooning cosmos of novel technologies on their shoulders.

Just like NVIDIA’s chips or SpaceX’s launchers and satellites are underpinning today’s AI or space race progress, going forward, successful Deeptech Titans will also bring new innovation and progress to mankind. Just like Prometheus brought humans the mastery over fire in the myth.

Globally, both the US and China have understood the value of building local Deeptech Titans as a long-term play for technology sovereignty.

The first is leveraging its world-leading venture capital powerhouse, supporting it with policies such as the CHIPS Act, and is already producing a host of market champions in space, defence and energy. The latter is going all in with its centralised state behind frontier technologies. Both have the sheer might of their economies and markets to bank on.

The new global space race is a good reflection of this new cold war and how each power is playing the game.

When it comes to hard-tech and science-based startups, despite having been mostly ignored by mainstream VCs for the last two decades, they managed to consistently punch above their weight. For instance: by raising about 7-10% of global venture capital but accounting for 10-30% of the unicorns, by pushing EV into mainstream adoption (Tesla), by giving us COVID vaccines (BioNTech, Moderna), or by reinventing space propulsion (SpaceX) and technology adoption in defence and security (Palantir, Anduril).

But the world is not short of technology challenges to solve. And there is only so much value you can extract from internet apps and social media. Therefore, now that the tide has turned both in terms of novel technology areas with commercial applications in sight and in terms of VC interest, the tailwinds for deeptech companies, investors, and host countries will only increase.

Main factors contributing to this trajectory are of course the same as what contributed to the software boom, but in a way, playing out in reverse:

Lower cost of capital (increase in private and state funding),

Better unit economics (thanks to the need to repatriate manufacturing supply chain away from hostile foreign powers influence, to fight future pandemics and climate crisis, and for core customers such as NASA, DoD or large contractors to experiment more with early stage startups), and

More talent flowing-in (as non-software technical people increasingly consider startup jobs and folks leaving early champions build up a “deeptech mafia”)

In the US, which moved aggressively into the space through venture capital ahead of everyone else, it already got to a point where what used to be an underfunded niche sector is now becoming competitive and harder to penetrate for new managers.

Europe might just seem like a distant spectator on today’s geopolitical chessboard, but whilst politically it has issues like fragmentation to overcome, you shouldn’t rush to dismiss its potential in the deeptech arena.

As per its “immaturity” compared to the US, this necessarily gives rise to challenges such as the need for American VCs to help fund Europe’s top growth stage companies, but also an arbitrage opportunity for new investors. New VC managers have their chance to shape the narrative, help the ecosystem grow stronger, and establish their brand whilst doing so.

NATO seems to agree with both the challenges and potential of the European market as they set up their €1 Billion innovation fund to focus only on European deeptech startups and funds.

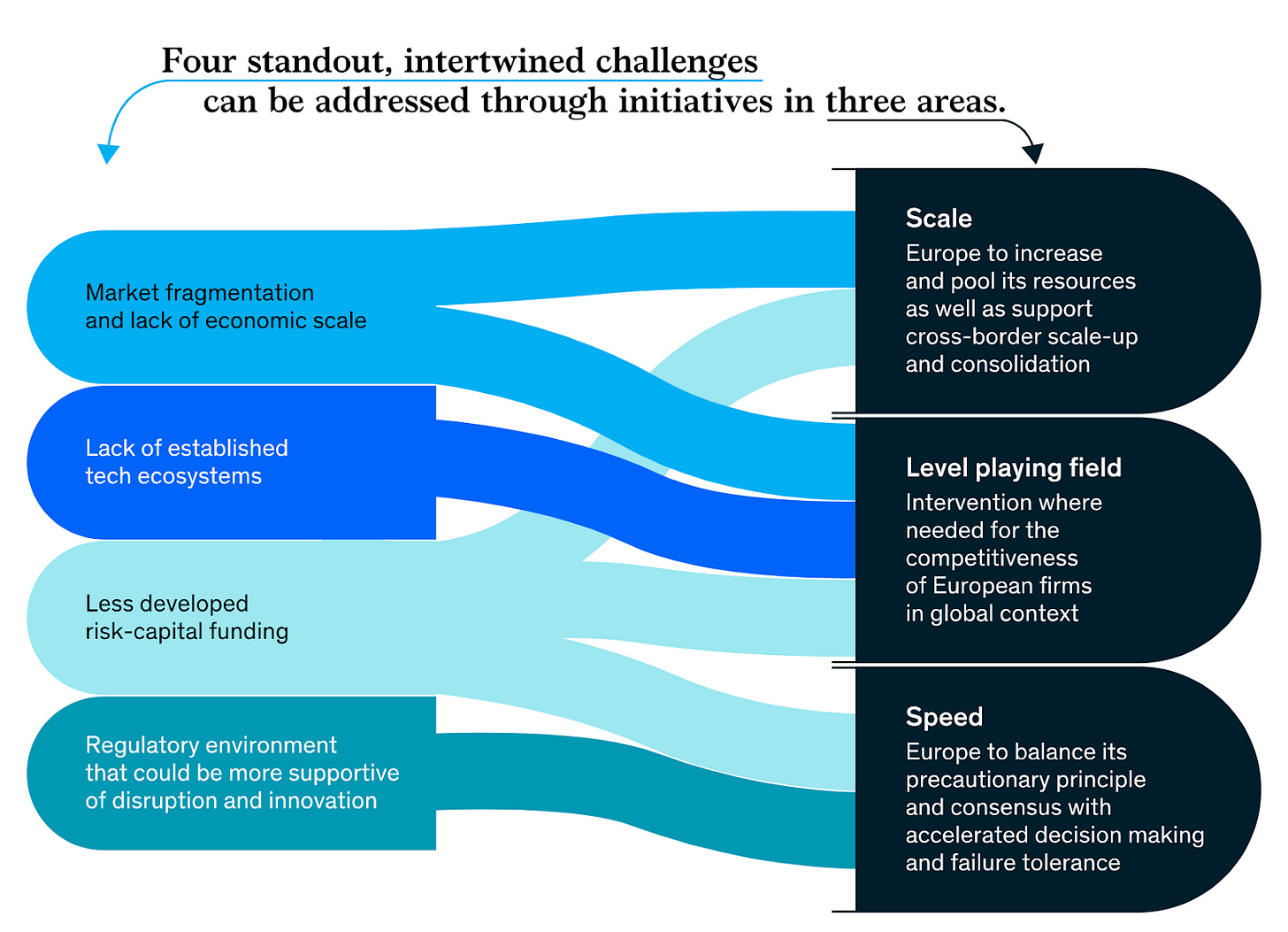

So where is the European Deeptech market at, exactly?

The Deeptech Opportunity In Europe

In 2023 the European Deeptech scene actually reached a pivotal stage. Yoram Wijngaarde, the founder of data platform Dealroom, shared exclusive insights about it at our pan-European Deeptech Demo Day last November. More data came up later in the year through their end-of-year report as well as other data surveys such as the State of European Tech 2023 and Pitchbook. I presented most of this data live to a webinar for Limited Partners last December, enriched by our experience on the field by running our VC and community work:

1. European Venture Capital Stabilization

After a period of turbulence, which has affected the whole world since the popping of the over-hype bubble in 2022, European venture capital activity has stabilised.

This newfound stability, although still fragile, is helping create a robust environment for investment. This situation is particularly beneficial for deeptech ventures, which often require more time and resources to reach the growth stage, compared to general tech ones ─even if this difference reduces substantially after the initial rounds.

Specifically on timing, with regular tech taking longer and longer to exit, there does not appear to be a true difference between deeptech and the rest over the long run. Most startups, in general, are taking today longer than 10 years to achieve larger M&A or IPO exits.

2. Rise of Deeptech Billion-Dollar Companies and Pivot to Physical Tech

As VC funding overall slowed, deeptech bucked the trend and actually rose as a share of total venture capital in Europe, now making up a third of the whole investment landscape. And despite this number sitting at about 10-20% for the last decade, it accounted for a staggering 33% of all European Billion and Multi-Billion Dollar valued companies in 2023.

European venture capital has also increasingly pivoted towards physical tech, reflecting a broader industry trend that values tangible, impactful innovations over virtual or purely digital solutions.

3. Unique Characteristics and Risks of Deeptech Startups

On the flip side, funding and building a deeptech company are not easy tasks. Deeptech startups come with different characteristics and risk profiles to their peers, when compared with regular tech.

They typically have long development phases and require substantial capital expenditure before reaching product-market fit. The commercial risk for these startups is not competition, network effects or market dominance but rather building a strong technological edge over the status quo.

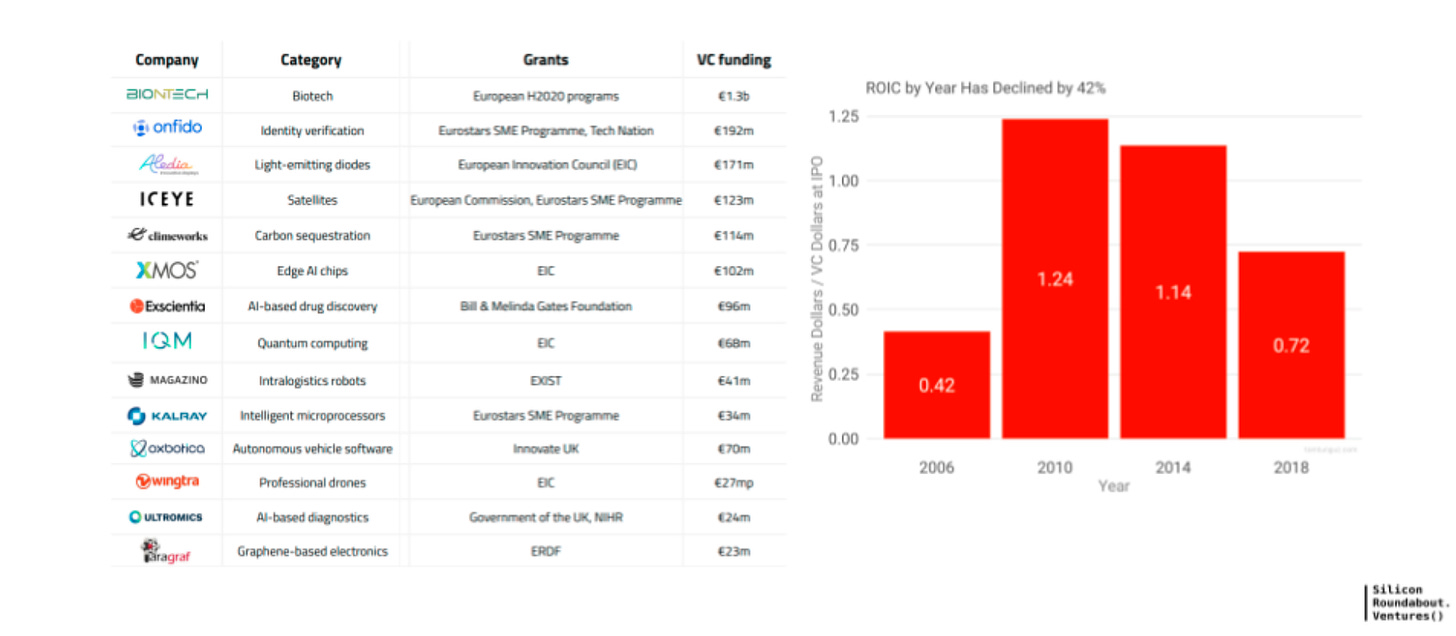

This paradigm shift from existing proven technologies to breakthrough or novel tech brings both higher technology risks and market opportunities. These startups often venture into markets with no comparable products, representing both a challenge and a significant potential for groundbreaking impact. They also require a substantial amount of capital to be developed, although this fact does not impact equity dilution much today, thanks to the plethora of grant funding available in deeptech.

4. Europe's Scientific & Deep Tech Clusters

More than half (11 of the top 20) of the world's top scientific tech hubs are now in Europe. This concentration of expertise and innovation serves as a fertile ground for deeptech development, offering a competitive edge in the global market.

The continent is also witnessing the formation of two major deeptech clusters, which harness Europe's excellence centres in various scientific areas and facilitate the exchange of talent, funding and resources.

5. European Excellence

Europe particularly excels in areas like Quantum Technology, Energy & Climate, Novel Computing & Telcos, and Techbio / Biotech. These sectors are receiving increased attention and funding, reflecting the continent's strategic focus and expertise in these cutting-edge fields.

Europe also enjoys a World-class researcher community, evidenced by Europe's share of highly cited researchers.

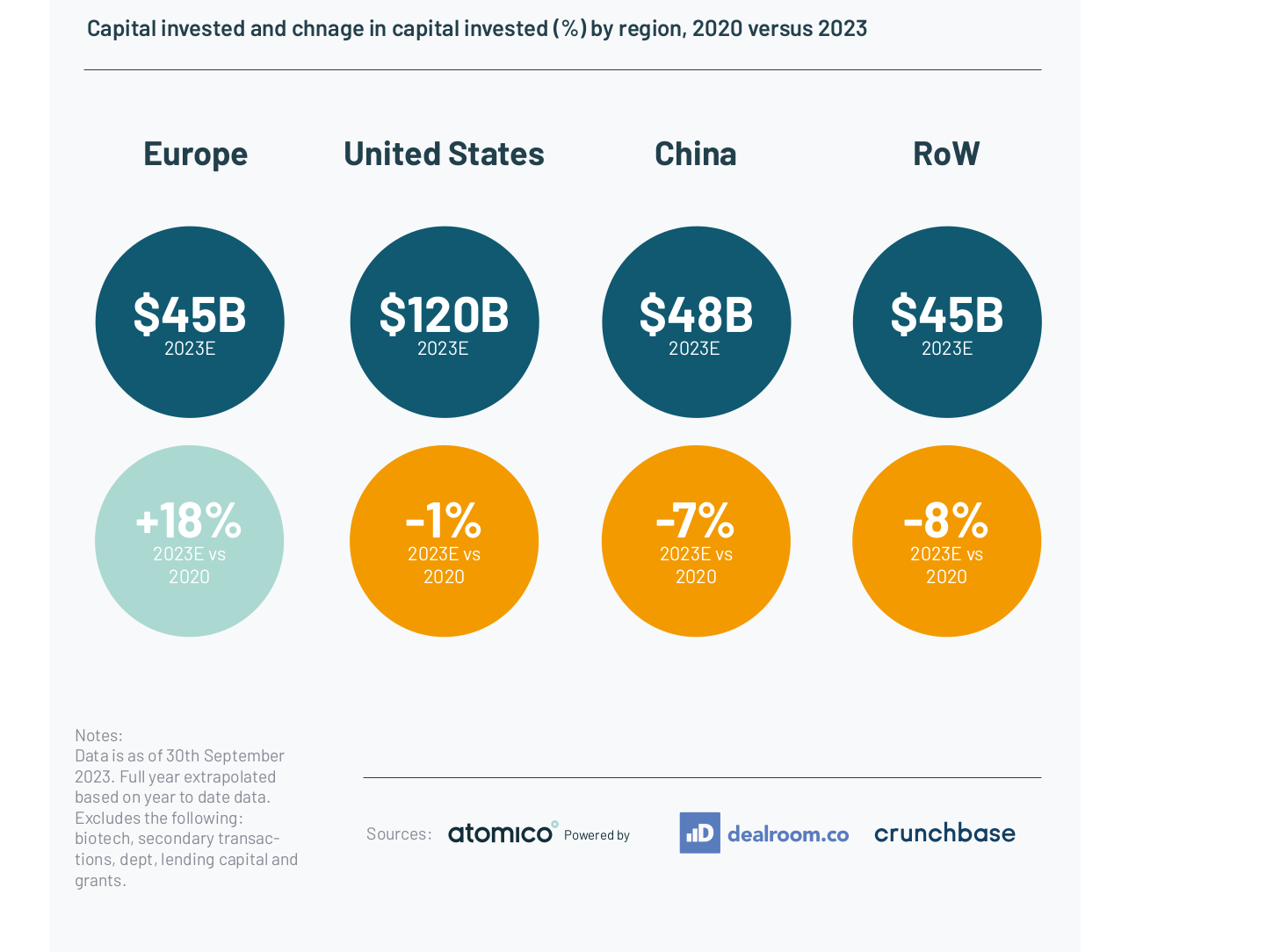

6. EMEA overall continues to raise in global VC share

Building deeptech companies able to shape the world around us, of course, requires more than talent and top-notch innovation. It also needs capital beyond state grants. But Europe, the Middle-East and Asia are constantly growing in terms of how much venture capital they attract into their company, signalling it’s no more just the US who can “build huge startup successes”.

Specifically, EMEA’s share of global VC received by local companies has grown from 10% to 25% since 2000, and nearly 30% at the early stage.

7. Large Tech Exits Growing In Europe

The whole EMEA now produces unicorns and decacorns at a similar rate as the USA. Whilst the catch up is nowhere near over, with the US having a multi-decade head start, the next chapter is simply a matter of time. $100B+ outcomes will happen all over the EMEAN region, with Europe taking a growing slice.

As deeptech is expanding fast in terms of capital received, and given it already accounts for a disproportionate share of billion+ dollar outcomes, it is likely that today’s European deeptech seed startups are amongst the most likely candidates to achieve those levels of gargantuan success over the next two decades.

Moreover, as the large scaleup scene expands, smaller but strong European startups will have an increased number of options for a strong acquisition exit. Not only from American companies as it’s already happening today, but also from EMEA tech champions.

8. The Talent Flywheel

We’ve already seen how, academically, Europe is in a leading global position when it comes to technical talent and research hubs.

Now this technical power is being compounded by an entrepreneurial tech talent flywheel, too.

As the deeptech share of huge commercial successes in Europe grows, this flywheel will increasingly generate exceptional founders for a new kind of deeptech startups: where the company is led by a ferociously ambitious team looking to build an enduring, large financial success, rather than focused on pure research commercialisation.

To add some context: more than 9,000 companies have been initiated by alumni of European exited unicorns that were founded during the 2000s ─a 50% increase compared to the unicorns founded in the 1990s. Whilst software dominated the type of successful companies in the early part of the last two decades, we have seen how this is rapidly changing in favour of deeptech.

If we consider that companies like Google, Amazon, Rolls-Royce, NVIDIA (European teams), Tesla (Germany) or Arm, to name just a few, have also recently seen an increase in European talent leaving to launch or join new companies, we can easily predict an ongoing rise of deeptech founding teams that have all it takes to build large-scale exit successes, as opposed to small IP-driven acquisitions.

9. Europe’s Tech and VC Scene Is Still Lagging Behind

Despite all these positive tailwinds, there is still not enough venture capital and advanced technology innovation support in Europe.

In deeptech, specifically, Europe still has a long way to go when it comes to establishing a strong and experienced VC scene. At seed in particular, the only VC funds who’ve historically been doing deeptech at all, such as IQ Capital or Amadeus in Cambridge, UK, have all been enjoying success by dominating local hubs and focusing on niches where local universities were strong in spinouts.

Whilst a few new larger funds have started or scaled up, such as VSquared in Germany or Seraphim Space in the UK, whilst CVC activity stays strong, and whilst smaller thematic funds launched in Quantum, Climate or other areas, good founders still don’t find enough capital and network support this side of the pond.

So far no brand has successfully established itself as a dominating deeptech player in the multi-billion European VC market, given that most new, pan-European funds are only just starting out and are often dependent on local ecosystems and individual government money.

Despite the need for more capital and ecosystem support for a wave of new deeptech startups with clear potential, Europe is ultimately not escaping the global VC slowdown. 141 VC funds, worth a combined €17.2 billion, closed in 2023 ─representing declines of 51.5% and 39%, respectively, from 2022. Fund count also reached its lowest annual total in a decade.

The sharper fall in fund count, combined with the lack of established deeptech investors comparable to the Founders Fund and Lux Capital in the US, and contrasting with an accelerating growth in the deeptech investment, billion dollar outcomes, and talent availability, ultimately point to an arbitrage opportunity for new investors with the right networks and theses to successfully win the right deals across the continent.

Value Potential Growth + Not Enough Competition = Arbitrage Opportunity

In summary, it’s clear there has been a shift in the global startup and venture capital landscape. Whilst the era of Deeptech is already mainstream in the US, Europe is ripe for a catch up. As it did for fintech over the last decade.

Investors are (finally!) moving away from the “digital unicorn chase” model. Gone are the days where all that mattered was a “spreadsheet growth” that would make the Tiger, Softbank and other late stage software investors of this world grant a multi-billion dollar price tag.

Moreover, as global problems with AI computational needs, wars, climate and health become more and more pressing, and as early European pioneers turn out to be deeptech Titans, there is a clear arbitrage opportunity still open for investors: spot tomorrow’s deeptech champions coming out of the Old Continent, when they are still at pre-seed or seed today.

Furthermore, as we’ve seen, the European deeptech landscape is in a prime position to have its voice heard on the global stage ─with its VC and startup scene now underpinned by a stabilised investment flow, the rise of deeptech billion-dollar companies, the reduction of the overall number of local funds, and a pivot towards physical tech.

2023: Launching A Community-Driven Deeptech VC

From Community to VC

2023 marked a pivotal chapter in my investment journey too, of course: given it was the year that my solo GP fund, Silicon Roundabout Ventures, officially launched.

After nearly a decade of community building, 12 years in computer science and engineering, 3 years of angel investing, and after spending 2022 going full time into herding cats for our first closing and building up our infrastructure, we launched at the turn of year with a Forbes interview and a Sifted article.

We've been on a remarkable journey throughout the year, as the reality sank in that completing the first closing of your first fund is merely the beginning of the journey. You basically made it to base camp. The real climb then starts.

As a solo VC, my focus has been on identifying and investing in European startups that not only leverage genuine technological innovation in computer science or physical sciences, but that have a shot at becoming those tech-infrastructure Titans I defined earlier in the article.

The community and network I built over time, first as the original Silicon Roundabout meetup and now as the Silicon Roundabout VC and Network community, has given me several years of exposure to both success and failure in the startup world.

This exposure was immediately useful in defining our investee startup profiling approach, which was then further strengthened by the contribution of our venture partners and LPs with the strongest investment experience.

However, even more importantly, our community’s pay-it-forward attitude and decade-long work helped us build a strong brand for us, even before our official fund launch. Tech founders, especially deeply technical founders, found a safe home with us for years, at our meetups ─Even before writing my first angel cheque, let alone setting up a fund. What I also found was that this work had a strong impact with founders we met in 2023 for the first time too, as they either knew of it or could quickly reference it.

For an engineer like me or my first venture partners, it was always obvious how powerful a network of peers is ─somewhere where you can show and tell about your work and learn from others over a beer and pizza. Yet, historically, the venture capital landscape in Europe wasn’t built by engineers, with data from some years back reporting that, for example, 96% of VCs in the UK never worked in a tech role. This might have been OK as long as fintech and B2B SaaS were the darlings to go after, or for later stage investors, but hardly OK if you’re aiming to attract and connect with deeptech teams when they’re just starting out.

Despite 2022 being the year deeptech began to go mainstream in the US and data suggesting 2023 is when such a trend infected Europe, we found that being both a long term community builder and strong voice in the space mattered for us to get a head start. Our events, connections, plus my writings on platforms like LinkedIn or even as a guest writer on tech publications preceded this VC interest shift. Our years of work were critical in punching way above our weight in terms of attracting founders, coinvestors, and helping us find deals before they became competitive or win over allocation in rounds where founders did have a choice.

Finally, having a strong and engaged community also meant that we could tap into our network and brand for references during our startup due diligence, as well as add value by supporting founders when they needed it. It’s a scalable and flexible approach to supporting them: from brand awareness activities, industry introductions, early team hires, founder-to-founder connections, to creating other valuable links that could help teams move along faster.

Or not: we realised, in fact, that we really don’t believe in the “super hands on VC” model, where investors feel like they need to almost co-run a business ─or at least sell this dream to LPs.

A community-based approach, instead, with our direct-to-the-GP “Super Angel” model, is something more like a self-service nurturing, where founders can get support if and when they need it, and it doesn't necessarily mean that it’s the fund that provides it. Maybe it’s an LP, maybe it's a fellow entrepreneur, or maybe it’s just someone in our network, or it’s the co-hosting of an event with us and targeting a specific audience. We like this balance of helpful, no BS, network-driven approach, as we feel it goes well with our belief on scouting and supporting exceptional engineer-entrepreneurs, rather than attempting to build a company for them.

If they need it, we can be whatsapping away at 11pm, sit on the board as an observer, or have weekly calls, but we are also ok with letting them “do their thing” and come back maybe for one of our meetups. Where they may want to meet a partner at Sequoia or an exited unicorn founder backstage ─and both these things actually happened with two portfolio founders last year.

Accomplishments, challenges, and lessons learned.

Turning challenges into assets

Our biggest challenge was launching the fund in the first place, given the start as a complete outsider to the industry and at a time of shrinking allocation from LPs.

Most of my mistakes during the first year of operations were related to lack of focus and wasting too much time with the wrong LPs or networks, as well as with founders who didn’t immediately convince us.

It’s a challenge that predated the fund launch and spilled over into 2023, especially given that our first closing didn’t really take place on a single day, but was a slow trickling of signed subscription agreements between Christmas 2022 and the end of Q1 2023.

A mix of classic European “impostor syndrome”, inexperience and “fear of losing out” on an investor or on a potential great startup, meant that time optimisation was one of the biggest challenges for a solo GP and one that I constantly work on improving even today.

One of the best ways I found to break away from bad habits was to book in calls with more experienced GPs who had been there before. I found that even 30 mins here and there helped massively with motivation and re-structuring our processes and targets. Good communities that helped expand our GP network were Allocate / Dragon Chasers, Frontier Deep Tech, AlignedVC (Whatsapp Group), and VCLab.

In a way, I’m still learning how to improve on these areas, and part of the reasons to open up with articles like the present, release our material and experiences, and our “build in public” approach, is to 1) continue to get feedback from peers, and 2) help future folks launch their own “challenger VCs” even if they are total outsiders to venture capital, like I was.

Given the magnitude of this challenge, getting the fund up and running and starting to make investments was also our biggest achievement of 2023.

When it came down to it, it was “just” about having a ton of sheer persistence and grit on one side, and on the other the combination of a process-driven mindset, borrowed from my engineering days, and this almost obsessive willingness to learn and share as much as possible.

The idea is that, as we scale the firm and keep learning from our LPs, co-investors, and even founders, we also try to build in public as much as possible and give back to the community.

I found it quite useful, for example, to write regularly on LinkedIn for the past 3 years and to go “all out” publishing the live pitch for our very first fund idea to an LP in 2021.

The response to that piece was encouraging: so, as the firm pivoted to a super-angel sized, solo GP fund strategy for fund 1, attracted venture partners, and defined its community-driven and tech-powered approach, we decided to publish the very deck that got us to first closing last year.

Now that we are live, we are opening up our LP updates (or at least a version that’s as close as possible without breaching confidentiality) as a Build-in-Public newsletter and publication and are working with another great LP to have one example reviewed live too!

2023 Achievements and Lessons Learned

The second achievement of 2023 was “being right” about the market direction.

The “rest” of the investment community might have finally started to fully awaken to the power of deeptech, as seen earlier in the article, but we have been advocating for it for years, in particular in Europe.

For example, at the start of 2023, during our inaugural open call with our LPs, we predicted that after Northvolt’s 2022 round (the largest ever in Europe for deeptech), 2023 would see an increase in billion-dollar deeptech companies as well as an increase in the number of technical people wanting to try their hand at launching deeptech startups. The hypothesis was that positive examples, with the right underlying macro-trends, help drive excitement (and capital).

This is just one of the trends I had started spotting years ago, mostly because of our community work, and that prompted me to go all in to both capture and support the immense growth potential for European deeptech.

Others, which I summarised in past articles, included the consequences of pouring money into “low-tech digital unicorns”, rather than taking bold bets. For instance, we noticed that, in spite of the cost of launching a digital business getting increasingly cheaper, “capital efficiency” for SaaS companies had actually started to decrease. It makes sense: if more and more money was stuffed into copycat “easy to launch” businesses with little to no technology differentiation, competition and marketing spend needs would increase.

(From Frontier Deep Tech, 2022)

(From a talk at the University of Surrey, 2021)

Other achievements from our first year of operations included scoring wins on a PR and brand building side. We got featured a few times on publications like Sifted.eu and UKTech News, as well as events such as London Tech Week and Allocate LP/GP. And our events were as successful as ever, with founders coming from all over the UK and Europe to attend both the in-person and online events, where guest speakers or startup competition judges included top-tier names such as exited unicorn founders and partners from the likes of Sequoia, Amadeus Capital and Molten Ventures.

We also helped some of our portfolio companies secure good PR launches, as in the case of Anaphite or Archangel Lightworks. Furthermore, we organically grew our following on LinkedIn to Top-Voice level, both for me personally and for the company account, by focusing on deeptech, the future of VC, and on relevant content in computing, climate and defence. Our objective is to focus on resonating with our key clients and “suppliers”: i.e. professional LPs and angels interested in deeptech, and specific deeptech founders or proto-founders, rather than “tech” people in general. Even if it means slower growth.

The biggest achievement of all, however, was securing the support of 2 PhDs for our DD work in both physics and computing, as well as a CTO for the firm: all joining as Venture Partners.

In the last part of the year, specifically, our VP and CTO Ralph helped us restructure our databases and began training models on our portfolio, thesis and data.

The three areas we seek to overhaul and control with tech are: thesis-aligned signalling on the sourcing side, decision-process streamlining on the investment side, and automation and product value enhancement on the operational side. However, since we are just at the beginning of our firm’s life, and since being engineers we know the limitations of AI today, we decided to start building on the operational side first. So that we can achieve more with less.

Finally, in terms of reviewing our first year of operations, I want to share our top 3 lessons learned on the field, as the “new deeptech kids on the block”:

1. A Titan’s team needs exceptional characters.

Everyone in venture capital says this. But true exceptional insights and capabilities don’t come cheap. They are often not learned in a Big 4 consultancy and produce people who are not exactly “coachable” and that you may not always agree with. These characters are not afraid to go against the grain in building their company “thesis” and yet are able to pull in great people to help them fulfil a long-term market vision, which, conversely, people do see as needed. They need to show acute intelligence and resilience too. Afterall, venture is an elitist game. A founder shouldn’t be backed because they are trying. They should be backed because they have something unique. Uniqueness, by definition, is rare.

We observed that the person leading the business growth should show evidence of their capacity to build and achieve something that mattered in their past. This doesn’t even have to be a business, but it can be, which is why we favour driven technical people or leaders in tech or manufacturing businesses who built and scaled teams, over MBAs and consultants. We always do expect a good combination of early network development in the right target industry and unique insights into why and how a tough technological challenge should be solved: it’s way more important than any product or CV logo.

Even in deeptech, we discovered that this “people factor” matters. In fact, it matters a lot. Finding amazing technology with good founders who built the original IP doesn’t cut it. A good investee company should, instead, have first of all insanely exceptional people able to generate unique insights into long-term market dynamics, and have the capacity to pull in the talent to build the right amazing technologies and have a plan on how to eventually “hack” their way into large contracts (deeptech is not a social media or SaaS game). Whatever tech they might have built or patented is effectively a way to validate at least some of their assumptions and capacity to deliver. If the founder(s) fit this description, we can (and should) go as early as we possibly can. But can also take an opportunistic seed deal here and there, if the potential for outsized returns remain unchanged. Going forward, starting this year, we will focus even more on strengthening our team assessment work to make our picking even stronger.

2. Good co-investors matter.

Already after a single year, we are learning that not all co-investors are created equal. Especially for a small fund like ours. Plus, as more generalist funds dip their toes into deeptech, the pool of whom we can consider good coinvestors is increasing. With that said, I find ourselves aligned more with a more “US-like” style of approaching investment and, crucially, post-investment company support. So, in 2024, we will strive to build stronger networks with co-investors whom we align more in terms of vision for the European deeptech scene.

3. Tech in VC is powerful.

As a new fund with a small AUM, we don’t actually need much of what most bigger funds are focusing on today. But we are finding ways to use AI and automation to minimise our work (what came before in this newsletter is a great example) and add value to our portfolio and LPs alike. By moving early, we are also laying the foundation for a tech-driven approach for when we scale our size (and dealflow needs) in future funds. With Ralph on board as a Venture Partner / CTO and my background in engineering, we will slowly but surely use this engineer-driven inception at our advantage as we chart our course in 2024 and the years ahead.

4. Consensus is overrated and Conviction underrated.

Whilst we are grateful to work with great co-investors in different deals, we believe you should never invest “because others do”. Part of the rationale behind launching an independent VC is that we can make our own market analysis, spot trends, analyse founders and technologies, write our own investment memos and make our own decisions.

Ultimately, if the best returns in seed venture capital are driven by a small amount of asymmetric, exceptional successes within a portfolio (power law) and by the ability to exploit some sort of information or access arbitrage, then it follows that not everyone will agree to such investment. Therefore, our goal as we scale the firm (for instance if we ever became a multi-partner firm) will be to be an investment company with an Amazon-style approach to decision making: if you gather the data, and can back up your decision-making process, you should go forward even without unanimous consensus.

5. It’s Just the First Step.

Finally, the biggest lesson from the year was an ongoing realisation that no lesson is final and learning never stops. 2023 was just the first year of the first fund, in what is a multi-decade, multi-fund journey. If there was to be only one commitment to our LPs and the founders who will choose to work with us is that we will continue to learn, work hard, and adapt, to make sure we stay ahead as the top deeptech seed investor that’s ever been.

Our 2023 investments ─meet the Titans.

Armed with our market thesis and community power, and our first LPs, we made 7 investments. The first was actually warehoused from the end of 2022 and we carried it into the fund portfolio for our investors to get a sense of the fund’s abilities to execute prior to first closing.

Our portfolio, while diverse, has a twofold common thread:

A strong focus on deep technological innovation at the infrastructural level (building a “picks and shovels” technology offering), and

Featuring founders who had a contrarian, yet compelling way to see how the world would develop ─and how to build a world-first company and technology stack to enable and exploit such change.

Climate Tech Needs Hardware Solutions

Our first bet was on Alex and Sam, founders of Anaphite: working on harnessing the power of graphene to power an electric future.

Their groundbreaking work in the field of battery materials is unlocking a new generation of advanced cathode materials that are helping batteries improve performance and manufacturers reduce cost by increasing production yield.

Today Anaphite’s co-founders have been joined by ex Johnson Matthey’s Joe Stevenson as CEO and the trio has been smashing through milestones and got their cathode materials in real trials with all the leading European EV OEMs.

ESG + D (D = Defence)

Another example is our first-cheque investment into Greenjets, a company looking to lead the aviation industry propulsion revolution into an electric future.

I was compelled by how Anmol and Guido, the company’s co-founders, attracted world-best talent from different fields, such as automotive, defence, aviation regulators, and F1 racing, as well as, of course, aerospace, to crack the challenges of electric aerospace propulsion: both battery powered (now) and hydrogen fuel cell powered (next).

Their approach to market domination targeting both defence and commercial drones first, before scaling to eVTOLs and aeroplanes later, was also something showing an unparalleled mix of maturity, ambition, and business acumen.

Unlocking Space Connectivity

What if you could rewind time and build or invest in the pioneers that laid out the internet routing pipework? Pioneers like Cisco, Juniper Networks and UUNET, who shaped the world of technology by enabling data to flow across the planet for the first time.

We backed Richard and his team at Archangel Lightworks because we believe their business has the same disruptive potential by enabling an entire new way of moving data across space and between space and earth. If successful, this team can help usher an entire new kind of telecom infrastructure thanks to their laser-based, high-volume, secure, wireless technology stack ─both hardware and software.

Dealing With The End of Moore’s Law

When we read a bachelor dissertation on chip architecture that is as good as a PhD thesis and when the author already built and sold a small venture, you take notice. When you realise that the same person, Ed, has kept on working on the concept and technology since his Uni days and is now ready to launch a new type of semiconductor company, you prepare to take your chequebook out.

That’s what we did: by backing Ed’s company, which he launched with the support of ex VC and semiconductor startup advisor, Russell, as Vypercore. This unusual semiconductor company developed between Bristol and Cambridge, uses a vertically integrated approach of both software and hardware to build the processors of the future:

Starting by building the world's 1st RISC-V CPU with integrated hardware garbage collection (based on Ed’s research and IP).

Aiming to accelerate all workloads by an order of magnitude, and remove one of the biggest causes of cyber-security risks in performance-based CPUs.

Eventually developing a business that can build specialised processors based on clever hardware-software fullstack approaches, just like their first product or like Google did with their own TPUs.

Quantum Infrastructure, AI Against Cancer, and Battery Recycling

Our other investee companies haven’t announced their rounds yet, but I’m keen to mention some details about them, even without revealing the startups’ names.

In one instance, we backed a duo of European founders who joined up thanks to COVID and managed to bring together the US entrepreneurial spirit with Europe’s research talent.

The goal? Building the semiconductor company of reference for quantum technologies.

A moonshot rocket that will have to raise billions of dollars before ever making a sale?

Yes and no. The ambition to build a Titan is definitely there, but their business plan included customers already lined up and the development of an initial fab within a couple of years from the starting up funding round they sought. A great combination of vision and pragmatism.

The CEO leveraged his work and connections in the US, where he was a Postdoc fellow prior to the pandemic, and joined forces with his now CTO to build the world’s first company to commercialise a novel kind of photonics quantum chips with extremely low interface losses.

In another case, we wrote a cheque to support a human maverick with a robotics background and an obsessive passion for fixing the nascent battery recycling supply chain. He’s currently working with his early team to start commercialisation of a new kind of recycling technology, after developing key demonstrators for his MVP, chemistry and commercial strategy.

Lastly, we backed a hustler, a biologist, and a talent magnet all rolled up into the same person. And this exceptional founder, who initially pitched at our events a couple of years back, went on to attract top-level pharma executives as advisors and angel investors, and two outstanding engineers to build out a whole platform for multi-omics molecular analysis. Their novel stack of algorithms is already approved in the UK for early detection of one type of cancer and are being tested by the healthcare system, whilst she expands commercially in the US.

We Are Only Just Starting

Going forward, we continue to seek out those hustling technical superhumans who are launching companies to lay out the next-generation technology infrastructure. With core areas continuing to be around our 3 themes of: future of computing, climate or health impactful technologies, and security and defence.

We already found one and we are joining her seed round to enable her to make quantum networking a global reality.

2024 and Beyond: Deeptech Forecasts and Trends

As we saw at the start, with the help of fresh market data from 2023, and after a year of community scaling, fund building, and investments, the fundamentals behind our thesis and conviction in growing our deeptech investment firm are only getting stronger.

From both quantum and non-quantum novel computing architectures to tech-bio computation companies, and from satisfying the world’s electrification, energy and decarbonisation needs to defence, the global hunger for high-tech solutions is only growing stronger.

In 2024, we are researching several different themes within our core areas. Mostly driven by our own insatiable curiosity and the tips we receive through our active community work. For example: How do new deeptech entrepreneurs think about making the next leap in AI actually feasible or go beyond traditional digital computing limits? How does the political West bring on-shore as much of the energy supply chain as possible and reduce waste? Are there any dual use companies that can realistically target the US market whilst serving local players in Europe and across NATO countries?

If there are credible answers to these questions, then we shall have more founders to provide equity funding to. And our strong belief is that not only there are answers, but that seed founders across Europe are working or will soon start working on these and adjacent segments.

Why It Matters

At Silicon Roundabout Ventures we’re strong believers that Titans form almost inevitably through a combination of exceptional, inspired leadership and the pull from changing market tides.

The job of great VCs is to read macroeconomics trends, predict what they will mean for potential markets and technology needs in broad strokes, then have the means to meet enough “right” people who can complete the painting with the final detail, and build a company to capitalise on those opportunities.

This is also true in deeptech, which is shaped and supported by huge factors that are now becoming obvious all around us. In a way it’s even more relevant in deeptech, because this kind of science-heavy companies are not just influenced by these underlying trends, but have actually a much stronger chance to influence the world back compared to the digital businesses of the last two decades.

If BioNTech got us out of COVID faster, Tesla brought forward EV adoption, and OpenAI popularised machine learning applications, just think what’s going to happen next: as this new rising wave of entrepreneurs, whom we are actively funding in deeptech today, bring forward novel computing technologies, energy systems, defence inventions, medicine breakthroughs, and so much more.

The world is not coming together

After more than half a century of globalisation, the world’s leading economies are increasingly seeking security and self-reliance over the benefits of global value chains.

In the venture capital realm, the trend towards deglobalization, marked by a shift to localised economic structures, underscores the strategic value of investing in deeptech as a way of building technological resilience.

Deeptech sectors are therefore crucial for portfolio diversification, especially at limited partners and institutional level, and, for Europe, offer the opportunity to enhance the cluster’s technological sovereignty. This means that grant funding is only going to increase for relevant startups. It also means that both countries and larger corporations, faced with pressure to innovate and repatriate supply chains, will work harder to better engage deeptech startups, even in areas such as energy or national security.

For specialist VCs like us, this presents a dual opportunity: to capture the high growth potential inherent in deeptech and resilience tech startups, and to contribute to the development of a more robust and self-sufficient European tech ecosystem. Investing in these sectors in 2024 and beyond, is therefore a forward-looking strategy that aligns with global economic shifts and addresses both current and future challenges

.

Inflationary Pressure

Whilst most people seem to agree the worst peak for inflation globally is behind us, the underlying reasons for its spike are far from over ─from the lingering effects of decades of money-printing and zero interests to conflicts and supply chain disruptions.

Therefore, inflation will continue to be a force shaping economies and markets for several years to come. To avoid the return of a high spike, central banks will need to maintain a certain level of interest rates, which affects the whole funding value chain. Moreover, the “free money bonanza” that fuelled the VC craze into low-tech unicorns focused only on scale is over for good.

This is a fundamentally different economic environment in which the future tech giants will need to thrive in.

For us as investors it means two things. One, venture capital's compass is now realigned towards hard tech firms solving real world problems, especially those causing inflationary disruptions like energy, security, and logistics. Two, more stakeholders find deeptech a better play than just another, slightly better CRM or a fast delivery app, which is adding tailwinds to deeptech plays in climate, dual-use, and industrial startups. This recalibration reflects a broader acknowledgment of value over velocity and is a terrain deeptech companies were already comfortable with, since they did not enjoy, especially in Europe, as much of the funding and valuation craze that pumped (and now dumped) other types of VC-backed companies.

For us, as European venture capitalists, the emphasis on areas where the most long-term value can be created and resilience generated, like climate, computing and security, is now an even more obvious choice.

Non-Zero Interests

Related to the inflationary pressure, is the final awakening from central banks that interests can’t be at or near zero forever.

Higher interest rates have paradoxically favoured deeptech investments by cooling down the overheated valuations and speculative excesses in more consumer-facing, low-tech sectors. This financial climate encourages a shift towards investments in substantial, foundational technologies. Deeptech companies, operating in fields like quantum computing, biotechnology, and advanced manufacturing, are seeing increased interest as these areas require patient capital that aligns well with higher interest environments.

Businesses that focus on long-term, transformational technologies may thus find a more receptive, discerning investment landscape. And it is precisely these kinds of businesses that we seek out and will continue to seek out in 2024.

On top of that, Big Tech and scaleups, who enjoyed the money train ride during the pandemic, continue their quest for cutting down on costs. Their staff layoff continues, and so does the focus shift away from moonshot projects and towards the core business units. As such, more talent becomes available to new companies and high-tech builders with an entrepreneurial bug may finally have enough reasons to quit and launch a company.

We are not just reviewing data here, our VC actually backed a founder who left a UK corporation that had axed the innovation department where he was working at. We expect to find more of these in 2024.

Capital Efficiency Is A Fairer Game

For the last two decades, investors have shunned deeptech and hardware startups claiming their capital requirements were “too large for VC” and their business model was not as “capital efficient” as SaaS apps. Even today, many investors remain stuck to the idea that, as software becomes cheaper to develop, digital startups become more efficient and generate more revenue with less capital.

The reality is of course different: we mentioned before that capital efficiency for SaaS companies has been on a decreasing path for a while, with a change of trend around a decade ago. Whilst the software development cost side of the average investor’s thinking is correct, there is also another side to the efficiency equation: competition. When the tech is easily replicable and VCs keep funding more and more copycats, or even downright unprofitable business models like 10-minutes delivery startups, “shallow tech” companies need to invest more and more on sales and marketing and struggle to take huge chunks of any given market.

On the other hand, whilst there is some merit to the assumption that some deeptech businesses require more investment cash, not all this cash needs to come from VCs. On the equity side, when infrastructure technology businesses grow past the seed stage, they have increasingly attracted larger investors ─eg: from private equity to Corporate Venture Capital (CVC) funds. Valuations often adjust to account for these larger injections, so that dilution does not need to squeeze deeptech shareholders any more than it does with other kinds of tech. Plus, grant funding can take up a major part of the cash injection needs. Especially in the earlier phases of a company’s growth.

In our portfolio, all the founders raised some kind of grant or equity free R&D funding. Sometimes even before raising from us or more than doubling the size of their seed round. In one case, one portfolio company recently told us they won so many grants in 2023 that their runway now stretches all the way to 2027. In the future, I also expect growing opportunities for venture debt to take up some of the burden. Northvolt is again pioneering this in Europe with the largest ever debt round on the continent.

For 2024 and beyond, we expect even more grants, CVC activity and even a nascent venture debt industry for deeptech to further add tailwind to our portfolio and investment thesis. Hence, we will double down our focus on infrastructure deeptech, as these are technologies that are strategic to governments’ and corporate agendas.

The Age Of Titans: Why Deeptech Is The New Tech, Again

So there you have it, as the venture capital landscape evolves, the spotlight has undeniably shifted (or shifted back) towards deeptech startups. These enterprises, driven by significant scientific and technological innovations, are not just pushing the boundaries of what's technologically possible; they are reshaping industries and the global economy at large.

The end of Moore's Law, the imperative for Europe to electrify and decarbonise, the exponential increase in AI's energy demands, geopolitical shifts, the emergence of a new space race, and global health challenges all underscore the critical role of founders solving hard, infrastructural problems. Their startups, with their potential to offer groundbreaking solutions, represent not just investment opportunities but strategic stakes in a sustainable, safer, and technologically advanced future.

In 2023, our firm crystallised from a tech community into a venture fund that, starting small and nimble, has been focused on reading as well as shaping the shifting European deeptech landscape. With that ethos, and following a thesis focused on scouting for infrastructure technology builders with strong technical and entrepreneurial talent, we made pivotal investments in startups like Greenjets, Vypercore, Archangel Lightworks, and Anaphite. Each embodies our commitment to disruptive technologies that promise to redefine industries from aerospace to quantum computing, from space telecommunications to sustainable energy solutions. We also learned some critical lessons and are keen to continue our growth alongside our founders and our LPs in this multi-decade journey in venture capital.

Ultimately, the potential impact of deeptech startups across sectors and on the global economy is immense. By addressing critical challenges with innovative solutions, these startups not only drive economic growth but also contribute to solving some of the most pressing global issues.

In conclusion, the dawn of the Titan age is upon us. The role of venture capital in a deeptech-driven future is more crucial than ever. But as with any new era, VC itself needs to adapt and transform, presenting an opportunity for new managers to re-shape the industry and carve a niche for their theses.

As we venture into 2024 and beyond, our commitment remains unwavering: to discover and invest in those deeptech Titans that will architect a prosperous, sustainable, and resilient future.