We wanted flying cars... We needed better engines! - Silicon Roundabout Ventures, Community Updates, Holidays 25 🎄

Our LP update, with fresh fund highlights, community events, and deeptech market insights. Written by our AI. Edited by our humans.

In This Edition

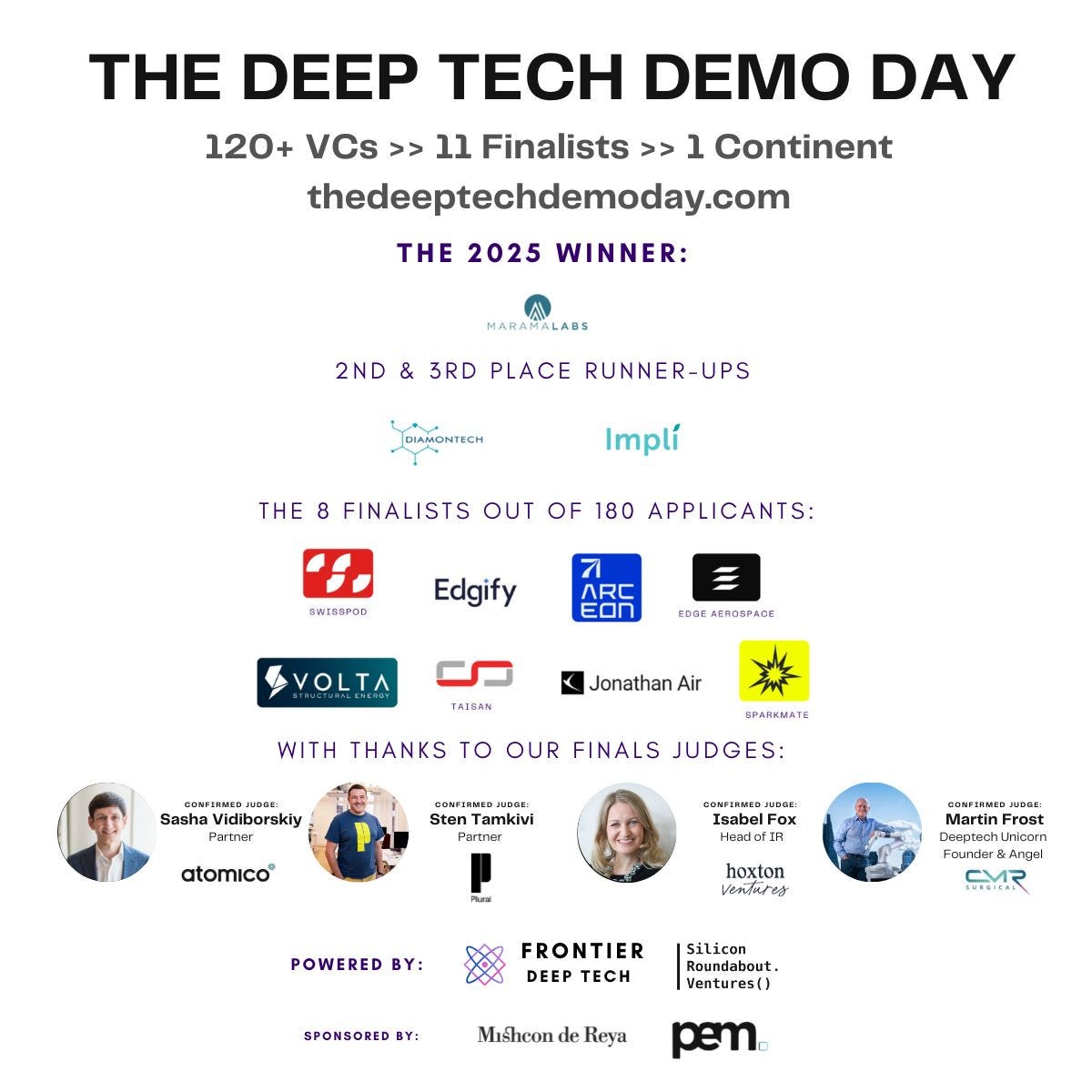

Deeptech Demo Day Winners - Marama Labs takes the crown from 200 European deeptech applicants, with DiaMonTech and Impli as runners-up

Thesis & Portfolio Deep Dive: Greenjets - The inevitable electrification of aerospace and why a team of Rolls-Royce defectors are leading the global charge for quiet electric propulsion for drones, shipping already to defence primes and neo-primes

GP Update: Silicon Valley is Automating the Wrong Things - Why we need robots for physical labour, not chatbots for junior jobs

A reminder of what we are about

Silicon Roundabout Ventures is a SuperAngel Seed fund in the UK investing in European Deep Tech startups. It leverages their community of 15,000 entrepreneurs and engineers, through which the team previously attracted, selected and helped launch 33 Deep Tech and Big Data startups now valued at over £6 Billion.

The fund is backed by top-tier VC Molten Ventures (LSE:GROW) and exited founders, engineers and execs: including ex googlers, amazonians and from 4 unicorns.

📅 Upcoming Events and Community Updates

The Deeptech Demo Day - The results!

🏆 Deeptech Demo Day: We Have a Winner!

We have a WINNER for the crown of most impressive deeptech pioneer in Europe! After 120 VCs scored nearly 200 applicants, our judges have spoken.

🥇 Winner: Marama Labs (Brendan Darby, PhD)

On a mission to accelerate RNA therapy development with rapid and precise optical characterisation of lipid nanoparticles!

Tailed by a fraction of a point:

🥈 DiaMonTech AG (Thorsten Lubinski) - Developed a novel medical device which can measure blood sugar non-invasively - i.e. without pricking

🥉 Impli (Anna Luisa Schaffgotsch) - Delivering continuous hormone monitoring to women’s health

The rest of the finalists (who emerged as the best from 180+ applicants):

Swisspod Technologies (Denis Tudor) - Physical AI company developing dual-tech solutions and autonomous vehicles for high-speed transportation at a fraction of the cost

Edgify (Mitchell Goldman) - Revolutionising retail operations with Edge AI solutions to combat shrink and drive operational efficiency

Arceon B.V. (Rahul Shirke) - Developed Carbeon, a proprietary material for extreme environments that disrupts the $5B graphite market

TaiSan (Sanzhar Taizhan) - Making next-gen polymer electrolyte to enable sodium batteries 2.0

VOLTA Structural Energy (Tommaso Randolfi) - Turns vehicle structures into load-bearing batteries

Edge Aerospace (Jarosław Jaworski) - Building the cloud of tomorrow in orbit, the “most natural place” for AI

Jonathan Air (Salvatore De Benedictis) - Powering a just world

Sparkmate (Morgan P.) - Forging the future of steel manufacturing 100% electric and CO2 free

Big thank you to our finals’ judges: Sasha Vidiborskiy (Partner at Atomico), Martin Frost (Deeptech Unicorn Founder & Angel, CMR Surgical), Isabel Fox (Head of IR at Hoxton Ventures), and Sten Tamkivi (Partner at Plural).

With our incredible co-hosts at Frontier Deep Tech (Dr Cristina Esteban Pardo) and special thanks to our sponsors Mishcon de Reya LLP and PEM who made it possible.

Portfolio Deep Dive: Greenjets

The Rolls-Royce alumni building the propulsion backbone for electric aviation

Greenjets is currently one of the strongest performing Fund I investments.

But while they are now closing contracts with governments, defence primes, and scaleups heavyweights like STARK, they did not seem obvious (especially to investors!) even as recently as last year.

We first backed CEO Anmol Manohar and CTO Dr. Guido Monterzino in early 2023, when they were operating out of a trailer in Bedfordshire. Committing before they had even completed their company’s incorporation.

Two years later, they have expanded from a team of eight to a dedicated manufacturing facility with a global supply chain, and are on track to produce hundreds of engines in 2025.

This deep dive explains what they build, why the economics work, and why we are so bullish on the underlying technology trends they ride (and help bring to their natural conclusion).

What They Build

Greenjets designs and manufactures ducted fan electric propulsion systems for drones, UAVs, and eventually larger aircraft. Their engines look like miniature jet engines, not the exposed propellers you see on most drones.

The product lineup spans four engine families:

Sycamore: small drones, optimised for efficiency

Aspen: multirotors, optimised for vertical lift

Hemlock: high-speed applications, cruise speeds over 540 km/h

Alder: larger drones and future eVTOL applications

The core technical claim is that their ducted architecture delivers up to 93% noise reduction and 45% less power consumption versus open-bladed propellers of equivalent thrust. But what’s really insane about these numbers, is that they aren’t a mere theoretical calculation. They’ve instead been validated through work with the University of Cambridge’s Whittle Laboratory and demonstrated publicly at Farnborough 2024, by which point, mind you, Greenjets had only a few backers, including us and had barely raised their pre-seed.

Why This Matters Now

Drones are loud. Traditional drone noise sits in frequency ranges that humans find particularly irritating, which limits where and when they can operate.

Regulations are catching up. The EU has set noise limits for drones under 600kg. Wing (Google’s drone delivery arm) has clashed with Australian regulators over noise complaints. As the commercial drone market scales toward widespread delivery, inspection, and surveillance, noise becomes a regulatory and social license problem.

Greenjets solved this by applying psychoacoustics research to propulsion design. This means they don’t just make engines quieter in decibels; instead, they shift the sound signature to frequencies humans find less annoying. This is the kind of deep technical insight that comes from founders who spent years inside Rolls-Royce and Cosworth thinking about engine acoustics.

The Team

The founding team’s pedigree is unusual for a startup at this stage.

Anmol Manohar (CEO) spent four years at Rolls-Royce developing novel aircraft concepts and led the Rolls-Royce eVTOL programme. He later ran the electric propulsion division at Blue Bear Systems Research, the defence UAV integrator where Greenjets was incubated.

Dr. Guido Monterzino (CTO) spent eight years at Cosworth as a technical programme manager in aerospace propulsion. His PhD from Cranfield focused on UAV systems engineering, including work on BAE Systems’ Demon UAV.

In June 2023, they added Colin Smith CBE to their advisory board. Smith spent 40 years at Rolls-Royce, rising to Director of Engineering and Technology on the main board, where he was Chief Design Engineer for the Trent 500 (Airbus A340) and Trent 700 (Airbus A330). When someone of that calibre joins a seed-stage startup, it signals something about the quality of the technical work.

The team has recently expanded with Pat Nagle leading programme delivery and defence accounts, and Dr. Kathryn Evans as Business Development Director. Evans previously led aerospace at Reaction Engines and holds a PhD in turbomachinery from Cambridge’s Whittle Laboratory.

Commercial Traction

Greenjets has moved from R&D to revenue.

Farnborough 2024: Their partnership with Striekair produced the Sentinel UAV, which was the only drone to fly live at the airshow. The 3-metre wingspan vehicle demonstrated VTOL capability, quiet operation, and high-speed flight powered by Greenjets’ Sycamore engines.

UK MoD Contract: In late 2024, they secured an R&D contract with the Ministry of Defence to develop the HS125 (Hemlock variant) engine for defence applications.

MGI Engineering SkyShark: In July 2025, MGI publicly demonstrated SkyShark, a British-sovereign strike drone designed to deliver 20kg payloads at 250km range and 450+ km/h speeds. One variant runs entirely on Greenjets’ HS125 electric ducted fans.

Ricardo Partnership: They completed the InCEPTion demonstrator with Ricardo plc, a fully operational electric propulsion module for aircraft under five tonnes featuring an immersion-cooled battery system.

The company now supplies engines to airframe manufacturers across North America and Europe, operating in both commercial and defence sectors.

The Energy Economics Argument

We’ve written before about our thesis that electricity-powered technologies win not because they’re “green” but because they’re riding the winning cost curve. Greenjets fits this pattern.

Electric propulsion offers fundamental advantages beyond emissions. Fewer moving parts means lower maintenance. Instant torque provides better performance for hover and transition flight. Battery and motor costs continue to fall on predictable curves, and no fuel logistics means you can charge from grid or renewables.

The ducted fan architecture adds further benefits. By integrating motor, battery, and thermal management into a single nacelle, Greenjets simplifies airframe integration for customers, reducing development time and certification burden.

Competitive Landscape

The most direct competitor is Whisper Aero, a US company that raised $32M in Series A in 2023 to develop similar quiet ducted fan technology. Whisper has strong backers (Menlo Ventures, Lux Capital) and NASA connections.

But Greenjets has achieved comparable technical milestones with significantly less capital. They were first to market with a shipping product (Sycamore launched May 2023), first to fly live at a major airshow, and first to secure UK defence contracts for their technology.

The market is large enough for multiple winners. Advanced air mobility is projected to reach $1.5 trillion by 2040, and different players will likely dominate different segments.

What Could Go Wrong

We’re not naive about the risks.

Market timing. The eVTOL and urban air mobility markets have been “five years away” for a while. If commercial applications don’t scale as projected, Greenjets becomes dependent on defence revenue, which is great now but may not be growing forever.

Technology scaling. Their current engines work. Whether the architecture scales to larger thrust classes for regional aircraft remains to be proven, and this is where the real transformative opportunity lies.

Competition. Whisper Aero has more capital. Larger aerospace primes could enter the market. A well-funded competitor with better manufacturing scale could compress margins. But so far Greenjets is both best in class and able to think beyond engines and provide entire solutions to go with them - and customers seem to love it.

Supply chain. They rely on manufacturing partners, and as volumes increase, supply chain execution becomes critical.

Why We Remain Bullish

Greenjets has done something rare: delivered real products to real customers while raising modest capital, then secured a very strong $7m Seed with an internal-only top-up that was snapped up in weeks at an even higher valuation. They went from a trailer to Farnborough main stage in under two years, and they’ve attracted talent and advisors that don’t typically engage with companies at this stage. Effectively shipping atoms at the speed of bits. Their last round closed in early 2025, led by Tanglin Venture Partners with participation from Spacewalk VC, 7percent Ventures, z21 Ventures, and MD One Ventures.

Defence demand is accelerating. The conflict in Ukraine has demonstrated the strategic importance of drone technology, and NATO allies are racing to build domestic manufacturing capability. Greenjets’ NATO-sovereign supply chain is increasingly valuable in this context.

We backed them early because we believed the team could execute in a technically demanding space. That thesis has been validated. The next chapter is scaling production while expanding the product range, which will determine whether they become a generational aerospace company or a successful niche player.

Either outcome works for our fund model. But we’re betting on the former.

Portfolio updates

How we think about portfolio construction:

Looking to acquire 1-3% of a company at pre-seed or seed in critical infrastructure technologies across our main themes with £150-200k cheques.

➕ New Additions

No new additions.

Markups

A recap of our markups: (latest round)

Greenjets Limited: [REDACTED: ONLY FOR LPs] (Seed)

Nu Quantum Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Infiniti Recycling Ltd: [REDACTED: ONLY FOR LPs] (Angel round)

Haiqu, Inc.: [REDACTED: ONLY FOR LPs] (Seed)

Anaphite Ltd: [REDACTED: ONLY FOR LPs] (Series A)

Panakeia Technologies Limited: [REDACTED: ONLY FOR LPs] (Seed+)

Notable performers preparing for a follow on round:

Origin Robotics - $[REDACTED: ONLY FOR LPs]m in defence contracts closed (Latvia and Netherlands)

SpiNNcloud Systems - $[REDACTED: ONLY FOR LPs]m in contracts closed (US and Europe)

Astral Systems - $[REDACTED: ONLY FOR LPs]m in annual revenue and word’s first breeding of tritium in a commercial reactor

Ephos - $[REDACTED: ONLY FOR LPs]m in annual sales crossed in 2024; also the first startup to receive EU Chips Act funding: secured 41m EUR to build the world’s most advanced photonics fab for glass-based chips

Performance Snapshot

Here is each fund’s performance to date. These numbers are taken directly from Vauban’s back office and represent our ownership position based on the most recent priced rounds, including any down rounds to better represent the current market value.

Note: We do not book non-priced rounds as markups.

Silicon Roundabout Ventures LP Fund 1

Vintage: 2023

New investments since last update: 1

Total Portfolio Companies: 21

Top-of-the-funnel Pipeline: 0 → Fund 1 fully deployed! :)

Key Deeptech Areas: Future of Computing, Energy, and Defence

Status: closed

Fund Target Size: £5M (Actual Size £5.05m)

Currently invested: [REDACTED: ONLY FOR LPs]

First closing: Dec 2022

TVPI: [REDACTED: ONLY FOR LPs]

DPI: [REDACTED: ONLY FOR LPs]

Net IRR: [REDACTED: ONLY FOR LPs]

MOIC: [REDACTED: ONLY FOR LPs]

Most Valuable Positions: [REDACTED: ONLY FOR LPs]

GP’s Angel Portfolio + 4 “Fund 0” SPVs

Vintage: 2020 (H2)

Investments: 15

TVPI: 2X

DPI: n/a

Highlight Companies: Ori.co, Aegieq.com, Kaizan.ai, Nanusens.com, rnwl.co.uk, Ecosync, Axiom.ai

Status: closed

Community “Virtual” Portfolio

Vintage: 2016

Companies considered: 26

Method for selection: Silicon Roundabout community pitch winners until the beginning of the GP investment activity

Assumed “virtual” investment: £200,000 cheque into each company; No follow-on

Simulated TVPI: 6-6.9X

Simulated Most Valuable Positions: 50-58X

Notable companies: Monzo, Zego, BlueVision Labs, Sano Genetics, Admix, Humanising Autonomy, CausaLens, iProov, Proximie, Senseon, VividQ

GP Personal Update

It’s now quite clear to me that Silicon Valley is obsessed with automating the wrong things.

I asked on LinkedIn: Who’s brave enough to tell the VCs?

The reflection was mostly based on the ever more pressing issues coming with an ageing and less fertile population: and so I realised it’s increasingly more obvious that we are pouring billions into the wrong stuff. Ie. “mainstream AI” (fancy autocomplete) to automate junior coding, copywriting, and customer service [1][2].

Basically, we are actively eroding the entry-level white-collar jobs our university graduates actually want and are trained for.

Meanwhile, we have a massive labour shortage in the physical world that software cannot fix.

We are leaving the most pressing needs unaddressed.

- Blue-collar automation?

- Specialist heavy industry work?

- Physical infrastructure repair?

We need more robots and physical machinery to advance these sectors. We need to replace dangerous and breaking manual labour, not junior creativity.

China gets this.

They are not distracted by the LLM echo chamber. They are racing ahead in industrial robotics and physical automation [3].

They are building the machines that will build the future, while San Francisco argues about whether a chatbot is sentient.

Europe has a fighting chance here.

But only if we stop treating everything coming out of the Bay Area as gospel [4]. Our strength has always been in engineering, hardware, and industrial application. We need to double down on that.

The current obsession with an all-powerful AGI replacing PhDs and human genius is a distraction. In the short and medium term, it is likely destined to fail [5].

It is only leading to more commercial products that automate what we need the least. And most economic benefit will probably be scooped up by incumbents rather than startups

(read: I’m long Google and short OpenAI, but neither will replace high level human thinking in a genrailised and fully autonomous fashion any time soon)

Let’s get back to building things that matter.

As per the investors, I believe most won’t realise this until the AGI promised by OpenAI and Co won’t materialise. By then of course it will be too late to avoid a massive crash. [6]

But hopefully from the ashes we will be able to build back, if enough founders and contrarian investors are willing to think differently.

👇 Sources

[1] https://intuitionlabs.ai/articles/ai-impact-graduate-jobs-2025

[2] https://blog.unrulycap.com/the-depopulation-trade-an-unruly-thesis/

[3] https://xpert.digital/en/china-39-s-robotics-offensive/

[4] https://www.mckinsey.com/capabilities/business-building/our-insights/europes-deep-tech-engine-could-spur-1-trillion-in-economic-growth

[5] https://towardsdatascience.com/stop-worrying-about-agi-the-immediate-danger-is-reduced-general-intelligence-rgi/

[6] Trillion-Dollar Crash: