The Complete Guide to Raising Your First Solo VC Fund

A Q&A blog based on the webinar I hosted for 140 LPs & GPs: "I raised my 1st SoloGP VC Fund: AMA"

Last updated: June 2025 | By Francesco Perticarari, Silicon Roundabout Ventures

My Journey from Venture Capital Outsider to Solo GP –Brutally Honest Guide

When I started this journey five years ago, I had no idea how many times I'd fail before finally closing my first, £5 million VC fund.

I tried syndicates (failed), a multi-partner fund with government LP money (failed again), and nearly gave up multiple times.

But here's what I learned: if you really believe in what you're building, the path will reveal itself –you just need to be stubborn enough to keep going.

This guide contains everything I wish I'd known when I started.

It's based on my live 2024 AMA with Dave Neumann, now an LP at Schroders and back then a FoF investor at Molten Ventures, where I got brutally honest about the highs, lows, and practical realities of raising your first fund, especially in Europe.

I'll keep updating this as I learn more by building Silicon Roundabout at the intersection of community, science and venture capital investing, and as I launch future funds.

I’ve summarised the questions asked and answers given (including some from Dave with his LP hat), and made this guide. And if you’d like to watch the AMA recording, here it is unfiltered for you:

If you’ve got any question not answered here and you’d like me to add it to this Public AMA/FAQ:

Just shoot it over at the email below in the resource section. I’ll do my best to answer it by updating this blog and let you know when it’s live!

Equally, if you’d like to flag resources for me to list here, do let me know about them and I can add them.

Quick Answers: The Questions Every Emerging Manager Asks

Q: Where do I begin as a first-time fund manager?

Start anywhere and embrace failure. I tried syndicates first (failed convincing angels to do deep tech deals quickly enough), then government funding (failed - they wanted big funds with multiple partners), before settling on a solo GP approach with angel capital. Start anywhere, be willing to pivot, and if you feel it's the right thing, don't give up.

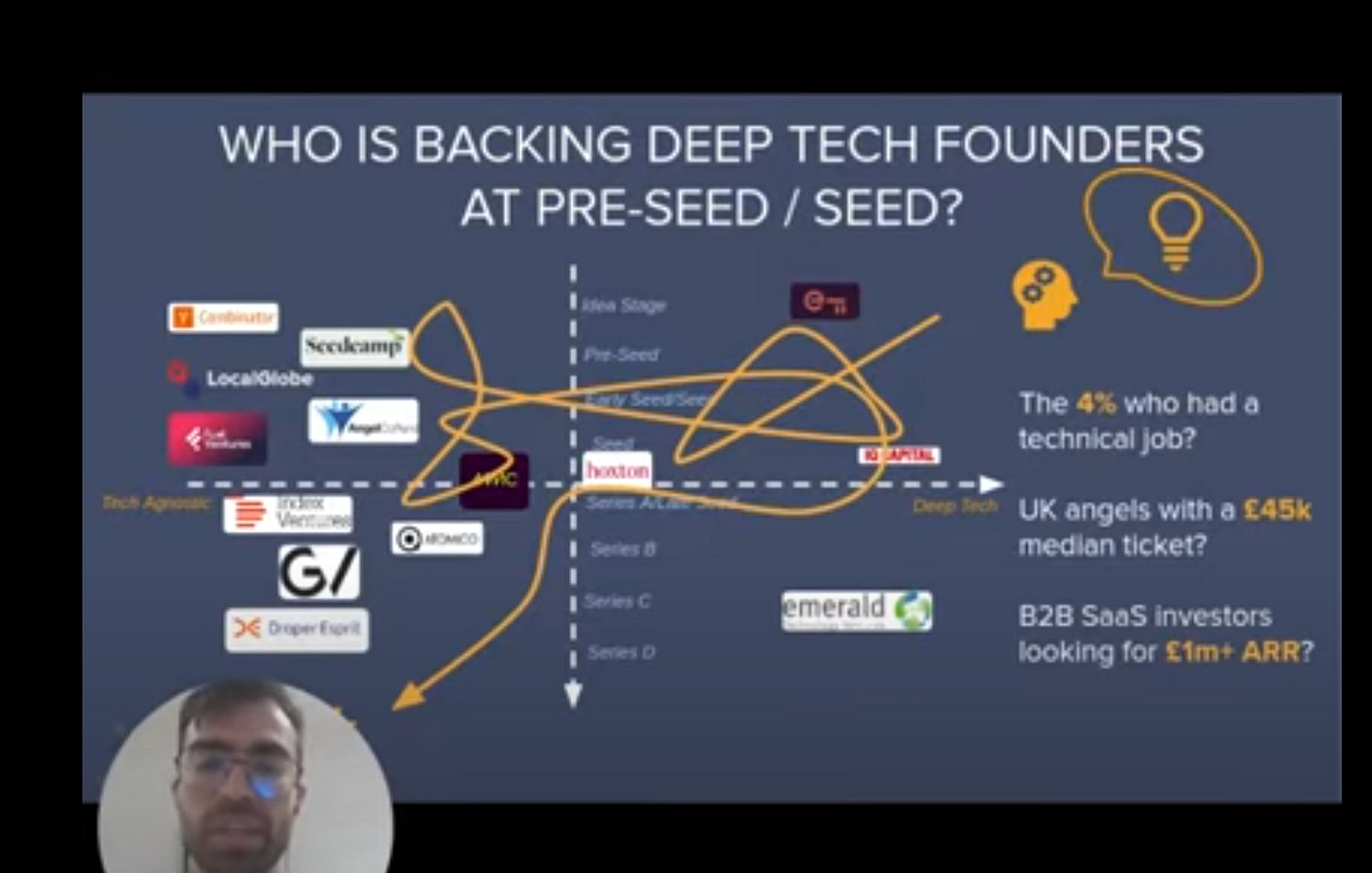

Q: How do you find your investment focus?

For a fund to exist, you need the self-belief that you might have a good chance of being a one-of-a-kind success. First, invest your own money to test your thesis. Then decide: are you generalist or specialist? I chose deep tech because of my community and technical background. Your focus should combine personal conviction with unique positioning. And you should never stop iterating on that thesis. Venture Capital is really a business of connections and finding common values, and it should also be about contrarian bets that turn out not-so-contrarian after a few years… A strong and deeply personal and unique thesis is where you can start to be different from basically being an ATM machine with a Patagonia vest.

In my case I find that writing it down helps. Sometimes I share part of the findings publicly too, and that’s useful for people to know what you stand for.

Q: How can solo GP decision-making be robust without an IC?

I write investment memos and hold IC with myself. The process of writing memos and doing DD means I turn down opportunities. I believe individuals often make better decisions than groups, especially with limited information at early stages. More people don't necessarily make better decisions - that's why corporates rarely out-innovate startups. I use AI to help collect and standardise the DD notes, but I find value in writing a much shorter memo and decision recommendation myself, as part of my thinking process. I think that is part of the job we should not look forward to having AI replace: our own thinking and reflections.

I’d also recommend having an LPAC. I hold mine regularly and I find value in holding myself accountable to experienced investors from a former founder now a multi-millionaire to a professional FoF GP.

Q: How did you raise from LPs?

Focus on angels, family offices, and private capital - not governments or traditional institutional LPs for Fund I. I used networking at conferences (never paid for tickets except community-driven events though as I found most of the value for new managers to be in the “hustle outside of the room”), leveraged my existing deep tech community, posted regularly on LinkedIn since 2022, did cold outreach, and asked for introductions. The key is finding "LP fit" - LPs who get your vision without extensive explanation. I also kept iterating on the fund-product, on figuring our my VC “product-LP fit” and in how I market that to people who’d ask for more info (always qualified and always via reverse solicitation, of course).

In the past I also shared the deck that got me to first closing:

You can find more on VC decks here: sifted.eu/articles/first-time-vc-pitch-decks

And here: alexanderjarvis.com/resources/collections/vc-pitch-deck-collection

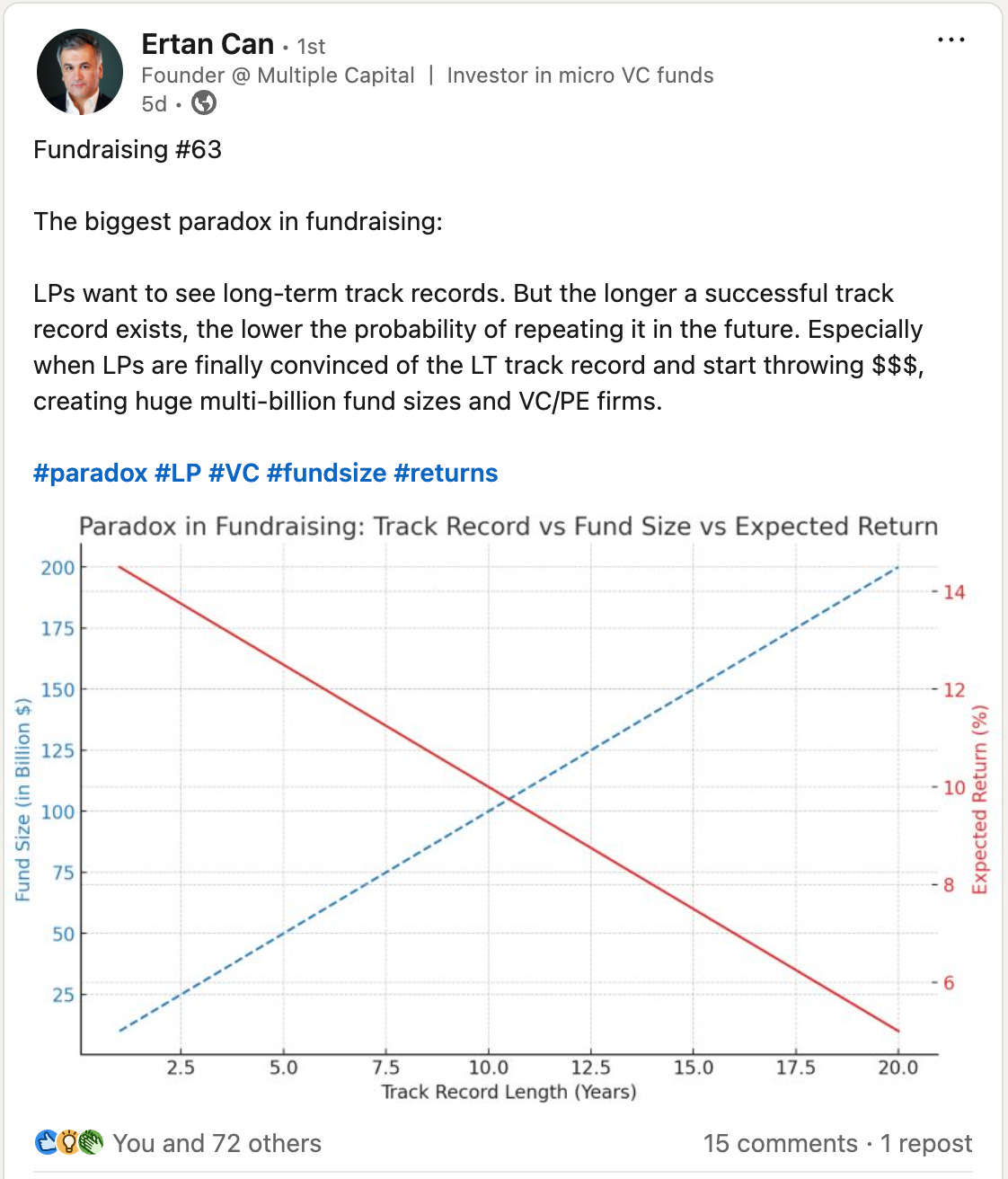

I also sat down with Ertan Can from Multiple Capital (who later joined our LP family too!) to go through our LP updates and get live feedback:

Plus fellow emerging soloGP Annelie Ajami from Anamcara shared some really honest takes on how it was to raise her fund a couple of years back: medium.com/anamcara-capital/raising-a-fund-on-your-own-some-insights-in-hindsight-294b7d9c1549

My very first fund deck and attempts to pitch as an engineer with thick glasses and an annoying tone full of “uhm” and “ehms” was THIS ugly:

And this silly:

One of my LPs recently looked for it in his inbox and we laughed so hard, then he stopped flicking and said “ok, let’s stop, this is giving me eye cancer”

😅

There was also some good stuff on the raw thesis and ideas. So I started putting it out there anyway. The whole process of building the firm was pretty much “in public” from day -1, with Jonathan Sibilia who used to run the FoF at Molten Ventures telling straight what he thought had potential and what didn’t make much sense to an LP:

THE VC “STRIPS OFF” – SILICON ROUNDABOUT VENTURES VC FUND DECK REVIEWED LIVE BY DRAPER ESPRIT LP

Originally published on the Silicon Roundabout community blog

In the end, through feedback, writing more personal angel cheques in a more diligent and systematic way, and even my own personal growth I learned how to convey the message more compellingly.

I got the brand to actually sync with what I was saying. Ultimately everything matters but you can’t wait for perfection to start talking to people! I think it got pretty spot on just by focusing on my core story and the USP of our community brand and network:

So in a nutshell, how I really closed LPs was because I kept showing up and made a good enough case to the “right fit” investors that I had a shot at building a 5-10X fund.

If you’re emerging there is really no reason to shoot for less. Neither for your own time and GP commit risk, nor for their time and capital.

Q: What was your lowest point and how did you overcome it?

When questioning "how am I going to get there?" - feeling like my management fee would be too small and wondering if I was making the wrong choice. I overcame it by focusing on carry potential rather than management fees, accepting the smallest viable fund size, and having my wife kick my ass when I wanted to give up. This is much more a patience and resilience game than a skills game.

Q: How long from first contact to LP signing?

Fast commits happened in 2-4 weeks (existing network), typical individual LPs took 3-6 months, family offices 6-12 months. My biggest individual check came from someone I met the day before they committed. FoFs? A basket case. You need to be in their box/target, when they have money, and go through a lengthy process. My only proper FoF (and they are focused on emerging managers to not exactly a typical one) knew me for 3 years by the time they invested, and Molten’s FoF was part of a VC firm and the partner there knew me for 2 years (also giving me feedback on all the crappy ideas I had about larger funds or syndicates, before landing on the “right fit” fund strategy for me).

The best sales happen fairly quickly - if you're explaining too much, they're probably not the right fit. But FoFs are a beast of its own.

You also get a lot of nos, but that’s part of the game:

You eventually also gets some amazing backers who built companies and literally made the history of tech! Those will make up for all the others:

Q: What do LPs love most about emerging managers?

LPs who invested asked questions about my community, founder relationships, and vision for deep tech - not fund mechanics or spreadsheet metrics. They wanted to understand what I saw in the market and why I was uniquely positioned to capture it. They focused on differentiation and authentic relationships over track record. One of my fund 1 LPs said it best: “I don’t care about your track record –I want to know you’re the first go-to brand/person in VC for great founders in your thesis scope”

Q: How do you run operations as a solo GP?

Keep it lean. I outsource fund administration, legal, and accounting. My biggest early expenses were legal setup (I used a personal Monzo loan initially trusting my guts that I will launch and close the fund –don't try this at home!), compliance, and basic operations. Focus your time on finding companies and supporting founders, not administrative tasks. Vauban (now Carta) and using a simple UK on-shore LP/GP structure with my own RVECA registration at the FCA directly was a setup that in 2023 costed me relatively little to launch, and it kept costs low ever since, but without any sacrifice on the LPs I can work with or the investments I can make. Tech is disrupting venture. Use it at your own advantage and try not to overcomplicate things. Do ask a lot around. The RVECA licensing for example is not well known in the UK, but just because most VCs use an expensive Appointed Representative firm doesn’t mean it’s the only way.

Do your own homework.

Resources and Templates

Fundraising Essentials

Target LP Categories for European Emerging Managers:

High-net-worth individuals (£50K-£500K tickets)

Family offices (£250K-£2m tickets)

Specialized fund-of-funds (Multiple Capital, Molten, etc.)

Ex-founders and entrepreneurs in your sector

Other emerging managers (micro-LPs £5K-£25K)

Fundraising Timeline Expectations:

Fund setup and legal: 2-3 months

First closing: 6-12 months from start

Final closing: 12-18 months total

LP commitment to signing: 2 weeks to 6 months

(Plus a preparation period of barking up the wrong tree and failing along the way: 1-3 years if you’re lucky and don’t give up)

Essential Documents:

Investment memo template (I write one for every deal more or less following this skeleton)

Fund pitch deck (see examples below)

LPA and fund documents –get good lawyers, but DON’T OVERPAY for it –basic and clean > fancy. Leverage your most sophisticated LPs and THEIR lawyers for initial feedback and suggestions, before you engage yours to re-write parts.

Due diligence questionnaire responses.

Fund financials and model. Here is the one I used for fund 1. But it was a bit clunky and I’m working on simplifying it and using more dynamic modeling through a software coded interface for the next one.

Great Resources I found online

Signature Block over in the US has some fantastic resources to get started:

The deck that got me to first closing:

More VC deck tips: sifted.eu/articles/first-time-vc-pitch-decks

A lot more decks here: alexanderjarvis.com/resources/collections/vc-pitch-deck-collection

LP communication tips:

Great Emerging managers sharing their journey or thesis:

Annelie Ajami from Anamcara : medium.com/anamcara-capital/raising-a-fund-on-your-own-some-insights-in-hindsight-294b7d9c1549

Stefano Bernardi on being transparent online (He inspired our open-source website): https://unrulycap.com/rule-breaking-website

Sarah Drinkwater from Common Magic: https://medium.com/@sarahdrinkwater/raising-common-magic-i-be2529ddec46

Next Steps for Emerging Managers

Before You Start:

Invest your own money to test your thesis

Build authentic relationships in your sector

Establish thought leadership through content/community

Map potential LPs and start relationship building

During Fundraising:

Focus on LP fit over LP size

Be prepared for the smallest viable fund size

Don't explain too much - if they don't get it quickly, move on

Use momentum and deadlines once you have traction

Want to Connect?

This guide will evolve as I learn more building Silicon Roundabout and preparing for Fund II. If you're an emerging manager or LP with experiences to share, or if you have questions not covered here, reach out:

LinkedIn: Francesco Perticarari

Email: francesco [at] siliconroundabout [dot] ventures

Community: Join our deep tech events at Silicon Roundabout » siliconroundabout.ventures

This guide is a living document. If you found this helpful, please share it with other emerging managers or LPs who might benefit or may want to share links and resources.

What would you add to this guide? Drop a comment below with your questions or experiences - I'll incorporate the best contributions into future updates.

Watch the Full AMA with Dave –formerly at Molten Ventures

Dave Neumann from when he was FoF investor at Molten and I covered everything from starting out to why they decided to back Silicon Roundabout. If you prefer watching to reading, this is the link:

📺 Watch the complete 1-hour AMA here

The conversation covers my complete journey, including the failures I don't usually talk about in PR interviews and Dave's perspective on what makes emerging managers interesting to fund-of-funds.

My Complete Journey: The Unedited Story

This is the full transcript from our conversation, cleaned up for readability but keeping all the messy reality of building a fund from scratch.

Getting Started: Finding Your Path (And Failing Forward)

The first step is actually to just start anywhere. For me it took a little bit of mastering the courage to go out there, but I've been testing different things and eventually landed on the fact that a fund was a sensible option.

My background is computer science and my day job was software engineering through most of the last decade. When COVID hit, I had to figure out what to do next. I knew I wanted to do something with the Silicon Roundabout community I'd been running –this huge deep tech meetup that's now expanded across Europe.

Out of this community, I realised we were seeing very disruptive early stage companies building extremely interesting technologies. I started angel investing, then wanted to scale it up. I tried to do some syndication first and actually failed at that –I couldn't convince angel investors to do deeptech on time for rounds for meaningful amounts where you could charge fees per company.

Then I tried to do a fund and the easiest LPs to find in Europe were the governments.

I spent time with them and they drilled into my head their agenda: you need to raise a big fund with lots of partners and lots of track record. I even got British Business Bank support for the idea, but it was going to be a UK fund with other partners –it felt like building a cathedral around something simple.

I failed again.

So I went back to square one and looked at emerging managers. LPs, including Jonathan from Molten, were pointing me toward: "you're so convinced about this, why don't you start with angel capital as a solo GP?" Eventually I got comfortable with that.

This is my long-winding way to say: start anywhere and embrace failure. I would be very surprised if you succeeded with the first idea that comes to mind. You're only going to find out if you stick with it long enough, embrace that you're going to fail, and keep pivoting.

Finding Your Investment Focus and Special Sauce

When I look at a startup, I think "is this going to be one-of-a-kind success?"

That applies to funds too.

For a fund to exist, you need at least the self-belief that you might have a good chance of being one-of-a-kind success.

If you don't have anything super special and just want to invest, I'm not sure we need so many funds around the world.

If you want to join the fight of elbowing each other for LP checks, are you sure that you really believe in what you're investing in? That's your investment thesis.

I think you're not an investor if you're not actually investing yourself –putting your money where your mouth is.

First, choose your focus personally where you're putting your money.

Then figure out what makes you uniquely qualified to scale it into a fund. Use that to make your firm thesis, which is different from your personal investment thesis. Your investment thesis is what you'd be investing anyway. Your fund thesis is “your investment thesis + your fund strategy = a good investment for an LP”.

For me, that was the community and deep tech focus.

I even had to let go community sponsors who wanted B2B SaaS companies because I was doing events just for deep tech.

You need that level of focus and commitment.

Solo GP Decision Making: Why I Believe Individual Decisions Beat Committees

The first thing is that I write my investment memos and have an IC with myself.

Obviously, if I have conviction by that point, unless I develop split personality, the result is pretty much a given. But the process of writing memos and doing DD means I turn down opportunities.

Who says that to make better decisions you need more people?

My personal answer –and I wouldn't do this otherwise– is that more people don't make better decisions, not necessarily.

That's why corporates can rarely out-innovate startups and end up buying them –too many people in “cc”.

In venture, especially in Europe in the past, consensus-driven investment is actually wrong.

The best firms are non-consensus. Lowercase Capital was a solo GP fund and best one of the best performing funds on record. So many solo GPs and angels have insane track records making high-conviction bets.

If you've got your strategy right and your portfolio construction is sound, and you follow your investment process, I don't see why a single person should make worse decisions than a group.

Individuals make better decisions in many cases, especially with limited information like seed stage.

The LP Fundraising Reality: It's All About Fit and Persistence

You don't have a fund until you have LPs.

Not all LPs are created equal, just like not all funds. In my case, I failed a lot initially talking to the wrong types of LPs.

I remember someone from Adeo Ressi’s VCLab told me "you can't be talking to just fund-of-funds; they're never going to give you money." Even Molten is different because of how it was born and what Dave mentioned )at the start of the AMA webinar) about their strategy.

The biggest categories that work for emerging managers: angels, family offices, private capital.

I found that two types of ex-founders worked well for me: non-deep tech founders interested in sector exposure who liked the entrepreneurial spirit, and people in similar spaces who wanted to help the fund grow.

I think LPs are your clients, not the startups.

Startups are more like suppliers –they're giving you equity that you're selling as your product. If you don't have clients paying fees and carry, you don't have a business.

What worked for me was a mix of networking at conferences (I never pay for tickets except community-driven events), leveraging my existing community, social media (LinkedIn since 2022), cold outreach, and introductions.

But this is much more a patience and resilience game than a skills game.

Your fundraising skills grow if you stick with it.

Overcoming the Low Points: When Everything Feels Impossible

It was hard. Really hard. When you're questioning "how am I going to get there? Is this the wrong choice? My management fee is too small. Why am I even doing this?"

Go back and think: are you doing it for management fee or carry?

If you're doing it for carry, a three to five million fund should be enough to give you millions in a few years if you really believe it.

That's what I told myself.

The advice that saved me came from Reece at Concept Ventures: this is much more a patience and resilience game than a skills game.

If you're happy to keep going until it works, you might raise.

The question is: do you want to do it or not?

My wife was crucial here.

Every time it got really hard, she'd mirror back: "You've gone through so much - what do you believe in? Wake up, don't give up right now."

She kicked my ass and I went back to it.

The Fundraising Process: What Actually Works

I found that if I had to explain too much, it wouldn't be the right fit.

The best sales happen fairly quickly. Looking back, you can sense synergy early –it doesn't mean it always goes through, but there's usually initial alignment.

For example, with Molten, despite being institutional and doing heavy DD, there was initial synergy.

I had my biggest individual check from someone I met the day before.

Then I had people I'd known forever who kept saying "nearly closing, nearly closing" and never closed.

Some of the biggest frustrations: people saying they'll invest £500K, then £200K, then £100K, then £50K, then nothing.

If something's going to happen, especially with individuals, it needs to happen quickly.

The smallest fund size you can go with was crucial advice.

Post-first closing when the market was crashing, I was prepared to close at £3M fund when I was at £2M closed.

That gives you strength because you're genuinely telling people the truth –you will close.

(Big shout out to Stefano Bernardi at Unruly Capital for the above tip!)

What LPs Actually Care About: Beyond the Spreadsheet

The people who invested asked completely unrelated questions to fund spreadsheets.

Jonathan from Molten asked about founder relationships, how I built the brand, what I see in deeptech. With one angel-LP I had a conversation about China, the future of venture –all vision and market, not fund mechanics.

I started seeing a pattern: people who invested were interested in the community, vision, what I saw in the market, why I launched this, how far I was prepared to go.

They focused on detecting something unique through conversations about founder relationships, politics, how you build things.

If you try to put Fund I on a spreadsheet - if someone says "come back when you have DPI," they're not serious.

Chris Sacca didn't have track record when he started. The EF guys did a 17x fund on their first test. You need questions that get into those qualities you cannot represent on spreadsheets.

Building Operations as a Solo GP

I committed £100K to my fund (including fees), in part from paying myself almost nothing in management fee, part from savings. I took massive risk and paid the initial lawyers with a Monzo loan (don't try this at home! But I believed I'd make it back up and that Europe needed more deep tech advocates.)

For operations, I outsource fund administration, legal, and accounting. Focus your time on finding companies and supporting founders, not admin. My annual costs are manageable within the management fee, and I limit board seats to stay focused.

Why Molten Invested: Dave's LP Perspective

From Dave Neumann, Molten Ventures:

Molten's main thing with our fund-of-funds is understanding who has different deal flow to what we already have. If we back 63 GPs, we want to understand: do you have deal flow that's different or better?

When we started speaking with Francesco, because of the network and community he built, it was clear his investments would become interesting for us.

The validation was that Francesco is very good at finding entrepreneurs that might be overlooked or companies that are too technical, or being a partner to bigger seed funds when finding great companies.

For us, investing in Francesco validated that he has the gravity pull of great founders and capability of finding and winning them over.